IA W 4 Iowa Department of Revenue Form

What is the IA W-4 Iowa Department of Revenue

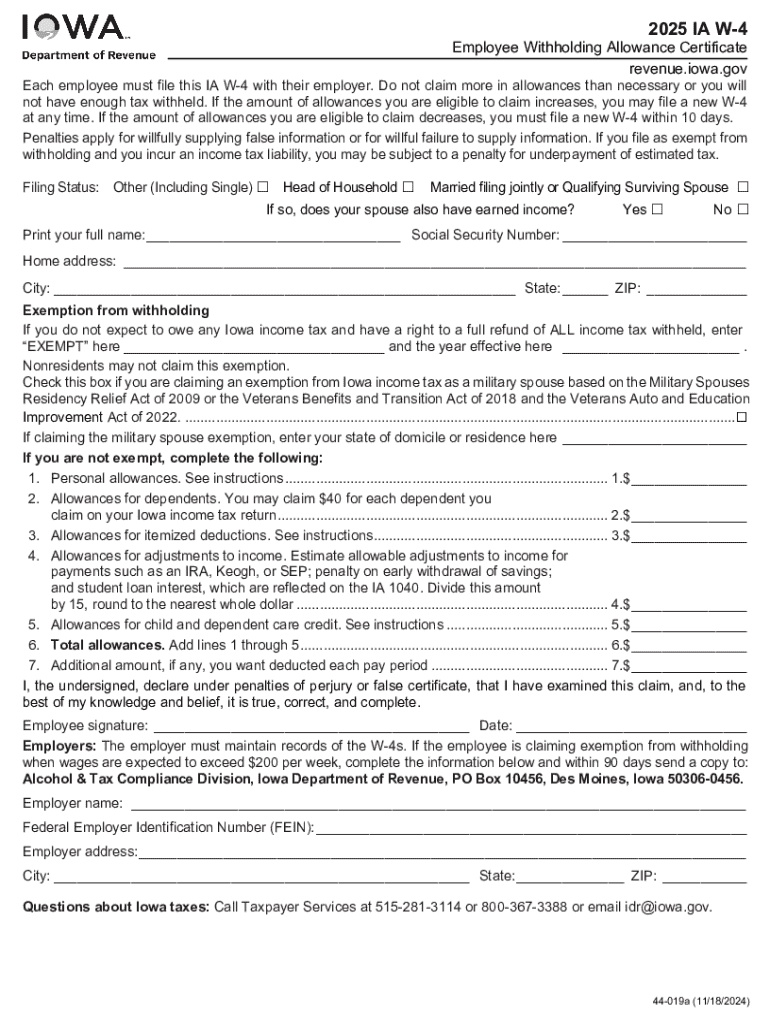

The IA W-4 is a form issued by the Iowa Department of Revenue that allows employees to indicate their state tax withholding preferences. This form is essential for ensuring that the correct amount of state income tax is withheld from an employee's paycheck. It is similar to the federal W-4 form but is specific to Iowa's tax regulations. Understanding the IA W-4 is crucial for both employers and employees to maintain compliance with state tax laws.

Steps to Complete the IA W-4 Iowa Department of Revenue

Completing the IA W-4 involves several straightforward steps:

- Obtain the form: You can download the IA W-4 from the Iowa Department of Revenue website or request a physical copy from your employer.

- Fill in personal information: Enter your name, address, and Social Security number at the top of the form.

- Claim allowances: Use the worksheet included with the form to determine the number of allowances you can claim based on your personal situation.

- Additional withholding: If you want to withhold an additional amount, specify that in the appropriate section.

- Sign and date: Ensure that you sign and date the form before submitting it to your employer.

Key Elements of the IA W-4 Iowa Department of Revenue

The IA W-4 contains several key elements that are important for accurate tax withholding:

- Personal Information: This includes your name, address, and Social Security number.

- Allowances: The number of allowances you claim affects how much tax is withheld.

- Additional Withholding: You can specify any extra amount you wish to be withheld from your paycheck.

- Signature: Your signature certifies that the information provided is accurate.

How to Use the IA W-4 Iowa Department of Revenue

Using the IA W-4 correctly ensures that your state tax withholding aligns with your financial situation. After completing the form, submit it to your employer, who will use the information to calculate the appropriate amount of state tax to withhold from your wages. It is advisable to review and update your IA W-4 whenever you experience significant life changes, such as marriage, divorce, or a change in employment status.

Legal Use of the IA W-4 Iowa Department of Revenue

The IA W-4 is a legally binding document that must be filled out accurately to comply with Iowa tax laws. Incorrect information may lead to under-withholding or over-withholding of state taxes, which can result in penalties or unexpected tax bills. Employers are required to keep the completed forms on file for their records and to ensure compliance with state tax regulations.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IA W-4. Generally, employees should submit their completed form to their employer as soon as they start a new job or experience a change in their tax situation. Employers must process the IA W-4 promptly to ensure accurate withholding in the upcoming pay periods. Additionally, it is advisable to review the form annually or whenever there are significant changes in personal circumstances.

Handy tips for filling out IA W 4 Iowa Department Of Revenue online

Quick steps to complete and e-sign IA W 4 Iowa Department Of Revenue online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for maximum simplicity. Use signNow to e-sign and share IA W 4 Iowa Department Of Revenue for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia w 4 iowa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help with document signing?

airSlate SignNow is a powerful tool that empowers businesses to send and eSign documents efficiently. If you're wondering how to ia, this platform simplifies the process by providing an easy-to-use interface and cost-effective solutions for electronic signatures.

-

How to ia with airSlate SignNow's features?

To effectively utilize airSlate SignNow, you can explore its features such as customizable templates, real-time tracking, and secure storage. Learning how to ia with these features can enhance your document management process and improve overall efficiency.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs. Understanding how to ia with these pricing options can help you choose the best plan that fits your budget while still providing essential features for document signing.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow supports integrations with numerous applications, making it easier to streamline your workflow. Knowing how to ia with these integrations can signNowly enhance your productivity and ensure seamless document management.

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security for document signing. If you're looking to understand how to ia, these advantages can help your business thrive in a competitive environment.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive documents. Learning how to ia with these security features ensures that your data remains confidential and secure throughout the signing process.

-

How to ia when using airSlate SignNow for the first time?

If you're new to airSlate SignNow, getting started is simple. Follow the user-friendly onboarding process, and you'll quickly learn how to ia by sending documents for eSignature and managing your workflows effectively.

Get more for IA W 4 Iowa Department Of Revenue

- Australia job description template form

- Patient financial agreement financial agreement form

- Patient registration new patient packet form

- Non dental surgical consent form broadview animal clinic

- Patient consent release information form

- Patient formsregistrationyoungstown orthopaedic

- Perio surgery consent form

- Routine data from hospital information systems can support

Find out other IA W 4 Iowa Department Of Revenue

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement