Iowa Withholding Tax Quarterly Return, 44095 Form

What is the Iowa Withholding Tax Quarterly Return, 44095

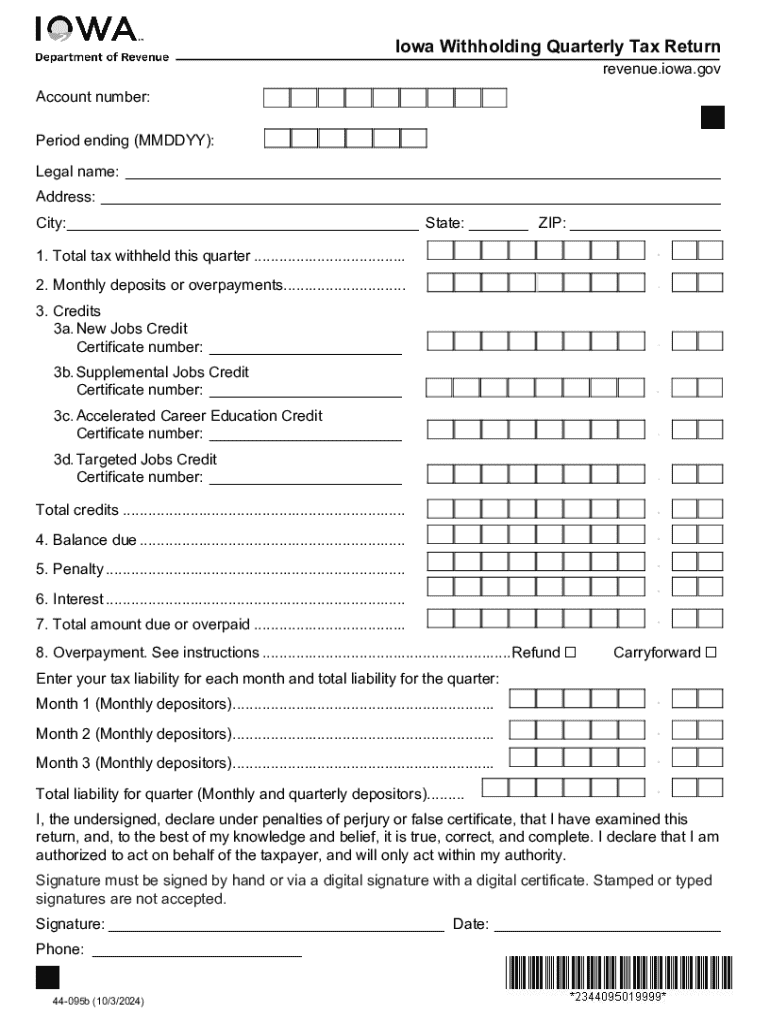

The Iowa Withholding Tax Quarterly Return, designated as form 44095, is a tax document used by employers in Iowa to report and remit state income tax withheld from employees' wages. This form is essential for maintaining compliance with Iowa state tax laws and ensuring that the appropriate amounts are submitted to the state government. The quarterly return provides a summary of the total amount withheld during the reporting period, which is crucial for both the employer and the state tax authority.

Steps to complete the Iowa Withholding Tax Quarterly Return, 44095

Completing the Iowa Withholding Tax Quarterly Return involves several key steps:

- Gather necessary information, including total wages paid and the amount of state income tax withheld for the quarter.

- Access the form 44095, available on the Iowa Department of Revenue website or through authorized tax software.

- Fill out the form with accurate figures, ensuring that all calculations are correct to avoid discrepancies.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the deadline, either electronically or by mail, along with any payment due for the withheld taxes.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing the Iowa Withholding Tax Quarterly Return. The due dates are typically as follows:

- For the first quarter (January to March), the return is due by April 30.

- For the second quarter (April to June), the return is due by July 31.

- For the third quarter (July to September), the return is due by October 31.

- For the fourth quarter (October to December), the return is due by January 31 of the following year.

It is important for employers to mark these dates on their calendars to ensure timely compliance and avoid penalties.

Key elements of the Iowa Withholding Tax Quarterly Return, 44095

The Iowa Withholding Tax Quarterly Return includes several key elements that must be accurately reported:

- Employer Information: This section requires the employer's name, address, and identification number.

- Employee Wages: Total wages paid to employees during the quarter must be reported.

- Withheld Taxes: The amount of state income tax withheld from employee wages must be clearly stated.

- Payment Information: Details regarding any payments made towards the withheld taxes should be included.

Accurate reporting of these elements is crucial for compliance and to avoid any potential issues with the Iowa Department of Revenue.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Iowa Withholding Tax Quarterly Return. These methods include:

- Online Submission: Employers can file the form electronically through the Iowa Department of Revenue's online portal, which is often the quickest method.

- Mail: The completed form can be printed and mailed to the designated address provided by the Iowa Department of Revenue.

- In-Person: Employers may also choose to submit the form in person at local tax offices, although this option may be less common.

Choosing the appropriate submission method can streamline the filing process and ensure timely compliance with state regulations.

Penalties for Non-Compliance

Failure to file the Iowa Withholding Tax Quarterly Return on time can result in significant penalties. Employers may face:

- Late Filing Penalties: A percentage of the tax due may be assessed for each month the return is late.

- Interest Charges: Interest may accrue on any unpaid tax amounts from the original due date until paid in full.

- Potential Legal Action: Continued non-compliance may lead to further legal consequences, including liens or levies.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iowa withholding tax quarterly return 44095

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Iowa Withholding Tax Quarterly Return, 44095?

The Iowa Withholding Tax Quarterly Return, 44095, is a form used by businesses in Iowa to report and remit state income tax withheld from employees' wages. This form is essential for compliance with Iowa tax regulations and must be filed quarterly to avoid penalties.

-

How can airSlate SignNow help with the Iowa Withholding Tax Quarterly Return, 44095?

airSlate SignNow simplifies the process of completing and submitting the Iowa Withholding Tax Quarterly Return, 44095, by providing an easy-to-use platform for eSigning and managing documents. This ensures that your tax returns are filed accurately and on time, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for tax returns?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that streamline the filing of the Iowa Withholding Tax Quarterly Return, 44095, making it a cost-effective solution.

-

Are there any integrations available with airSlate SignNow for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, allowing for efficient data transfer and management. This integration is particularly beneficial for businesses preparing the Iowa Withholding Tax Quarterly Return, 44095, as it reduces manual entry and enhances accuracy.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSigning, templates, and secure storage. These features are designed to streamline the preparation and submission of the Iowa Withholding Tax Quarterly Return, 44095, ensuring that all documents are organized and easily accessible.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure cloud storage. This ensures that your Iowa Withholding Tax Quarterly Return, 44095, and other sensitive information are protected from unauthorized access.

-

Can I track the status of my Iowa Withholding Tax Quarterly Return, 44095, with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your documents, including the Iowa Withholding Tax Quarterly Return, 44095. This feature provides peace of mind, as you can confirm when your return has been signed and submitted.

Get more for Iowa Withholding Tax Quarterly Return, 44095

Find out other Iowa Withholding Tax Quarterly Return, 44095

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online

- Sign Nebraska Mortgage Quote Request Simple

- Can I Sign Indiana Temporary Employment Contract Template

- How Can I Sign Maryland Temporary Employment Contract Template

- How Can I Sign Montana Temporary Employment Contract Template

- How Can I Sign Ohio Temporary Employment Contract Template

- Sign Mississippi Freelance Contract Online

- Sign Missouri Freelance Contract Safe

- How Do I Sign Delaware Email Cover Letter Template

- Can I Sign Wisconsin Freelance Contract

- Sign Hawaii Employee Performance Review Template Simple

- Sign Indiana Termination Letter Template Simple

- Sign Michigan Termination Letter Template Free

- Sign Colorado Independent Contractor Agreement Template Simple

- How Can I Sign Florida Independent Contractor Agreement Template

- Sign Georgia Independent Contractor Agreement Template Fast

- Help Me With Sign Nevada Termination Letter Template

- How Can I Sign Michigan Independent Contractor Agreement Template

- Sign Montana Independent Contractor Agreement Template Simple