Maryland Form 502X Amended Tax Return

What is the Maryland Form 502X Amended Tax Return

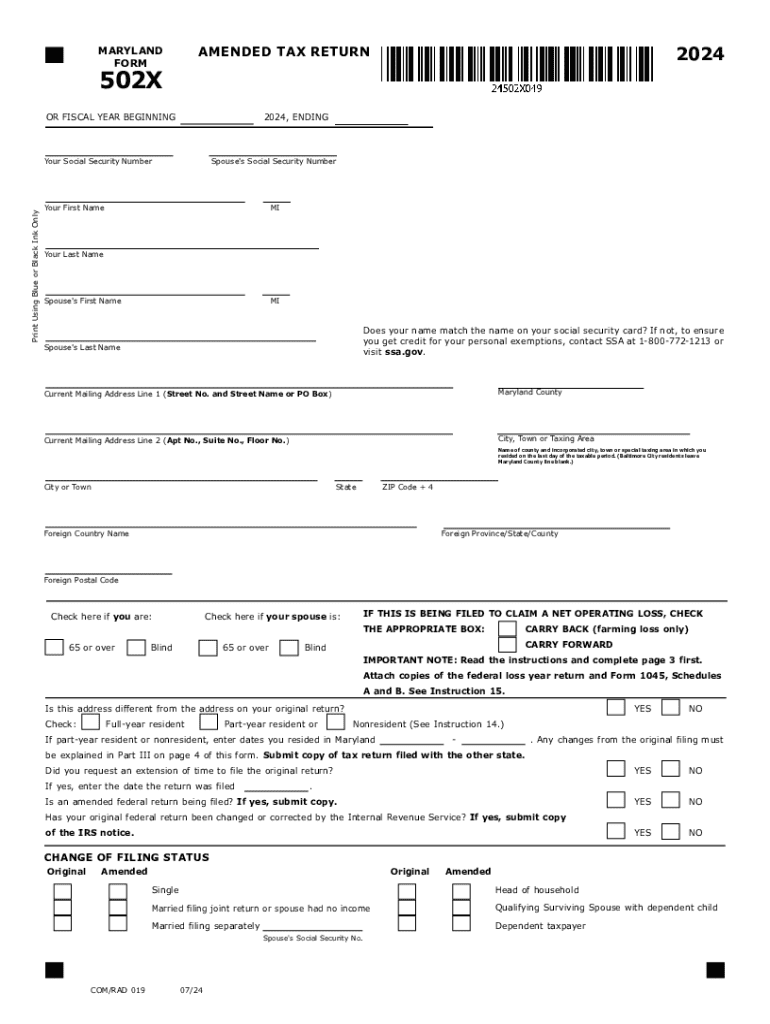

The Maryland Form 502X is an amended tax return form used by individuals to correct errors or make changes to their previously filed Maryland state tax returns. This form is essential for taxpayers who need to adjust their income, deductions, or credits after submitting their original return. By filing the 502X, taxpayers can ensure that their tax records are accurate and up-to-date, which can help avoid potential issues with the Maryland State Comptroller.

How to use the Maryland Form 502X Amended Tax Return

Using the Maryland Form 502X involves several key steps. First, obtain the form from the Maryland Comptroller's website or through authorized tax preparation services. Next, fill out the form with the necessary corrections, including the original amounts and the amended amounts. It is important to provide a clear explanation for each change made on the form. After completing the form, review it for accuracy before submitting it to the appropriate state tax authority.

Steps to complete the Maryland Form 502X Amended Tax Return

Completing the Maryland Form 502X requires careful attention to detail. Follow these steps:

- Gather your original tax return and any supporting documents.

- Indicate your personal information at the top of the form, including your name, address, and Social Security number.

- Fill in the sections that require corrections, clearly showing the original and amended amounts.

- Provide explanations for each change in the designated area on the form.

- Sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Maryland Form 502X. Generally, taxpayers must file the amended return within three years from the original due date of the return or within one year from the date of any tax payment made, whichever is later. Staying informed about these deadlines helps ensure compliance and prevents potential penalties.

Required Documents

When filing the Maryland Form 502X, certain documents may be required to support your amendments. These can include:

- Your original tax return.

- Any W-2 forms or 1099 forms that report income.

- Documentation for any deductions or credits you are claiming.

- Any additional forms that pertain to the changes being made.

Form Submission Methods

The Maryland Form 502X can be submitted through various methods. Taxpayers have the option to file the form online using the Maryland Comptroller’s e-filing system, or they can mail a paper copy to the appropriate address provided on the form. In-person submissions may also be possible at designated state tax offices. Choosing the right submission method can help ensure timely processing of your amended return.

Handy tips for filling out Maryland Form 502X Amended Tax Return online

Quick steps to complete and e-sign Maryland Form 502X Amended Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for maximum straightforwardness. Use signNow to e-sign and send Maryland Form 502X Amended Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502x amended tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland tax form 502X?

The Maryland tax form 502X is an amended income tax return used by residents to correct errors on their original Maryland tax return. This form allows taxpayers to adjust their income, deductions, and credits to ensure accurate tax reporting. Using the Maryland tax form 502X can help you avoid penalties and ensure compliance with state tax laws.

-

How can airSlate SignNow help with the Maryland tax form 502X?

airSlate SignNow provides a seamless platform for electronically signing and sending the Maryland tax form 502X. With its user-friendly interface, you can easily prepare and submit your amended tax return without the hassle of printing and mailing. This not only saves time but also ensures that your documents are securely handled.

-

Is there a cost associated with using airSlate SignNow for the Maryland tax form 502X?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that streamline the process of managing documents like the Maryland tax form 502X. You can choose a plan that fits your budget while benefiting from an efficient eSignature solution.

-

What features does airSlate SignNow offer for managing the Maryland tax form 502X?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for documents like the Maryland tax form 502X. These features enhance the efficiency of your workflow, allowing you to manage your tax documents with ease. Additionally, you can collaborate with others directly within the platform.

-

Can I integrate airSlate SignNow with other software for filing the Maryland tax form 502X?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to file the Maryland tax form 502X. This integration allows for a smoother workflow, ensuring that all your financial documents are in sync and accessible when needed. You can streamline your tax preparation process signNowly.

-

What are the benefits of using airSlate SignNow for the Maryland tax form 502X?

Using airSlate SignNow for the Maryland tax form 502X provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and sign your amended tax return quickly, minimizing the risk of errors. Additionally, your documents are stored securely, ensuring compliance with data protection regulations.

-

How do I get started with airSlate SignNow for the Maryland tax form 502X?

Getting started with airSlate SignNow for the Maryland tax form 502X is simple. You can sign up for an account on their website, choose a suitable plan, and start creating your documents. The platform offers tutorials and customer support to help you navigate the process of preparing and submitting your amended tax return.

Get more for Maryland Form 502X Amended Tax Return

- Cupe unit 3 form

- Pdf customer credit application alpco form

- Get new customer authorisation form aviva amii org

- Who lives at 2419 9th ave w williston nd 58801spokeo form

- Wwwchamberofcommercecomunited statesmichigancapital area humane society spay ampamp neuter clinic in lansing form

- Parental consent form for youth eventssaint aidans catholic church

- Wwwsconeequinehospitalcomauour teampageteam archive page 4 of 5 scone equine form

- Wwwtopnpicomtx1598825994dr david daviddr david r david 708 8th street armour sd form

Find out other Maryland Form 502X Amended Tax Return

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online