Connecticut Form CT 1096 Annual Summary Instructions

What is the Connecticut Form CT 1096 Annual Summary?

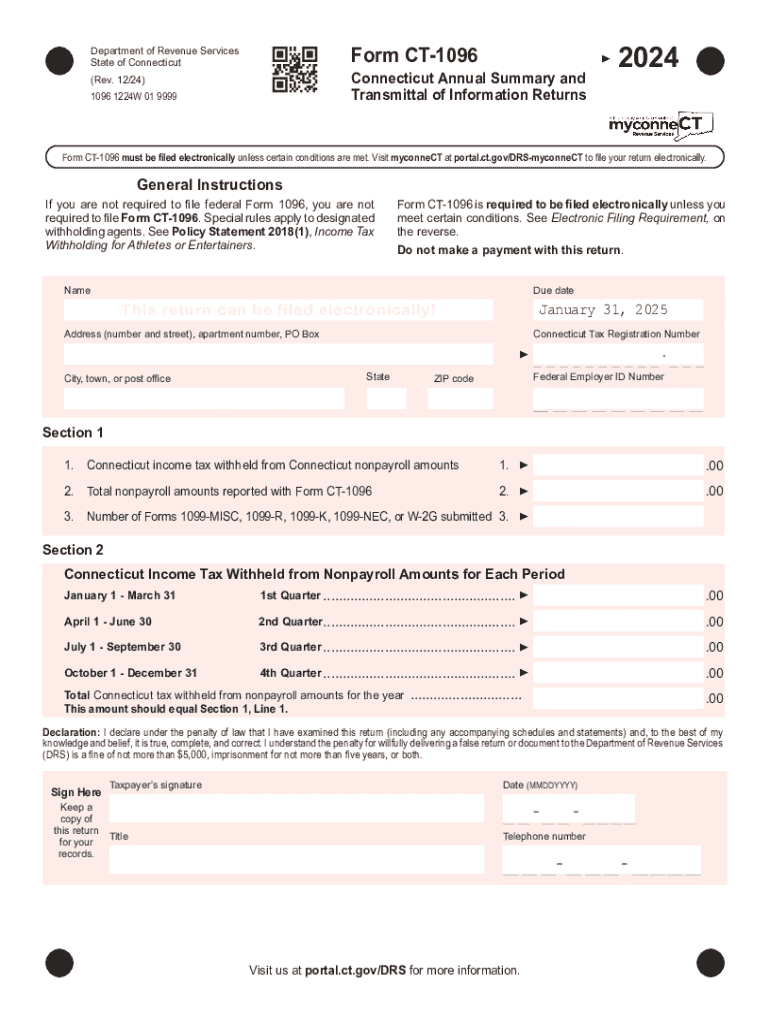

The Connecticut Form CT 1096 is an annual summary form used by businesses to report miscellaneous income payments made during the tax year. This form is essential for businesses that have made payments to individuals or entities that are not classified as employees. The CT 1096 serves as a summary of all the 1099 forms issued by a business, consolidating the information for the state tax authorities. It is crucial for ensuring compliance with Connecticut state tax regulations and helps facilitate accurate reporting of income for recipients.

Steps to Complete the Connecticut Form CT 1096 Annual Summary

Completing the Connecticut Form CT 1096 involves several key steps:

- Gather all relevant information from the 1099 forms issued throughout the year, including recipient names, addresses, and amounts paid.

- Enter the total amount of miscellaneous income paid to recipients in the appropriate sections of the form.

- Ensure that all information is accurate and matches the records of the recipients to avoid discrepancies.

- Review the completed form for any errors or omissions before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Connecticut Form CT 1096. Typically, the form must be submitted to the Connecticut Department of Revenue Services by the end of January following the tax year. If the deadline falls on a weekend or holiday, it is usually extended to the next business day. Timely submission is crucial to avoid penalties and ensure compliance with state tax laws.

Legal Use of the Connecticut Form CT 1096 Annual Summary

The legal use of the Connecticut Form CT 1096 is mandated by state tax laws. Businesses are required to file this form if they have made payments that require reporting under Connecticut tax regulations. Failure to file the CT 1096 can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations regarding this form to maintain compliance and avoid legal issues.

Who Issues the Form

The Connecticut Form CT 1096 is issued by the Connecticut Department of Revenue Services (DRS). The DRS is responsible for overseeing the administration of state tax laws, including the collection of income taxes and the enforcement of compliance regulations. Businesses can obtain the form directly from the DRS website or through authorized tax professionals.

Examples of Using the Connecticut Form CT 1096 Annual Summary

Businesses that frequently engage in transactions requiring the issuance of 1099 forms will find the CT 1096 particularly useful. For instance, a contractor who pays various subcontractors throughout the year would compile all payments made to these subcontractors on the CT 1096. Similarly, a business that provides prizes or awards may also need to report these payments using this form. By summarizing these payments, businesses ensure that they meet their reporting requirements and provide necessary information to the state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the connecticut form ct 1096 annual summary instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT 1096 fillable form?

The CT 1096 fillable form is a document used for reporting Connecticut income tax withheld. It allows businesses to easily fill out and submit their tax information electronically, ensuring compliance with state regulations.

-

How can airSlate SignNow help with CT 1096 fillable forms?

airSlate SignNow simplifies the process of completing CT 1096 fillable forms by providing an intuitive platform for eSigning and document management. Users can easily fill out the form, sign it, and send it securely, streamlining their tax reporting process.

-

Is there a cost associated with using airSlate SignNow for CT 1096 fillable forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion and signing of CT 1096 fillable forms, ensuring a cost-effective solution for document management.

-

What features does airSlate SignNow offer for CT 1096 fillable forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of working with CT 1096 fillable forms. These tools help users manage their documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for CT 1096 fillable forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing users to seamlessly connect their workflows. This means you can easily manage CT 1096 fillable forms alongside other business tools for enhanced productivity.

-

What are the benefits of using airSlate SignNow for CT 1096 fillable forms?

Using airSlate SignNow for CT 1096 fillable forms provides numerous benefits, including time savings, improved accuracy, and enhanced security. The platform ensures that your documents are completed correctly and submitted on time, reducing the risk of penalties.

-

Is it easy to use airSlate SignNow for CT 1096 fillable forms?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete CT 1096 fillable forms. The straightforward interface allows users to navigate the process without any technical expertise, ensuring a smooth experience.

Get more for Connecticut Form CT 1096 Annual Summary Instructions

- State of new mexico taxation and revenue department tax form

- Tax shelter reporting and disclosure requirements form

- Fillable online supporting childrens writing in reception form

- Form cr q1 ampquotcommercial rent tax returnampquot new york city

- Form it 238 claim for rehabilitation of historic properties

- Pdf form it 605 claim for ez investment tax credit and ez employment

- Form it 631 claim for security officer training tax credit

- Form it 112 r new york state resident credit tax year 2020

Find out other Connecticut Form CT 1096 Annual Summary Instructions

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer