Maryland Form 502UP Underpayment of Estimated Income Tax by Individuals

Understanding the Maryland Form 502UP for Underpayment of Estimated Income Tax

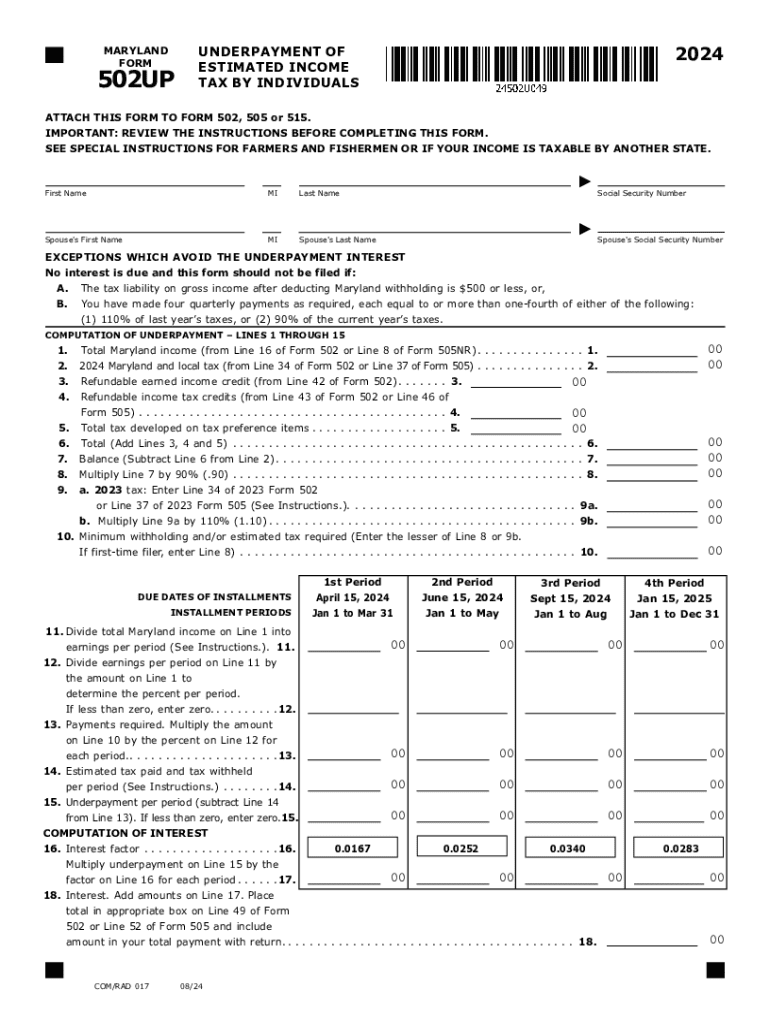

The Maryland Form 502UP is designed for individuals who may have underpaid their estimated income tax. This form is essential for taxpayers who have not met the required payment thresholds throughout the year, thus incurring a potential penalty. The form allows individuals to calculate any underpayment and determine the amount owed to the state. Understanding its purpose is crucial for maintaining compliance with Maryland tax laws and avoiding unnecessary penalties.

Steps to Complete the Maryland Form 502UP

Completing the Maryland Form 502UP requires careful attention to detail. Here are the general steps to follow:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of estimated tax payments you have made throughout the year.

- Use the form's worksheet to calculate any underpayment based on your estimated tax liability and payments made.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for accuracy before submission.

Obtaining the Maryland Form 502UP

The Maryland Form 502UP can be easily obtained through the Maryland Comptroller's website or by visiting local tax offices. Additionally, many tax preparation software programs include this form as part of their offerings, allowing for digital completion. It is important to ensure you are using the most current version of the form to comply with state regulations.

Key Elements of the Maryland Form 502UP

Several key elements are essential when filling out the Maryland Form 502UP:

- Taxpayer Information: This includes your name, address, and Social Security number.

- Estimated Tax Liability: The total amount of tax you expect to owe for the year.

- Payments Made: A record of all estimated tax payments submitted during the year.

- Underpayment Calculation: A section that helps determine if you owe additional tax due to underpayment.

Filing Deadlines for the Maryland Form 502UP

Timely filing of the Maryland Form 502UP is crucial to avoid penalties. Generally, the form must be submitted by the same deadlines as your income tax return. This typically falls on April 15 each year, but it is advisable to check for any changes or extensions that may apply. Keeping track of these deadlines will help ensure compliance with state tax laws.

Penalties for Non-Compliance with the Maryland Form 502UP

Failure to file the Maryland Form 502UP or to pay any owed taxes can lead to significant penalties. The state may impose fines based on the amount of underpayment, and interest may accrue on any unpaid balance. Understanding these potential consequences emphasizes the importance of accurately completing and submitting the form on time.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502up underpayment of estimated income tax by individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 502UP?

The Maryland Form 502UP is a tax form used for reporting income and calculating tax liabilities for individuals in Maryland. It is essential for residents to accurately complete this form to ensure compliance with state tax regulations. Using airSlate SignNow can simplify the process of filling out and eSigning the Maryland Form 502UP.

-

How can airSlate SignNow help with the Maryland Form 502UP?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the Maryland Form 502UP. With its intuitive interface, users can quickly complete the form and securely send it for signatures. This streamlines the process, making tax filing more efficient and less stressful.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form 502UP?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. The cost is competitive and reflects the value of the features provided, such as document management and eSigning capabilities for forms like the Maryland Form 502UP. You can choose a plan that best fits your requirements.

-

What features does airSlate SignNow offer for the Maryland Form 502UP?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are beneficial for managing the Maryland Form 502UP. These features ensure that users can efficiently complete their tax forms while maintaining compliance and security. Additionally, the platform allows for easy collaboration with tax professionals.

-

Can I integrate airSlate SignNow with other applications for the Maryland Form 502UP?

Yes, airSlate SignNow offers integrations with various applications, enhancing the workflow for managing the Maryland Form 502UP. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. This integration capability helps users maintain a seamless workflow when handling their tax documents.

-

What are the benefits of using airSlate SignNow for tax forms like the Maryland Form 502UP?

Using airSlate SignNow for tax forms like the Maryland Form 502UP provides numerous benefits, including time savings, enhanced security, and ease of use. The platform allows users to complete and eSign documents from anywhere, reducing the hassle of traditional paper forms. This convenience can lead to faster processing and submission of tax documents.

-

Is airSlate SignNow secure for handling the Maryland Form 502UP?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like the Maryland Form 502UP. The platform employs advanced encryption and security protocols to protect user data. This ensures that your tax information remains confidential and secure throughout the signing process.

Get more for Maryland Form 502UP Underpayment Of Estimated Income Tax By Individuals

- New zealand health services form

- New zealand non profit 609547135 form

- Fraser institute annual survey of mining companies 2020 form

- Pdf a nnual e nterprise s urvey stats nz form

- New zealand health services 609548443 form

- Study health form

- New zealand vacancy work 609549140 form

- Wwwstatsgovtnz assets uploadsprivacy impact assessment for adding social survey data to form

Find out other Maryland Form 502UP Underpayment Of Estimated Income Tax By Individuals

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT