TSDWithholdingQuarterlyReturnforMonthlyPayersG7M

What is the G-7 form?

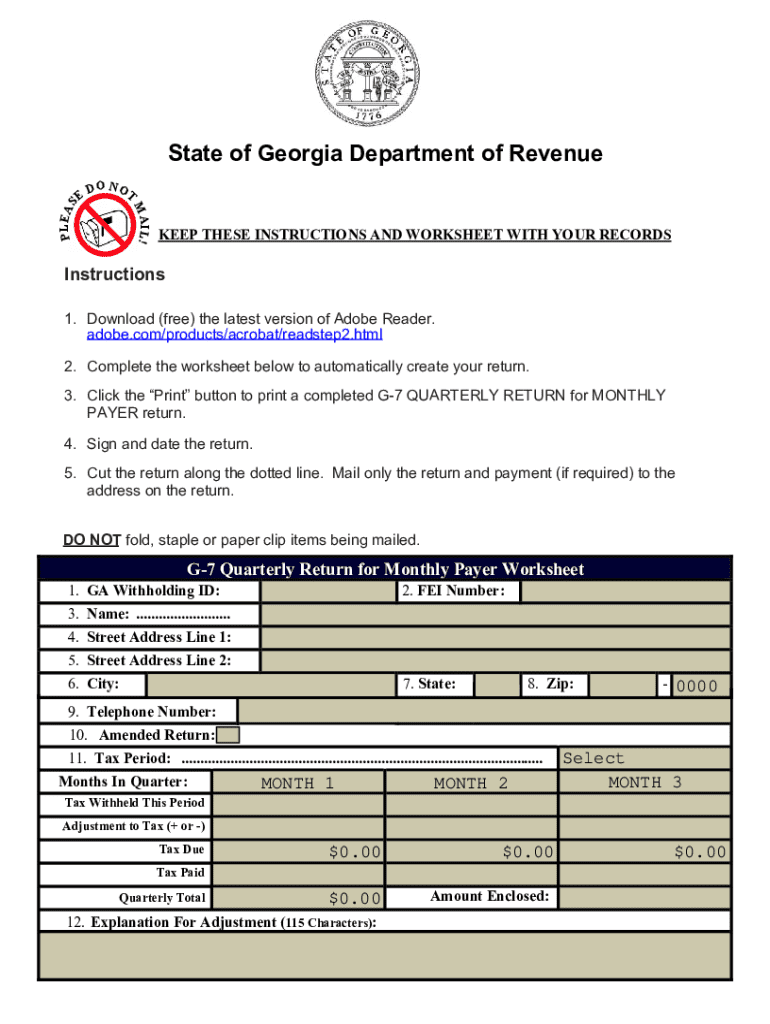

The G-7 form, also known as the TSD Withholding Quarterly Return for Monthly Payers, is a tax document used by employers in Georgia to report and remit withholding taxes. This form is specifically designed for businesses that are required to submit their withholding taxes on a monthly basis. Understanding this form is crucial for compliance with state tax regulations, as it helps ensure that the appropriate amounts are reported and paid to the Georgia Department of Revenue.

Key elements of the G-7 form

The G-7 form includes several important components that businesses must complete accurately. Key elements include:

- Employer Identification: Information about the business, including name, address, and federal employer identification number (FEIN).

- Tax Period: The specific month for which the withholding taxes are being reported.

- Withholding Amounts: Total amounts withheld from employees' wages during the reporting period.

- Payment Details: Information on how the payment will be made, whether electronically or by check.

Steps to complete the G-7 form

Completing the G-7 form involves several steps to ensure accuracy and compliance:

- Gather Information: Collect all necessary employee wage and tax information for the reporting month.

- Fill Out the Form: Enter the required information, including employer details and withholding amounts.

- Review for Accuracy: Double-check all entries to ensure there are no errors or omissions.

- Submit the Form: File the completed G-7 form with the Georgia Department of Revenue by the due date.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of the filing deadlines associated with the G-7 form. Typically, the G-7 form must be submitted by the 15th day of the month following the reporting month. For example, the form for January must be filed by February 15. Missing these deadlines can result in penalties and interest charges.

Penalties for Non-Compliance

Failure to file the G-7 form on time or inaccuracies in reporting can lead to significant penalties. The Georgia Department of Revenue may impose fines based on the amount of tax due. Additionally, late payments may incur interest charges. It is crucial for businesses to stay compliant to avoid these financial repercussions.

Form Submission Methods

The G-7 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses opt to file electronically through the Georgia Department of Revenue's online portal.

- Mail: The completed form can be printed and sent via postal mail to the appropriate address.

- In-Person: Businesses may also choose to deliver the form in person at their local Department of Revenue office.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsdwithholdingquarterlyreturnformonthlypayersg7m

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is g7 in the context of airSlate SignNow?

The term g7 refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. With g7, users can streamline their workflows, ensuring that documents are signed quickly and efficiently. This feature is designed to meet the needs of businesses looking for a reliable eSigning solution.

-

How does g7 improve the eSigning process?

g7 improves the eSigning process by providing an intuitive interface that simplifies document preparation and signing. Users can easily upload documents, add signature fields, and send them for signing in just a few clicks. This efficiency helps businesses save time and reduce errors in their document workflows.

-

What are the pricing options for g7 features?

airSlate SignNow offers competitive pricing for its g7 features, making it accessible for businesses of all sizes. Pricing plans are designed to fit various budgets, with options for monthly or annual subscriptions. Each plan includes essential features that leverage the power of g7 for effective document management.

-

Can g7 integrate with other software applications?

Yes, g7 is designed to integrate seamlessly with a variety of software applications, enhancing its functionality. Users can connect airSlate SignNow with popular tools like CRM systems, project management software, and cloud storage services. This integration capability allows businesses to create a cohesive workflow that maximizes productivity.

-

What benefits does g7 offer for businesses?

g7 offers numerous benefits for businesses, including increased efficiency, reduced turnaround times, and improved document security. By utilizing g7, companies can ensure that their documents are signed quickly and securely, which enhances overall operational effectiveness. Additionally, the user-friendly interface makes it easy for teams to adopt and use the platform.

-

Is g7 suitable for small businesses?

Absolutely, g7 is particularly suitable for small businesses looking for an affordable and effective eSigning solution. The features offered by g7 are tailored to meet the needs of smaller teams, allowing them to manage documents without the complexity of larger systems. This makes it an ideal choice for startups and growing businesses.

-

How secure is the g7 eSigning process?

The g7 eSigning process is highly secure, employing advanced encryption and authentication measures to protect sensitive information. airSlate SignNow complies with industry standards to ensure that all documents are signed and stored securely. This commitment to security gives businesses peace of mind when handling important documents.

Get more for TSDWithholdingQuarterlyReturnforMonthlyPayersG7M

- Iosh test exam papers with answers form

- Ration dealer application form

- Feeling thermometer pdf form

- Ngo profile template word form

- Delivery challan format in pdf

- Request for exemption of select biological agents and toxins or ecu form

- Nyc buildings form pw2fill out and use this pdf

- Fhs athletic packet attention all athletes must h form

Find out other TSDWithholdingQuarterlyReturnforMonthlyPayersG7M

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template