Maryland Form 502V Use of Vehicle for Charitable Purposes

Understanding the Maryland Form 502V for Charitable Vehicle Use

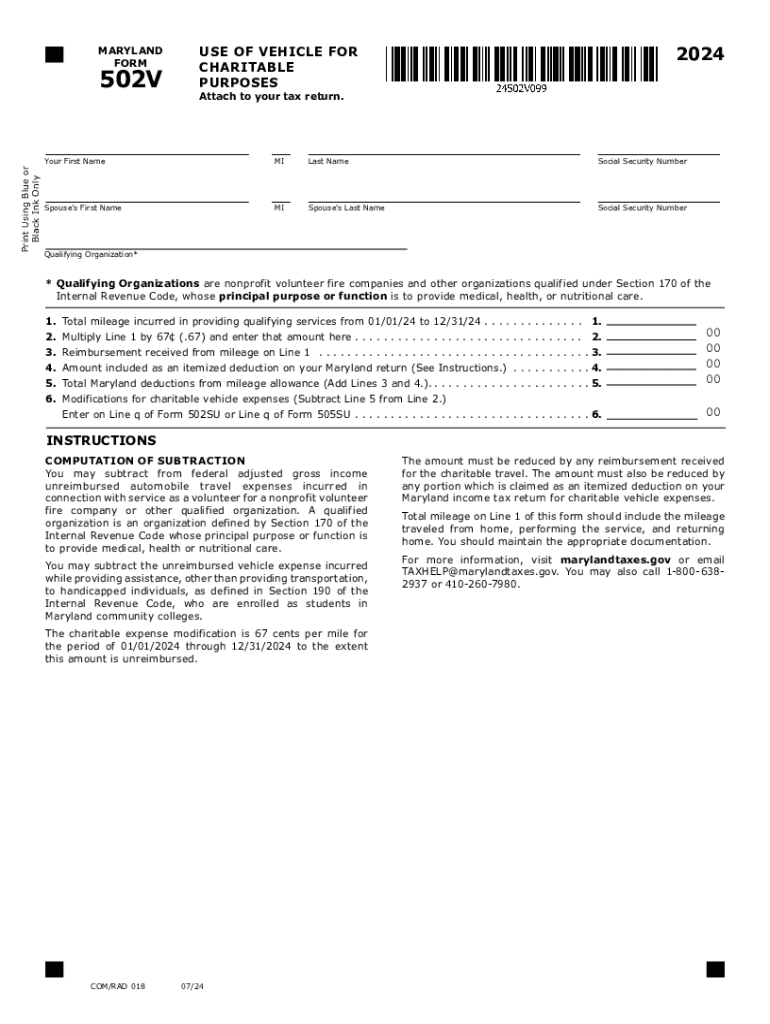

The Maryland Form 502V is essential for individuals or businesses that wish to claim deductions for the use of a vehicle for charitable purposes. This form allows taxpayers to report the fair market value of the vehicle used in service to a qualified charitable organization. It is important to understand how this form functions within the context of Maryland state tax regulations and federal guidelines.

Steps to Complete the Maryland Form 502V

Completing the Maryland Form 502V involves several key steps:

- Gather necessary documentation, including records of the vehicle's fair market value and details about the charitable organization.

- Fill out the form accurately, ensuring all required fields are completed, including your personal information and the specifics of the vehicle use.

- Calculate the total deduction based on the fair market value reported.

- Review the form for accuracy before submission to avoid any potential issues.

Eligibility Criteria for Using the Maryland Form 502V

To qualify for using the Maryland Form 502V, taxpayers must meet specific eligibility criteria. The vehicle must be used primarily for charitable purposes, and the organization must be recognized as a qualified charity by the IRS. Additionally, the taxpayer must retain proper documentation to substantiate the claim, including receipts and records of the vehicle's use.

Legal Considerations for the Maryland Form 502V

Understanding the legal implications of using the Maryland Form 502V is crucial. Taxpayers must comply with both state and federal laws regarding charitable contributions. Misreporting or failing to provide adequate documentation can lead to penalties, including fines or disallowance of the claimed deduction. It is advisable to consult with a tax professional if there are any uncertainties regarding compliance.

Obtaining the Maryland Form 502V

The Maryland Form 502V can be easily obtained through the Maryland State Comptroller's website or by visiting local tax offices. It is available in both digital and paper formats, ensuring accessibility for all taxpayers. For those who prefer digital solutions, the form can be filled out and submitted online, streamlining the process significantly.

Filing Deadlines for the Maryland Form 502V

Timely filing of the Maryland Form 502V is essential to ensure that taxpayers receive their deductions. The filing deadline typically aligns with the state income tax return due date, which is usually on April fifteenth. Taxpayers should be aware of any changes to deadlines that may occur due to holidays or other factors, and plan accordingly to avoid late submissions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502v use of vehicle for charitable purposes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the 2024 vehicle?

The 2024 vehicle comes equipped with advanced safety features, enhanced fuel efficiency, and state-of-the-art technology. These features ensure a smooth driving experience while prioritizing safety and comfort. Additionally, the 2024 vehicle offers customizable options to suit individual preferences.

-

How does the pricing of the 2024 vehicle compare to previous models?

The pricing of the 2024 vehicle is competitive, reflecting the latest advancements and features. While it may be slightly higher than previous models, the added value in technology and efficiency justifies the cost. Customers can also explore financing options to make the purchase more manageable.

-

What are the benefits of choosing the 2024 vehicle?

Choosing the 2024 vehicle means investing in reliability, innovation, and sustainability. With improved fuel economy and reduced emissions, it aligns with eco-friendly goals. Furthermore, the 2024 vehicle offers a warranty that provides peace of mind for new owners.

-

Are there any special promotions for the 2024 vehicle?

Yes, there are several promotions available for the 2024 vehicle, including limited-time discounts and financing offers. Customers are encouraged to check with local dealerships for specific deals. These promotions can signNowly reduce the overall cost of the 2024 vehicle.

-

What integrations are available for the 2024 vehicle?

The 2024 vehicle supports various integrations with smart devices and apps, enhancing the driving experience. Features like smartphone connectivity and navigation systems are designed to keep drivers informed and entertained. These integrations make the 2024 vehicle a modern choice for tech-savvy consumers.

-

How does the 2024 vehicle perform in terms of fuel efficiency?

The 2024 vehicle boasts impressive fuel efficiency ratings, making it an economical choice for daily commuting and long trips. With advancements in engine technology, drivers can expect to save on fuel costs without sacrificing performance. This efficiency is a key selling point for the 2024 vehicle.

-

What safety features are included in the 2024 vehicle?

Safety is a top priority in the 2024 vehicle, which includes features such as adaptive cruise control, lane-keeping assist, and automatic emergency braking. These technologies work together to enhance driver and passenger safety. The 2024 vehicle has received high safety ratings from industry standards.

Get more for Maryland Form 502V Use Of Vehicle For Charitable Purposes

- Elms service request form elms service request form

- Ibew associate form

- Nyc 210 claim form

- Acp enrollment form

- Exit survey for chairholders who resigned their chair position form

- Open pdfs in acrobat reader from chrome adobe help form

- Hi22 form

- Form 11 lohnausweiscertificat de salairecertificato di salario

Find out other Maryland Form 502V Use Of Vehicle For Charitable Purposes

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy