IA 706 Iowa Inheritance Tax Return Tax Iowa GovDec Form

Understanding the IA 706 Iowa Inheritance Tax Return

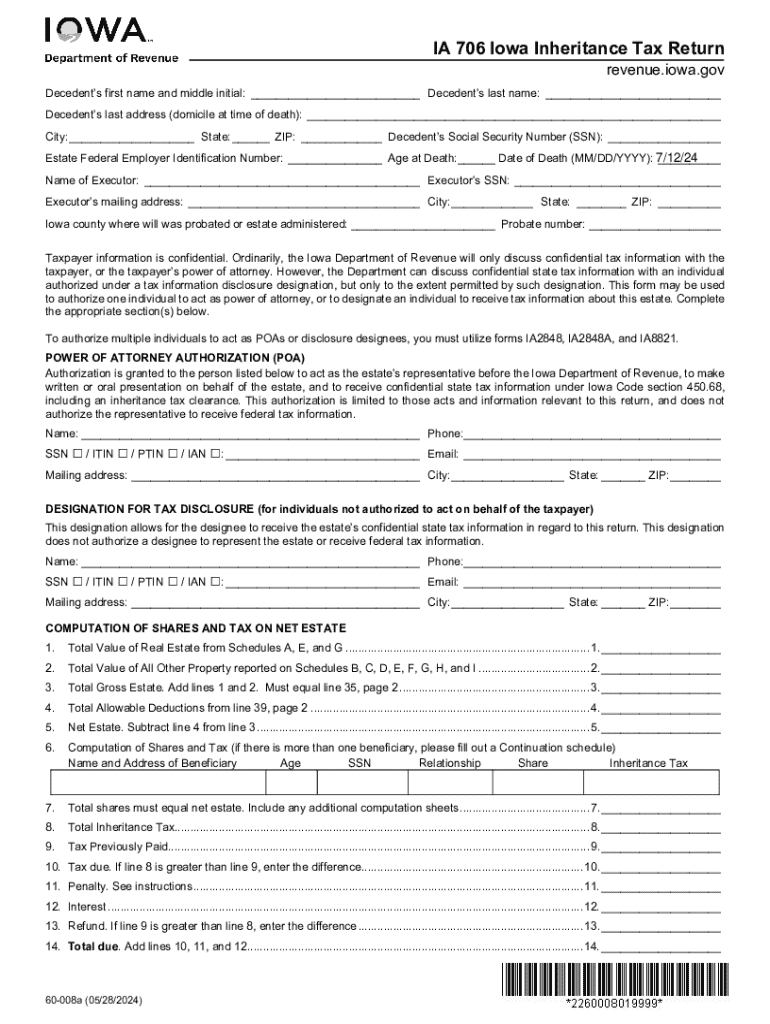

The IA 706 Iowa Inheritance Tax Return is a critical document required for reporting and paying inheritance taxes in Iowa. This form is used by the estate of a deceased individual to calculate the tax owed on assets transferred to heirs. It is essential for ensuring compliance with state tax laws and for the proper distribution of the deceased's estate. The form includes information about the decedent, the beneficiaries, and the value of the estate, which is necessary for determining the applicable inheritance tax rates.

Steps to Complete the IA 706 Iowa Inheritance Tax Return

Completing the IA 706 form involves several key steps:

- Gather all necessary documentation, including the decedent's will, asset valuations, and beneficiary information.

- Fill out the IA 706 form accurately, ensuring that all required fields are completed.

- Calculate the total value of the estate and the corresponding inheritance tax based on Iowa inheritance tax rates.

- Review the completed form for accuracy and ensure all supporting documents are attached.

- Submit the form to the Iowa Department of Revenue by the specified deadline.

Required Documents for the IA 706 Iowa Inheritance Tax Return

When filing the IA 706 form, certain documents are necessary to support the information provided. These documents typically include:

- The decedent's death certificate.

- A copy of the will or trust documents.

- Asset appraisals or valuations for real estate, personal property, and financial accounts.

- Documentation of any debts or liabilities of the estate.

- Identification information for all beneficiaries.

Filing Deadlines for the IA 706 Iowa Inheritance Tax Return

Timely filing of the IA 706 form is crucial to avoid penalties. The form must be submitted within nine months of the decedent's date of death. If additional time is needed, an extension may be requested, but it is essential to check with the Iowa Department of Revenue for specific procedures and requirements.

Legal Use of the IA 706 Iowa Inheritance Tax Return

The IA 706 form serves a legal purpose in the administration of an estate. It is necessary for fulfilling state tax obligations and ensuring that the estate is settled according to Iowa law. Failure to file the IA 706 can result in penalties, interest on unpaid taxes, and complications in the distribution of the estate to heirs.

Key Elements of the IA 706 Iowa Inheritance Tax Return

Understanding the key elements of the IA 706 form is vital for accurate completion. The form typically includes:

- Information about the decedent, including name, date of birth, and date of death.

- A detailed list of assets and their valuations.

- Identification of beneficiaries and their relationship to the decedent.

- Calculations of the inheritance tax owed based on the estate's value.

How to Obtain the IA 706 Iowa Inheritance Tax Return

The IA 706 form can be obtained from the Iowa Department of Revenue's official website or by contacting their office directly. It is available in both paper and digital formats, allowing for easier completion and submission. For those preferring a digital approach, the fillable version of the form can simplify the process of entering information and calculations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia 706 iowa inheritance tax return tax iowa govdec

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa Department of Revenue inheritance tax?

The Iowa Department of Revenue inheritance tax is a tax imposed on the transfer of property from a deceased person to their heirs. This tax varies based on the relationship of the heir to the deceased and the value of the inheritance. Understanding this tax is crucial for estate planning and ensuring compliance with state regulations.

-

How can airSlate SignNow help with Iowa Department of Revenue inheritance tax documents?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to the Iowa Department of Revenue inheritance tax. Our solution simplifies the process of managing estate documents, ensuring that all necessary forms are completed accurately and submitted on time. This helps reduce the stress associated with tax compliance.

-

What features does airSlate SignNow offer for managing inheritance tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing inheritance tax documents. These features streamline the process, making it easier to handle the complexities of the Iowa Department of Revenue inheritance tax. Additionally, users can collaborate in real-time, ensuring all parties are informed.

-

Is airSlate SignNow cost-effective for handling Iowa Department of Revenue inheritance tax?

Yes, airSlate SignNow is a cost-effective solution for managing documents related to the Iowa Department of Revenue inheritance tax. Our pricing plans are designed to fit various budgets, allowing users to access essential features without overspending. This makes it an ideal choice for individuals and businesses alike.

-

Can I integrate airSlate SignNow with other tools for inheritance tax management?

Absolutely! airSlate SignNow offers integrations with various tools that can assist in managing the Iowa Department of Revenue inheritance tax. Whether you need to connect with accounting software or CRM systems, our platform supports seamless integrations to enhance your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for inheritance tax documentation?

Using airSlate SignNow for inheritance tax documentation provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform ensures that all documents related to the Iowa Department of Revenue inheritance tax are handled securely and efficiently, allowing users to focus on other important aspects of estate management.

-

How does airSlate SignNow ensure the security of inheritance tax documents?

airSlate SignNow prioritizes the security of your documents, especially those related to the Iowa Department of Revenue inheritance tax. We utilize advanced encryption and secure cloud storage to protect sensitive information. Additionally, our platform complies with industry standards to ensure that your data remains safe and confidential.

Get more for IA 706 Iowa Inheritance Tax Return Tax iowa govDec

- New patient form knee dr alan m hirahara md frcsc

- Case 215 cv 05909 km jbc document 239 filed 111016 form

- While toxicology tests take time state crime lab exceeds form

- 806 cv 00458 jfb fg3 doc 135 filed 111208 page 1 of 21 page id form

- P the grantee will maintain systematic participant enrollment information

- Home community service waiver form

- Weatherizationarizona department of housing form

- Mdataramirezwork in progressdeanna14cv3398 l form

Find out other IA 706 Iowa Inheritance Tax Return Tax iowa govDec

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors