MO 1120 Corporation Income Tax Return Form

What is the MO 1120 Corporation Income Tax Return

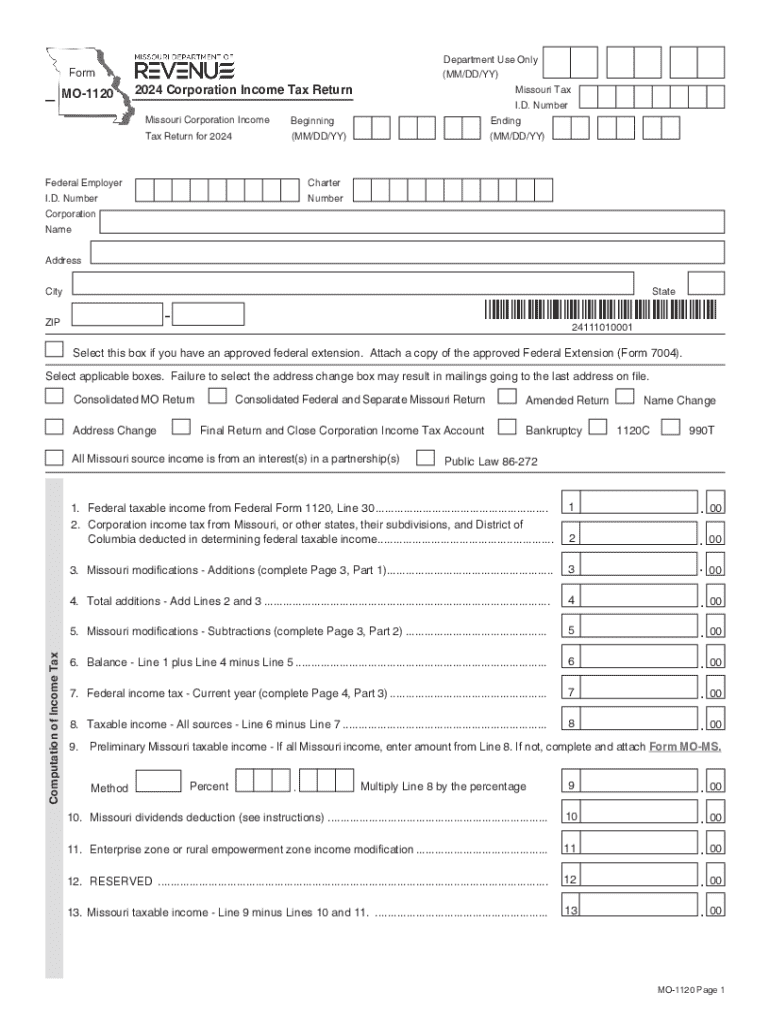

The MO 1120 Corporation Income Tax Return is a form used by corporations operating in Missouri to report their income, deductions, and tax liability to the state. This form is essential for corporations to comply with state tax laws and ensure accurate reporting of their financial activities. The information provided on the MO 1120 is used by the Missouri Department of Revenue to assess the corporation's tax obligations and determine the amount of tax owed.

Steps to complete the MO 1120 Corporation Income Tax Return

Completing the MO 1120 involves several key steps:

- Gather financial information: Collect all necessary financial records, including income statements, balance sheets, and any relevant deductions.

- Fill out the form: Input your corporation's income, deductions, and any credits on the MO 1120 form. Ensure all figures are accurate and match your financial records.

- Review for accuracy: Double-check all entries for correctness. Errors can lead to delays or penalties.

- Submit the form: File the completed MO 1120 with the Missouri Department of Revenue by the designated deadline.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for filing the MO 1120. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by April 15. It is crucial to file on time to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the MO 1120 accurately, corporations need to prepare several documents:

- Income statements detailing revenue earned during the fiscal year.

- Balance sheets showing assets, liabilities, and equity.

- Documentation for any deductions or credits claimed.

- Previous year’s tax return for reference.

Form Submission Methods

The MO 1120 can be submitted to the Missouri Department of Revenue through various methods. Corporations may choose to file online using the department's e-filing system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate address provided by the department. In-person submissions are also an option, although they may require an appointment.

Penalties for Non-Compliance

Failure to file the MO 1120 by the deadline can result in significant penalties. Corporations may incur late fees and interest on any unpaid tax amounts. Additionally, non-compliance can lead to audits and further scrutiny from the Missouri Department of Revenue, potentially resulting in additional fines or legal action.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mo 1120 corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Missouri MO1120 form?

The 2024 Missouri MO1120 form is a tax return document that corporations in Missouri must file to report their income and calculate their tax liability. Understanding this form is crucial for businesses to ensure compliance with state tax regulations and avoid penalties.

-

How can airSlate SignNow help with the 2024 Missouri MO1120 filing process?

airSlate SignNow streamlines the filing process for the 2024 Missouri MO1120 by allowing users to easily send, sign, and manage documents electronically. This not only saves time but also enhances accuracy and ensures that all necessary signatures are obtained promptly.

-

What are the pricing options for using airSlate SignNow for the 2024 Missouri MO1120?

airSlate SignNow offers various pricing plans that cater to different business needs, making it a cost-effective solution for managing the 2024 Missouri MO1120. You can choose from monthly or annual subscriptions, with features that scale according to your requirements.

-

What features does airSlate SignNow provide for the 2024 Missouri MO1120?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for efficiently handling the 2024 Missouri MO1120. These tools help ensure that your documents are completed accurately and on time.

-

Are there any integrations available with airSlate SignNow for the 2024 Missouri MO1120?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the 2024 Missouri MO1120 alongside your other financial documents. This integration helps streamline workflows and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the 2024 Missouri MO1120?

Using airSlate SignNow for the 2024 Missouri MO1120 offers numerous benefits, including enhanced efficiency, reduced paperwork, and improved compliance. The platform's user-friendly interface makes it accessible for businesses of all sizes, ensuring a smooth filing experience.

-

Is airSlate SignNow secure for filing the 2024 Missouri MO1120?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive information while filing the 2024 Missouri MO1120. You can trust that your documents are safe and secure throughout the process.

Get more for MO 1120 Corporation Income Tax Return

Find out other MO 1120 Corporation Income Tax Return

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure