SBA 7a Borrower Information Form

Understanding the SBA 7a Borrower Information Form

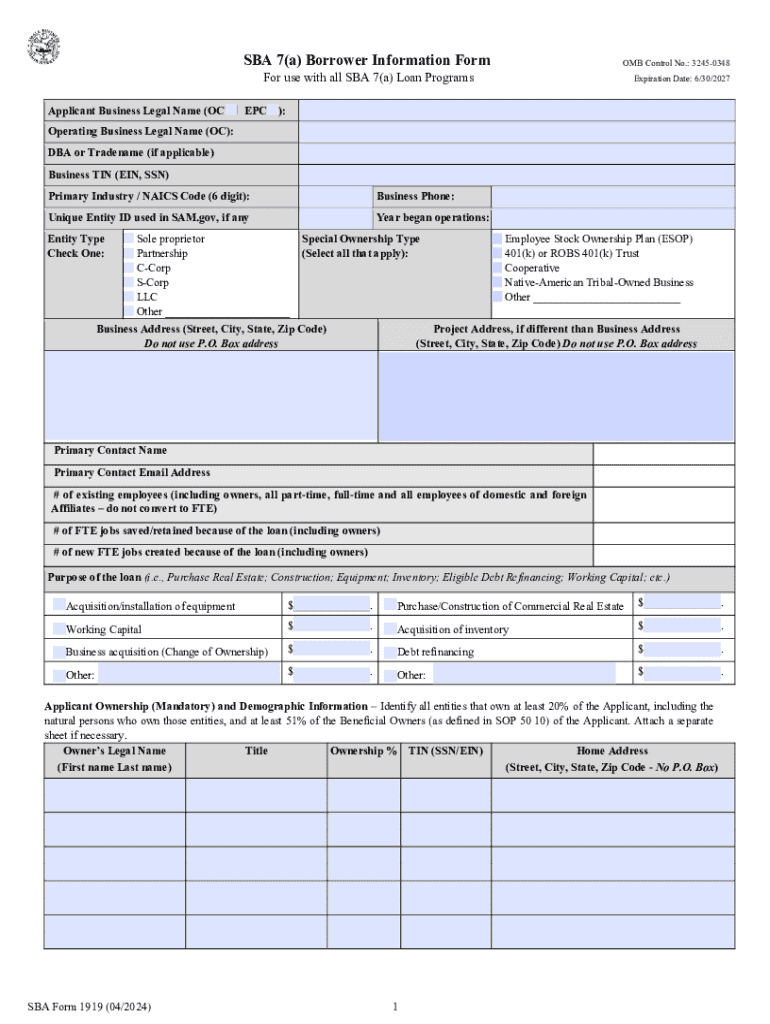

The SBA 7a Borrower Information Form, commonly referred to as the SBA 1919 form, is a crucial document used by small businesses seeking financial assistance through the Small Business Administration's 7(a) loan program. This form collects essential information about the borrower, including business details, ownership structure, and financial history. It serves as a foundational element in the loan application process, enabling lenders to assess the eligibility and creditworthiness of the applicant. Proper completion of this form is vital for a successful loan application, as it ensures that all necessary information is provided for review.

Steps to Complete the SBA 7a Borrower Information Form

Completing the SBA 1919 form involves several key steps to ensure accuracy and completeness. First, gather all required information about the business, including its legal name, address, and tax identification number. Next, provide details about the ownership structure, including the names and ownership percentages of all owners. It is also important to disclose any criminal history or previous bankruptcies, as this information can impact loan eligibility. After filling out the form, review it carefully for any errors or omissions before submitting it to the lender. Ensuring that the form is filled out correctly can significantly enhance the chances of loan approval.

Required Documents for the SBA 7a Borrower Information Form

When submitting the SBA 1919 form, certain documents are typically required to support the information provided. These documents may include personal financial statements from each owner, business tax returns for the past three years, and a business plan outlining the purpose of the loan and how the funds will be utilized. Additionally, proof of ownership, such as articles of incorporation or partnership agreements, may be necessary. Having these documents ready can streamline the application process and help lenders make informed decisions.

Eligibility Criteria for the SBA 7a Loan Program

Eligibility for the SBA 7a loan program hinges on several factors outlined in the SBA guidelines. To qualify, businesses must operate for profit and fall within the size standards set by the SBA, which generally means having fewer than five hundred employees. Additionally, the business must demonstrate a need for the loan and the ability to repay it. Owners must also meet certain personal creditworthiness criteria, including a satisfactory credit score and a clean financial history. Understanding these eligibility requirements is essential for potential borrowers to assess their chances of securing funding.

Application Process and Approval Time for the SBA 7a Loan

The application process for the SBA 7a loan involves several stages, beginning with the completion of the SBA 1919 form and submission of supporting documents to a participating lender. Once submitted, the lender will review the application, which may take anywhere from a few days to several weeks, depending on the lender’s workload and the completeness of the application. After the initial review, the lender may request additional information or clarification. Upon approval, the loan terms will be outlined, and funds can be disbursed. Understanding the timeline and process can help businesses prepare adequately for their funding needs.

Legal Use of the SBA 7a Borrower Information Form

The SBA 1919 form is legally binding, and the information provided must be accurate and truthful. Misrepresentation or failure to disclose relevant information can lead to penalties, including denial of the loan application or legal repercussions. It is crucial for borrowers to understand the legal implications of the information they provide on this form. Compliance with all SBA regulations and guidelines is necessary to maintain eligibility for the loan and to avoid any potential legal issues in the future.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sba 7a borrower information form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the sba 1919 7a loan program?

The sba 1919 7a loan program is a government-backed financing option designed to help small businesses access capital. It offers flexible terms and competitive interest rates, making it an attractive choice for entrepreneurs looking to grow their businesses. Understanding this program can help you leverage airSlate SignNow for efficient document management during the application process.

-

How can airSlate SignNow assist with the sba 1919 7a application?

airSlate SignNow streamlines the sba 1919 7a application process by allowing you to easily send and eSign necessary documents. This reduces the time spent on paperwork and ensures that all forms are completed accurately. With our platform, you can manage your documents securely and efficiently, enhancing your chances of loan approval.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for startups applying for the sba 1919 7a loan. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose a plan that fits your budget while still accessing all the essential features for document management.

-

What features does airSlate SignNow provide for sba 1919 7a applicants?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking of document status, which are crucial for sba 1919 7a applicants. These tools help you manage your documents efficiently and ensure that you meet all deadlines. Additionally, our platform is user-friendly, making it easy for anyone to navigate.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow offers numerous benefits, especially for businesses applying for the sba 1919 7a loan. Our platform enhances productivity by simplifying document workflows and reducing turnaround times. Furthermore, the security features ensure that your sensitive information is protected throughout the process.

-

Can airSlate SignNow integrate with other tools I use?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your workflow when applying for the sba 1919 7a loan. This integration allows you to connect your existing systems, making document management more efficient. You can easily sync data and streamline processes across platforms.

-

Is airSlate SignNow suitable for all business sizes?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including those seeking the sba 1919 7a loan. Whether you are a small startup or a larger enterprise, our platform provides the tools necessary to manage your documents effectively. This versatility makes it an ideal choice for any business looking to improve its document workflows.

Get more for SBA 7a Borrower Information Form

- Mco report card form

- Open competitive continuous examination program title listing 574471956 form

- Change of physician additional treatment by consent state board of form

- 15832680587pdf uia 1583rev 03 19 authorized by mcl form

- Fillable online information needed to file a claim fax

- Summary process eviction complaint termination of lease form

- Address if you do not respond to this document within form

- In re boulders on the river inc 218 br 528 d or form

Find out other SBA 7a Borrower Information Form

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure