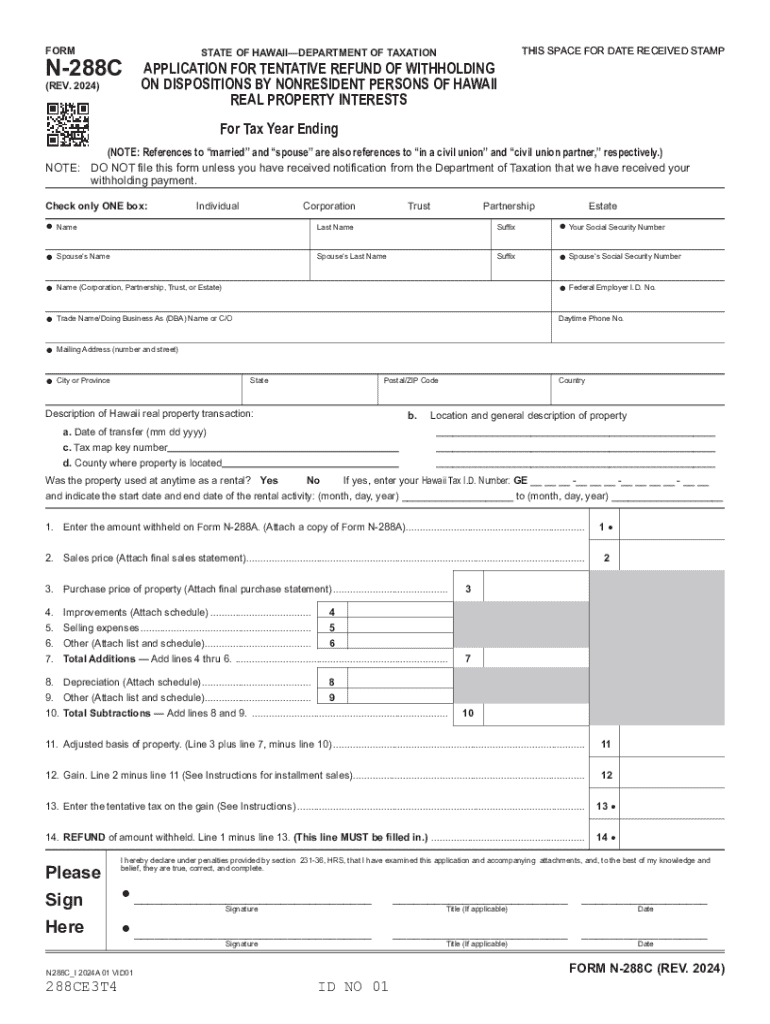

Form N 288C, Rev , Application for Tentative Refund of Withholding on Dispositions by Nonresident Persons of Hawaii Real Propert

What is the Form N-288C?

The Form N-288C, also known as the Application for Tentative Refund of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests, is a crucial document for nonresident individuals or entities who have sold real estate in Hawaii. This form allows them to apply for a refund of excess withholding tax that may have been deducted from the sale proceeds. It is specifically designed to address the unique tax implications for nonresidents involved in real estate transactions within the state.

How to Use the Form N-288C

Using the Form N-288C involves several steps to ensure accurate completion and submission. First, gather all relevant documentation related to the real estate transaction, including the closing statement and any withholding tax receipts. Next, fill out the form with precise information regarding the transaction and your personal details. After completing the form, review it for accuracy before submitting it to the Hawaii Department of Taxation. It is important to keep copies of all documents for your records.

Steps to Complete the Form N-288C

Completing the Form N-288C requires attention to detail. Follow these steps:

- Provide your name, address, and taxpayer identification number.

- Indicate the details of the property sold, including the address and sale date.

- List the total amount withheld and the amount you believe you are entitled to refund.

- Attach supporting documents, such as the closing statement and any relevant tax forms.

- Sign and date the form before submission.

Eligibility Criteria for the Form N-288C

To be eligible to use the Form N-288C, you must be a nonresident who has disposed of real property in Hawaii. Additionally, you should have had withholding tax deducted from the sale proceeds. It is essential to ensure that all information provided is accurate and that you meet the specific criteria outlined by the Hawaii Department of Taxation. If you do not meet these criteria, your application may be denied.

Filing Deadlines for the Form N-288C

Filing deadlines for the Form N-288C are crucial to ensure timely processing of your refund request. Generally, the form must be submitted within a specific timeframe following the sale of the property. It is advisable to check the Hawaii Department of Taxation's guidelines for the exact deadlines applicable to your situation. Late submissions may result in delays or denial of your refund application.

Required Documents for Submission

When submitting the Form N-288C, you must include several key documents to support your application. These typically include:

- A copy of the closing statement from the real estate transaction.

- Any withholding tax receipts that were issued.

- Proof of your nonresident status, if applicable.

- Additional documentation as required by the Hawaii Department of Taxation.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 288c rev application for tentative refund of withholding on dispositions by nonresident persons of hawaii real property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Hawaii Form 288C?

The Hawaii Form 288C is a document used for specific business purposes in the state of Hawaii. It is essential for compliance with local regulations and can be easily managed using airSlate SignNow's eSigning features.

-

How can airSlate SignNow help with Hawaii Form 288C?

airSlate SignNow streamlines the process of filling out and signing the Hawaii Form 288C. Our platform allows users to create, send, and eSign the form quickly, ensuring that all necessary information is captured accurately.

-

Is there a cost associated with using airSlate SignNow for Hawaii Form 288C?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the Hawaii Form 288C and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Hawaii Form 288C?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the Hawaii Form 288C. These tools enhance efficiency and ensure compliance with state requirements.

-

Can I integrate airSlate SignNow with other applications for Hawaii Form 288C?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the Hawaii Form 288C alongside your existing workflows. This integration enhances productivity and simplifies document management.

-

What are the benefits of using airSlate SignNow for Hawaii Form 288C?

Using airSlate SignNow for the Hawaii Form 288C offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled efficiently and securely.

-

Is airSlate SignNow user-friendly for completing Hawaii Form 288C?

Yes, airSlate SignNow is designed with user experience in mind. Completing the Hawaii Form 288C is straightforward, making it accessible for users of all technical skill levels.

Get more for Form N 288C, Rev , Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real Propert

- Carnival cake walk oak hall school form

- Quadratic formula worksheet 1

- Legionella risk assessment form for landlords pdf

- Msbc youth ministry servant team commitment form msbchurch

- Athletic participation form physical

- Ermc online application form

- Committee of application form

- Employee witness statement form

Find out other Form N 288C, Rev , Application For Tentative Refund Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real Propert

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document