Form P 64A, Rev , Conveyance Tax Certificate

Understanding the P 64A Form: Conveyance Tax Certificate

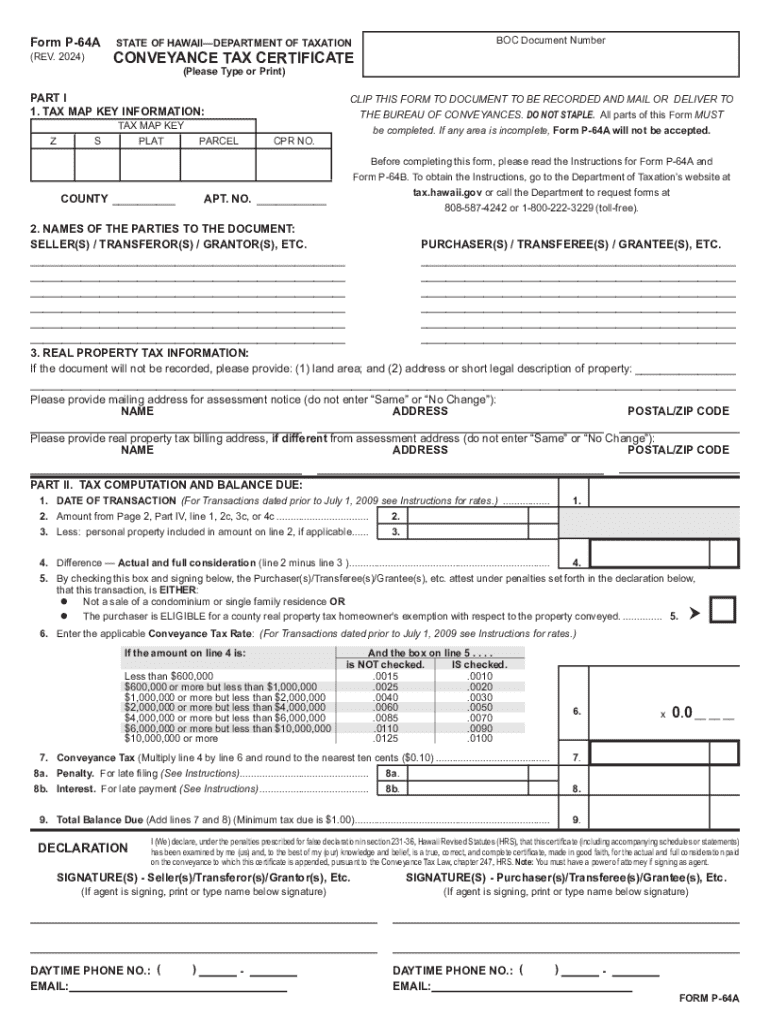

The P 64A form, also known as the Hawaii conveyance tax certificate, is a crucial document used in real estate transactions within Hawaii. This form is required when transferring property ownership and is essential for calculating the conveyance tax owed. It serves to document the sale price of the property and any exemptions that may apply. Understanding this form is vital for both buyers and sellers to ensure compliance with state tax regulations.

Steps to Complete the P 64A Form

Completing the P 64A form involves several key steps:

- Gather necessary information, including the property address, sale price, and details about the buyer and seller.

- Fill out the form accurately, ensuring all fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate county office as part of the property transfer process.

It is important to follow these steps carefully to ensure the form is accepted and processed without issues.

Obtaining the P 64A Form

The P 64A form can be obtained through various means. It is available at county offices responsible for real estate transactions, including the Department of Taxation. Additionally, the form can often be downloaded from official state websites. Ensuring you have the most current version of the form is essential, as updates may occur periodically.

Legal Use of the P 64A Form

The P 64A form must be used in accordance with Hawaii state law. It is legally required for any conveyance of real property, ensuring that the appropriate taxes are collected. Failure to submit this form can result in penalties and complications in the property transfer process. It is crucial for all parties involved in a real estate transaction to understand their obligations regarding this form.

Key Elements of the P 64A Form

Several key elements must be included when filling out the P 64A form:

- Property details, including the address and tax map key number.

- The sale price of the property being transferred.

- Information about the buyer and seller, including names and addresses.

- Any applicable exemptions or deductions that may affect the conveyance tax calculation.

Providing accurate and complete information in these sections is vital for the successful processing of the form.

Filing Deadlines and Important Dates

It is important to be aware of filing deadlines related to the P 64A form. Typically, the form must be submitted at the time of the property transfer. Delays in submission can lead to fines or additional tax liabilities. Keeping track of these deadlines ensures compliance with state regulations and smooth transactions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form p 64a rev conveyance tax certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii conveyance tax?

The Hawaii conveyance tax is a tax imposed on the transfer of real property in Hawaii. It is calculated based on the sale price of the property and is typically paid by the seller. Understanding this tax is crucial for anyone involved in real estate transactions in Hawaii.

-

How does airSlate SignNow help with Hawaii conveyance tax documentation?

airSlate SignNow streamlines the process of preparing and signing documents related to the Hawaii conveyance tax. With our easy-to-use platform, you can quickly create, send, and eSign necessary forms, ensuring compliance and efficiency in your real estate transactions.

-

What are the costs associated with using airSlate SignNow for Hawaii conveyance tax forms?

airSlate SignNow offers a cost-effective solution for managing Hawaii conveyance tax forms. Our pricing plans are designed to fit various business needs, allowing you to choose a plan that suits your budget while providing all the necessary features for document management.

-

Can airSlate SignNow integrate with other tools for managing Hawaii conveyance tax?

Yes, airSlate SignNow integrates seamlessly with various tools and platforms that can assist in managing Hawaii conveyance tax documentation. This integration allows for a more streamlined workflow, enabling you to connect your existing systems and enhance productivity.

-

What features does airSlate SignNow offer for handling Hawaii conveyance tax documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for Hawaii conveyance tax documents. These features ensure that your documents are handled efficiently and securely, making the process easier for all parties involved.

-

Is airSlate SignNow compliant with Hawaii conveyance tax regulations?

Absolutely! airSlate SignNow is designed to comply with all relevant regulations, including those pertaining to the Hawaii conveyance tax. Our platform ensures that your documents meet legal standards, providing peace of mind during your real estate transactions.

-

How can I get support for questions about Hawaii conveyance tax on airSlate SignNow?

Our dedicated support team is available to assist you with any questions regarding Hawaii conveyance tax on airSlate SignNow. You can signNow out via our help center, live chat, or email support, and we will provide you with the information you need to navigate your documentation.

Get more for Form P 64A, Rev , Conveyance Tax Certificate

- Digital products and remote access software exemption certificate form

- Highway vehicle registration form

- New patient application lower umpqua hospital lowerumpquahospital form

- Petition form uc berkeley extension extension berkeley

- Lab tracking form

- Clayton county democratic party membership form

- Arlington heights fence regulations form

- Ems run sheet form

Find out other Form P 64A, Rev , Conveyance Tax Certificate

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free