PARA PROP SITOS INFORMATIVOS SOLAMENTE NO UTILICE

Understanding the Planilla para Personas de 65

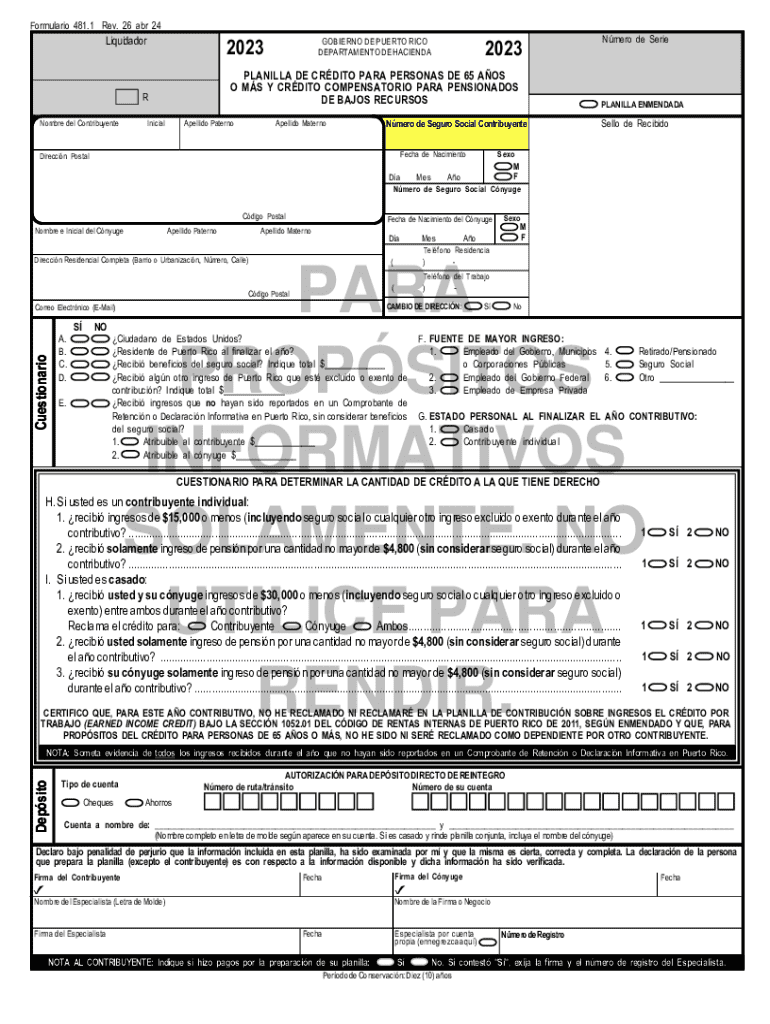

The planilla para personas de 65 is a specific tax form designed for individuals aged 65 and older in Puerto Rico. This form allows eligible seniors to report their income and claim various tax credits, including those related to pensions and retirement income. Understanding the purpose of this form is essential for seniors to ensure compliance with tax regulations while maximizing their potential benefits.

Steps to Complete the Planilla para Personas de 65

Completing the planilla para personas de 65 involves several key steps:

- Gather necessary documents, including proof of income, pension statements, and any relevant deductions.

- Fill out the form accurately, ensuring all personal information is correct.

- Calculate any applicable credits, especially those available for individuals aged 65 and older.

- Review the completed form for accuracy before submission.

Required Documents for the Planilla para Personas de 65

To successfully complete the planilla para personas de 65, individuals must have specific documents on hand:

- Social Security number or taxpayer identification number.

- Proof of income, such as W-2 forms or 1099 statements.

- Documentation of any tax credits being claimed, particularly those for seniors.

- Bank statements or other financial records that support income claims.

Eligibility Criteria for the Planilla para Personas de 65

Eligibility for the planilla para personas de 65 is primarily based on age and income level. Individuals must:

- Be at least 65 years old by the end of the tax year.

- Meet specific income thresholds to qualify for certain tax credits.

- Be a resident of Puerto Rico during the tax year.

Filing Deadlines for the Planilla para Personas de 65

It is crucial to be aware of the filing deadlines associated with the planilla para personas de 65. Generally, the deadline for submitting this form aligns with the standard tax filing deadline in Puerto Rico, which is typically on April 15 of each year. However, it is advisable to check for any updates or changes to the schedule that may occur annually.

Form Submission Methods for the Planilla para Personas de 65

The planilla para personas de 65 can be submitted through various methods:

- Online submission via the official tax portal for Puerto Rico.

- Mailing the completed form to the appropriate tax office.

- In-person submission at designated tax offices throughout Puerto Rico.

Handy tips for filling out PARA PROP SITOS INFORMATIVOS SOLAMENTE NO UTILICE online

Quick steps to complete and e-sign PARA PROP SITOS INFORMATIVOS SOLAMENTE NO UTILICE online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for maximum simpleness. Use signNow to electronically sign and send PARA PROP SITOS INFORMATIVOS SOLAMENTE NO UTILICE for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the para propsitos informativos solamente no utilice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a planilla para personas de 65?

A planilla para personas de 65 is a specialized document designed to cater to the needs of individuals aged 65 and older. It simplifies the process of managing important paperwork, ensuring that seniors can easily access and complete necessary forms.

-

How can airSlate SignNow help with the planilla para personas de 65?

airSlate SignNow provides an intuitive platform for creating, sending, and eSigning the planilla para personas de 65. With its user-friendly interface, seniors can navigate the document process with ease, ensuring that they can manage their paperwork efficiently.

-

What are the pricing options for using airSlate SignNow for the planilla para personas de 65?

airSlate SignNow offers flexible pricing plans that cater to different needs, including options for individuals and businesses. By choosing the right plan, users can efficiently manage their planilla para personas de 65 without breaking the bank.

-

What features does airSlate SignNow offer for the planilla para personas de 65?

Key features of airSlate SignNow for the planilla para personas de 65 include customizable templates, secure eSigning, and document tracking. These features ensure that users can create and manage their documents with confidence and ease.

-

Are there any benefits to using airSlate SignNow for the planilla para personas de 65?

Using airSlate SignNow for the planilla para personas de 65 offers numerous benefits, including time savings and enhanced security. Seniors can complete their documents quickly and securely, reducing the stress associated with paperwork.

-

Can I integrate airSlate SignNow with other tools for the planilla para personas de 65?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage the planilla para personas de 65 alongside other tools. This integration enhances workflow efficiency and ensures that all necessary documents are easily accessible.

-

Is airSlate SignNow user-friendly for seniors managing the planilla para personas de 65?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for seniors managing the planilla para personas de 65. The straightforward interface and guided processes help ensure that users can navigate the platform with ease.

Get more for PARA PROP SITOS INFORMATIVOS SOLAMENTE NO UTILICE

- Community based economic development cbed technical and financial assistance program application for grant writing technical form

- Pennsylvania high school transcript request form

- Vsc 33 ucf veterans academic resource center form

- Ri unemployment direct deposit form

- Stfx transcript request form

- Republictaxpayer form

- Tender of please or admission and waiver of rights form

- St tammany parish communications district 9 1 1 addressing form

Find out other PARA PROP SITOS INFORMATIVOS SOLAMENTE NO UTILICE

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself