Arizona Form 348

What is the Arizona Form 348

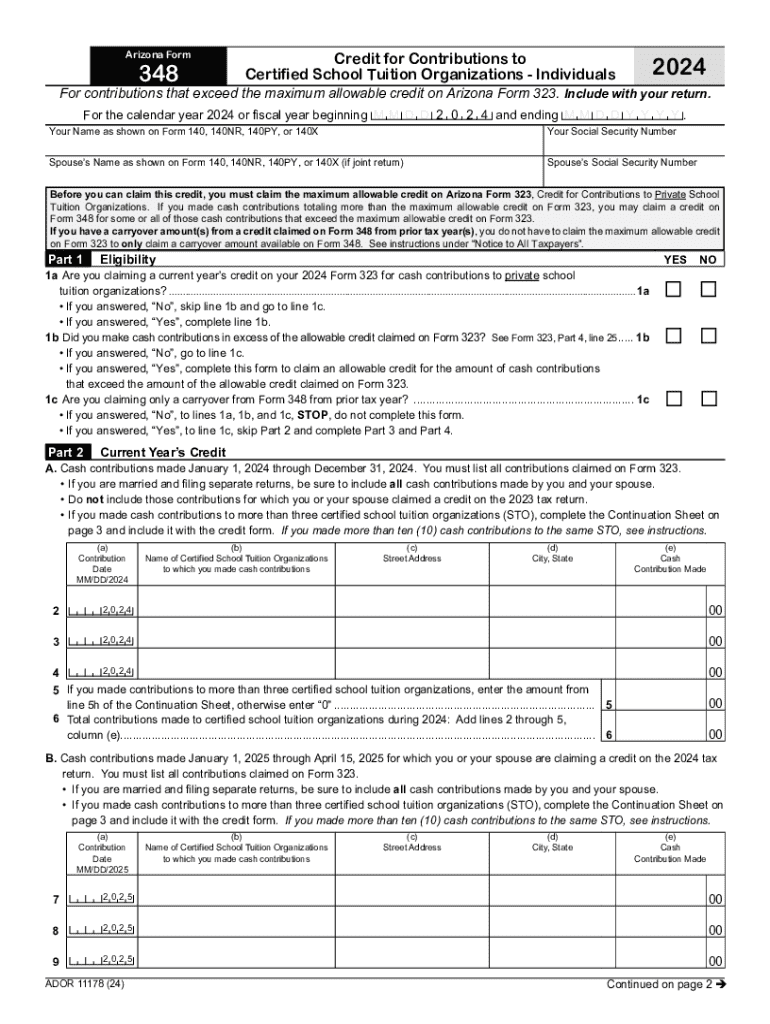

The Arizona Form 348 is a document used for reporting specific tax information related to certain business activities in the state of Arizona. This form is essential for businesses that need to disclose their income and expenses accurately to comply with state tax regulations. It helps ensure that businesses meet their tax obligations and can take advantage of any applicable deductions or credits.

How to use the Arizona Form 348

To use the Arizona Form 348 effectively, businesses should first gather all necessary financial records, including income statements, expense reports, and any relevant documentation that supports the figures reported on the form. After completing the form, it should be reviewed for accuracy before submission. This careful preparation helps avoid potential issues with the Arizona Department of Revenue.

Steps to complete the Arizona Form 348

Completing the Arizona Form 348 involves several key steps:

- Gather all relevant financial documents.

- Fill out the form with accurate income and expense figures.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to certify its authenticity.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Arizona Form 348

The Arizona Form 348 must be used in accordance with state tax laws. It is crucial for businesses to ensure that the information provided is truthful and complete, as any discrepancies can lead to audits or penalties. Understanding the legal implications of using this form helps businesses maintain compliance and avoid legal issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Arizona Form 348 vary based on the type of business and the specific tax year. Generally, businesses should be aware of the following important dates:

- The annual filing deadline, typically aligned with the federal tax deadline.

- Extensions, if applicable, must be filed before the original deadline.

- Any changes in deadlines announced by the Arizona Department of Revenue.

Who Issues the Form

The Arizona Form 348 is issued by the Arizona Department of Revenue. This state agency is responsible for overseeing tax collection and ensuring compliance with tax laws. Businesses should refer to the Department of Revenue for any updates or changes to the form and its requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona form 348

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona Form 348?

The Arizona Form 348 is a specific document used for various legal and administrative purposes in the state of Arizona. It is essential for businesses and individuals who need to comply with state regulations. Understanding how to properly fill out and submit the Arizona Form 348 can streamline your processes.

-

How can airSlate SignNow help with the Arizona Form 348?

airSlate SignNow provides an efficient platform for sending and eSigning the Arizona Form 348. With its user-friendly interface, you can easily upload, fill out, and send the form securely. This not only saves time but also ensures compliance with Arizona's legal requirements.

-

What are the pricing options for using airSlate SignNow for the Arizona Form 348?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently use the Arizona Form 348. You can choose from monthly or annual subscriptions, with options that provide additional features for enhanced document management. This cost-effective solution ensures you get the best value for your eSigning needs.

-

Are there any features specifically designed for the Arizona Form 348?

Yes, airSlate SignNow includes features that are particularly beneficial for managing the Arizona Form 348. These features include customizable templates, automated workflows, and secure storage options. This ensures that your documents are not only compliant but also easily accessible.

-

Can I integrate airSlate SignNow with other tools for managing the Arizona Form 348?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to manage the Arizona Form 348 alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, you can enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for the Arizona Form 348?

Using airSlate SignNow for the Arizona Form 348 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and tracking of documents, ensuring that you stay organized and compliant with state regulations. This ultimately leads to better productivity for your business.

-

Is airSlate SignNow secure for handling the Arizona Form 348?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling the Arizona Form 348. The platform employs advanced encryption and authentication measures to protect your sensitive information. You can confidently send and sign documents, knowing that your data is secure.

Get more for Arizona Form 348

- Petition and order to use funds conservatorship michigan courts courts michigan form

- Houston police department identification division city of houston houstontx form

- Certification of certificate form

- Employment application settoon towing llc form

- Calfresh notice approval form

- Dl400d form

- Certificate of dissolution marriage form

- Cook county order of possession ccm n114 form

Find out other Arizona Form 348

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form