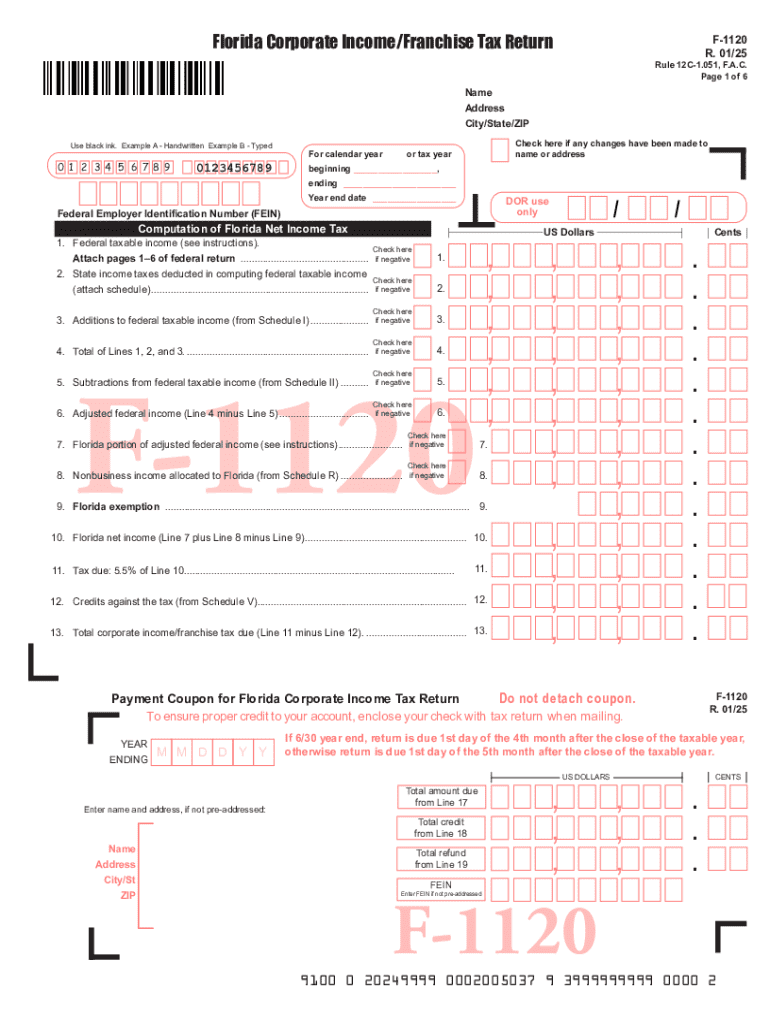

Florida Corporate IncomeFranchise Tax Return F 11 Form

Understanding the Florida Corporate Income Franchise Tax Return F 1120

The Florida Corporate Income Franchise Tax Return, commonly referred to as Form F 1120, is a crucial document for corporations operating within the state. This form is used to report a corporation's income, calculate its tax liability, and ensure compliance with Florida's corporate tax laws. The tax applies to various business entities, including corporations and limited liability companies (LLCs) that elect to be taxed as corporations. Understanding the purpose and requirements of this form is essential for maintaining good standing with the state.

Steps to Complete the Florida Corporate Income Franchise Tax Return F 1120

Completing the Florida Form F 1120 involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Calculate your corporation's total income, deductions, and credits to determine the taxable amount.

- Fill out the form accurately, ensuring all sections are completed, including income, expenses, and any applicable adjustments.

- Review the form for accuracy and completeness before submission.

- Submit the completed form by the due date to avoid penalties.

Filing Deadlines / Important Dates for Form F 1120

Corporations must be aware of specific deadlines when filing Form F 1120. The due date for filing this form typically aligns with the corporation's fiscal year end. For most corporations operating on a calendar year, the deadline is April fifteenth of the following year. If the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to these dates annually.

Required Documents for Filing Form F 1120

When preparing to file Form F 1120, certain documents are essential to ensure a smooth filing process. These include:

- Financial statements, including income statements and balance sheets.

- Prior year tax returns for reference.

- Documentation of any deductions or credits claimed.

- Records of any estimated tax payments made during the year.

Having these documents ready will facilitate the accurate completion of the form and help avoid delays.

Penalties for Non-Compliance with Form F 1120

Failure to file Form F 1120 on time or inaccuracies in reporting can result in significant penalties. The state of Florida imposes fines for late filings, which can accumulate over time. Additionally, underreporting income or failing to pay the correct tax amount may lead to interest charges and further penalties. It is crucial for corporations to adhere to filing requirements to avoid these financial consequences.

Digital vs. Paper Version of Form F 1120

Corporations have the option to file Form F 1120 either digitally or via paper submission. The digital version is often more efficient, allowing for quicker processing and confirmation of receipt. Electronic filing may also reduce the likelihood of errors, as many software programs offer built-in checks. Conversely, some businesses may prefer the traditional paper method for record-keeping purposes. Regardless of the method chosen, it is important to ensure that the form is completed accurately and submitted on time.

Handy tips for filling out Florida Corporate IncomeFranchise Tax Return F 11 online

Quick steps to complete and e-sign Florida Corporate IncomeFranchise Tax Return F 11 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant solution for maximum straightforwardness. Use signNow to e-sign and send out Florida Corporate IncomeFranchise Tax Return F 11 for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the florida corporate incomefranchise tax return f 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Florida Form F 1120?

Florida Form F 1120 is a corporate income tax return form used by corporations operating in Florida. It is essential for businesses to accurately report their income and calculate their tax obligations. Understanding how to complete this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with Florida Form F 1120?

airSlate SignNow simplifies the process of preparing and submitting Florida Form F 1120 by allowing users to eSign documents securely. With its user-friendly interface, businesses can easily manage their tax documents and ensure timely submissions. This streamlines the workflow and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that facilitate the completion of forms like Florida Form F 1120. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing forms like Florida Form F 1120, ensuring that all necessary signatures are obtained efficiently. The platform enhances collaboration and document organization.

-

Is airSlate SignNow compliant with Florida tax regulations?

Yes, airSlate SignNow is designed to comply with Florida tax regulations, including those related to Florida Form F 1120. The platform ensures that all documents are handled securely and in accordance with legal standards. This compliance helps businesses avoid potential legal issues.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing its functionality. This allows users to connect their existing tools with airSlate SignNow, making it easier to manage documents related to Florida Form F 1120 and other business processes.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like Florida Form F 1120 provides numerous benefits, including increased efficiency and reduced paperwork. The platform allows for quick eSigning and document sharing, which can save time during tax season. Additionally, it helps maintain a clear audit trail for compliance purposes.

Get more for Florida Corporate IncomeFranchise Tax Return F 11

- 2020 schedule a form 940 irs tax formsabout schedule a form 940 multi state employer and futa credit reductioninternal revenue

- 2021 instructions for form 990 return of organization exempt from income tax instructions for form 990 return of organization

- Fillable online rental form northeast passage fax email

- 2021 form 8853 archer msas and long term care insurance contracts

- Schedule d schedule dform 1120 department of the

- 2021 form 1099 a acquisition or abandonment of secured property

- 2021 general instructions for forms w 2 and w 3about form w 2 wage and tax statementinternal general instructions for forms w 2

- Form 4972 tax on lump sum distributions from qualified

Find out other Florida Corporate IncomeFranchise Tax Return F 11

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement