480 2 CORP 07 21 480 2 CORP 07 21 Form

What is Form 480.2 for Puerto Rico?

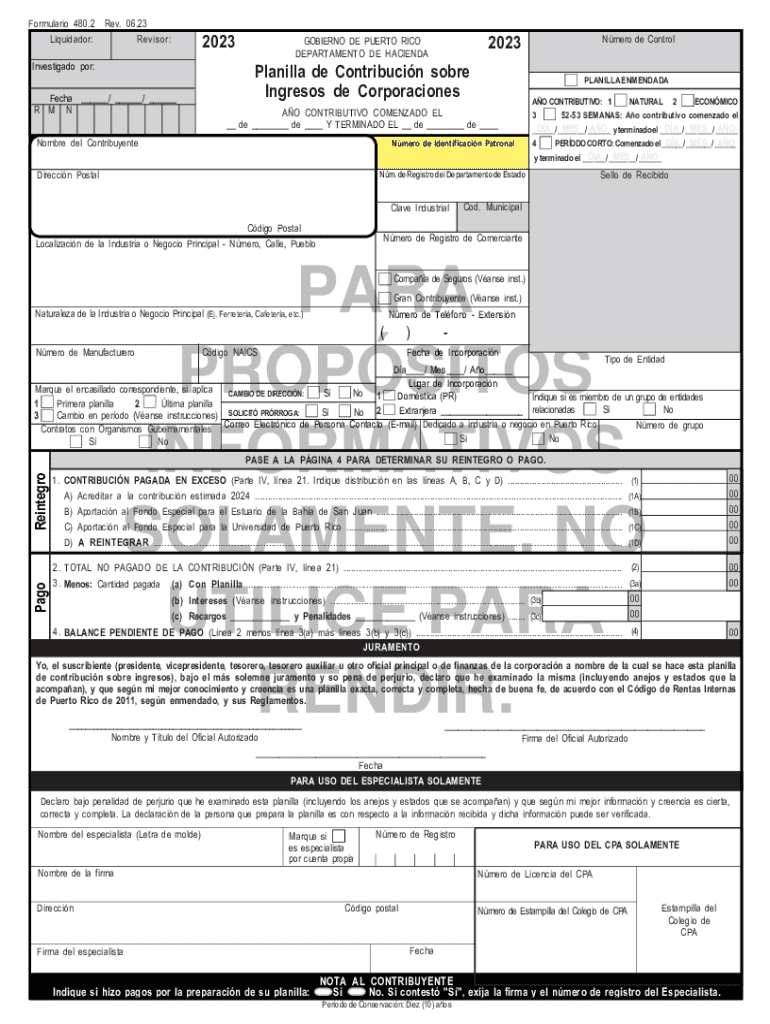

Form 480.2, also known as the Puerto Rican tax form 480.2, is a document used by corporations in Puerto Rico to report income and expenses. This form is essential for businesses operating in Puerto Rico as it helps ensure compliance with local tax laws. It is specifically designed for corporations to declare their earnings and calculate the taxes owed to the Puerto Rico Department of Treasury.

How to Obtain Form 480.2

To obtain Form 480.2, individuals can visit the official website of the Puerto Rico Department of Treasury, where the form is available for download in PDF format. Additionally, businesses may request a physical copy of the form from local tax offices. It is important to ensure that you are using the most recent version of the form to comply with current tax regulations.

Steps to Complete Form 480.2

Completing Form 480.2 involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form with accurate information regarding your corporation's income, deductions, and credits.

- Review the completed form for any errors or omissions.

- Submit the form to the Puerto Rico Department of Treasury by the specified deadline.

Legal Use of Form 480.2

Form 480.2 is legally required for corporations in Puerto Rico to report their financial activity. Failure to file this form can result in penalties, including fines and interest on unpaid taxes. It is crucial for businesses to understand their obligations under Puerto Rican tax law and ensure timely and accurate submission of Form 480.2.

Filing Deadlines for Form 480.2

The filing deadline for Form 480.2 typically aligns with the corporate tax return due date in Puerto Rico. Corporations should be aware of these deadlines to avoid late fees and potential legal issues. It is advisable to consult the Puerto Rico Department of Treasury's official guidelines for the exact dates each tax year.

Required Documents for Form 480.2

When completing Form 480.2, corporations must have several documents ready, including:

- Financial statements that detail income and expenses.

- Any relevant tax credit documentation.

- Previous tax returns for reference.

Form Submission Methods for 480.2

Corporations can submit Form 480.2 through various methods. These include:

- Online submission via the Puerto Rico Department of Treasury's electronic filing system.

- Mailing a printed copy of the form to the appropriate tax office.

- Submitting the form in person at designated tax offices.

Handy tips for filling out 480 2 CORP 07 21 480 2 CORP 07 21 online

Quick steps to complete and e-sign 480 2 CORP 07 21 480 2 CORP 07 21 online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for maximum simpleness. Use signNow to e-sign and send 480 2 CORP 07 21 480 2 CORP 07 21 for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 480 2 corp 07 21 480 2 corp 07 21

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 480 2 Puerto Rico?

Form 480 2 Puerto Rico is a tax form used by businesses to report income and expenses to the Puerto Rico Department of Treasury. It is essential for ensuring compliance with local tax regulations. Understanding how to properly fill out this form can help businesses avoid penalties and streamline their tax processes.

-

How can airSlate SignNow help with form 480 2 Puerto Rico?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign documents, including form 480 2 Puerto Rico. With its user-friendly interface, you can easily manage your tax forms and ensure they are signed and submitted on time. This helps reduce the stress associated with tax season.

-

What are the pricing options for using airSlate SignNow for form 480 2 Puerto Rico?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a basic plan to more advanced options. Each plan includes features that can assist with managing form 480 2 Puerto Rico efficiently. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for managing form 480 2 Puerto Rico?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage form 480 2 Puerto Rico alongside your other business tools. This integration helps streamline your workflow and ensures that all your documents are easily accessible. Popular integrations include CRM systems and cloud storage services.

-

What features does airSlate SignNow offer for form 480 2 Puerto Rico?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for form 480 2 Puerto Rico. These features enhance the efficiency of your document management process. Additionally, you can automate reminders for signatures to ensure timely submissions.

-

Is airSlate SignNow secure for handling form 480 2 Puerto Rico?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including form 480 2 Puerto Rico. You can trust that your sensitive information is safe while using our platform. Regular security audits further ensure the integrity of your data.

-

Can I access form 480 2 Puerto Rico on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage form 480 2 Puerto Rico on the go. This flexibility ensures that you can send, sign, and track your documents anytime, anywhere. The mobile app provides a seamless experience for busy professionals.

Get more for 480 2 CORP 07 21 480 2 CORP 07 21

- Canada application change name form

- Uba debit card application form

- Person of interest entity disclosure form

- Direct registration form

- Declaration of funds and assets on arrival refugee form

- K baptist medical center jacksonvillewolfson childrens hospital form

- Victoria tenancy agreement form

- Georgia labor form

Find out other 480 2 CORP 07 21 480 2 CORP 07 21

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document