IA 126 Iowa Nonresident and Part Year Residen Form

Understanding the IA 126 Iowa Nonresident and Part-Year Resident Form

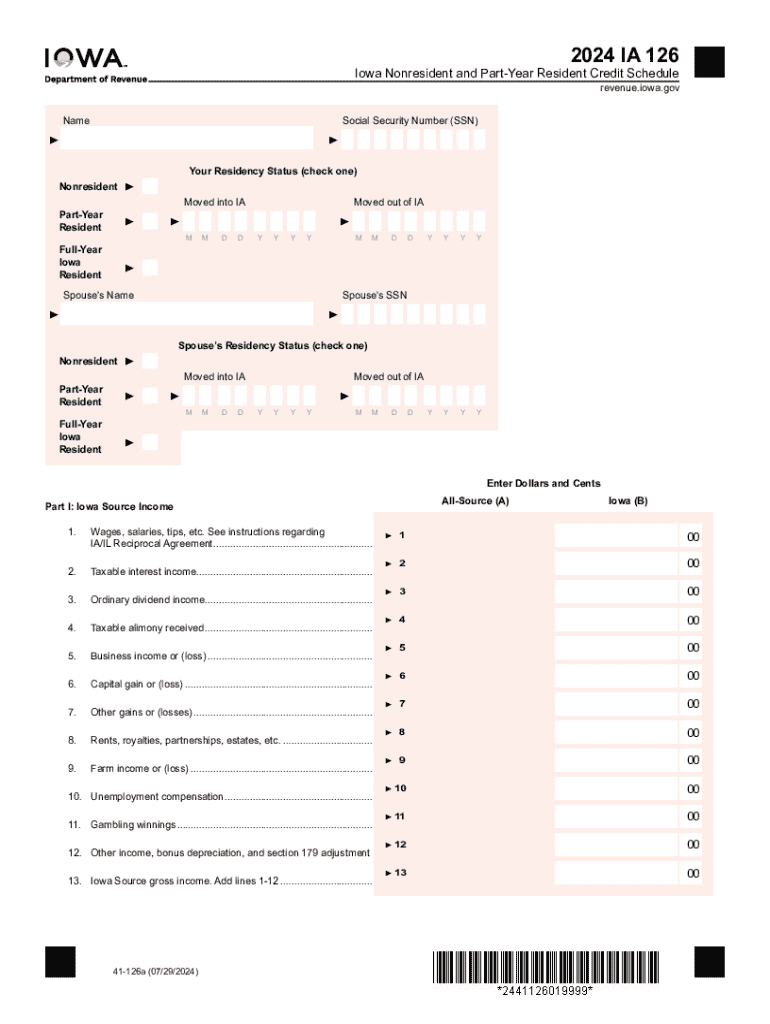

The IA 126 form is specifically designed for nonresidents and part-year residents of Iowa who need to report income earned within the state. This form is essential for individuals who do not reside in Iowa for the entire year but have income sourced from Iowa. It helps ensure that taxpayers pay the correct amount of state income tax based on their earnings while living or working in Iowa.

Nonresidents are individuals who live outside Iowa but earn income from Iowa sources, while part-year residents are those who have moved into or out of Iowa during the tax year. Understanding the distinctions between these categories is crucial for accurate tax reporting.

Steps to Complete the IA 126 Iowa Nonresident and Part-Year Resident Form

Completing the IA 126 form involves several key steps to ensure accuracy and compliance. The following outlines the process:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Determine your residency status for the year and calculate the income earned while in Iowa.

- Fill out the IA 126 form, providing your personal information, income details, and any applicable deductions.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated filing deadline.

Each step is crucial to ensure that your tax obligations are met and that you avoid potential penalties.

Eligibility Criteria for the IA 126 Iowa Nonresident and Part-Year Resident Form

To be eligible to file the IA 126 form, individuals must meet specific criteria. Primarily, the form is for nonresidents and part-year residents who have earned income in Iowa during the tax year. Eligibility is determined based on the following:

- Nonresidents must have income sourced from Iowa, such as wages, rental income, or business income.

- Part-year residents must have moved into or out of Iowa during the tax year and earned income while residing in the state.

- Taxpayers must provide documentation to support their claims of residency status and income sources.

Meeting these criteria is essential to ensure that the correct tax obligations are reported and paid.

Filing Deadlines for the IA 126 Iowa Nonresident and Part-Year Resident Form

Filing deadlines for the IA 126 form are crucial for compliance. Typically, the form must be submitted by April 30 of the year following the tax year. For example, for income earned in 2023, the form would be due by April 30, 2024. It is important to keep track of these deadlines to avoid penalties and interest on unpaid taxes.

Additionally, if an extension is needed, taxpayers should file for an extension before the original deadline to avoid late fees.

Required Documents for the IA 126 Iowa Nonresident and Part-Year Resident Form

When preparing to file the IA 126 form, certain documents are required to support your income claims and residency status. Key documents include:

- W-2 forms from employers reporting Iowa income.

- 1099 forms for any freelance or contract work performed in Iowa.

- Records of any other income earned while residing or working in Iowa.

- Proof of residency status, such as lease agreements or utility bills, if applicable.

Having these documents ready will streamline the filing process and help ensure accuracy in reporting.

Form Submission Methods for the IA 126 Iowa Nonresident and Part-Year Resident Form

The IA 126 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the Iowa Department of Revenue's e-file system.

- Mailing a paper version of the completed form to the appropriate address.

- In-person submission at designated Iowa Department of Revenue offices.

Choosing the right submission method can depend on personal preference and the urgency of the filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 126 iowa nonresident and part year residen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 Iowa 126 form and why is it important?

The 2024 Iowa 126 form is a crucial document for businesses operating in Iowa, as it is used for reporting income and expenses. Understanding this form is essential for compliance with state tax regulations. Using airSlate SignNow can simplify the process of completing and eSigning the 2024 Iowa 126, ensuring accuracy and efficiency.

-

How can airSlate SignNow help with the 2024 Iowa 126 form?

airSlate SignNow provides an easy-to-use platform for businesses to fill out and eSign the 2024 Iowa 126 form. With its intuitive interface, users can quickly navigate through the document, ensuring all necessary information is included. This streamlines the submission process and reduces the risk of errors.

-

What are the pricing options for using airSlate SignNow for the 2024 Iowa 126?

airSlate SignNow offers various pricing plans to accommodate different business needs, making it cost-effective for handling the 2024 Iowa 126 form. Plans are designed to provide flexibility, whether you're a small business or a larger enterprise. You can choose a plan that best fits your budget while ensuring access to essential features.

-

What features does airSlate SignNow offer for the 2024 Iowa 126?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the 2024 Iowa 126 form. These features enhance productivity and ensure that your documents are handled securely and efficiently. Additionally, users can collaborate in real-time, making it easier to gather necessary signatures.

-

Are there any integrations available with airSlate SignNow for the 2024 Iowa 126?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow when dealing with the 2024 Iowa 126 form. Whether you use CRM systems, cloud storage, or accounting software, these integrations help streamline the document management process. This ensures that all your data is synchronized and easily accessible.

-

What are the benefits of using airSlate SignNow for the 2024 Iowa 126?

Using airSlate SignNow for the 2024 Iowa 126 offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows for quick document preparation and eSigning, which can signNowly reduce turnaround times. Additionally, your documents are stored securely, ensuring compliance with data protection regulations.

-

Is airSlate SignNow user-friendly for completing the 2024 Iowa 126?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 2024 Iowa 126 form. The platform features a straightforward interface that guides users through the process, ensuring that even those with minimal technical skills can navigate it effectively. This accessibility is key for busy professionals.

Get more for IA 126 Iowa Nonresident And Part Year Residen

- Cash sale deed louisiana form

- Mississippi petition change name form

- Agreement sale purchase real property form

- Colorado beneficiary deed pdf form

- Printable community property agreement pdf form

- Agreement between heirs as to division of estate form

- Missouri declaratory judgment car title form

- Florida closing form

Find out other IA 126 Iowa Nonresident And Part Year Residen

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself