Form 14135 Rev 11

What is the Form 14135 Rev 11

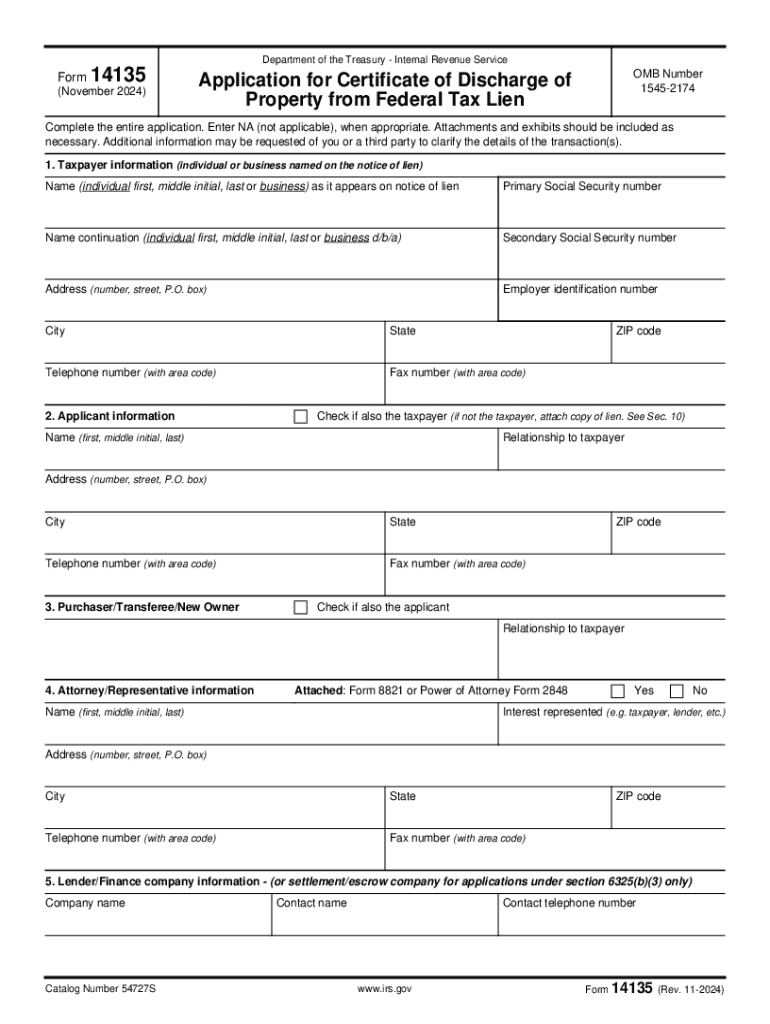

The Form 14135 Rev 11 is an official document used to request the discharge of a tax lien. This form is essential for individuals and businesses looking to clear their financial records of tax-related encumbrances. A tax lien can significantly impact credit scores and financial opportunities, making the discharge process crucial for those affected. Understanding the purpose and implications of this form is vital for effective financial management.

How to use the Form 14135 Rev 11

Using the Form 14135 Rev 11 involves filling it out accurately to ensure that your request for discharge is processed smoothly. Begin by providing your personal information, including your name, address, and Social Security number. Next, include details about the tax lien you wish to discharge, such as the date it was filed and the amount owed. Finally, sign and date the form to certify that the information provided is correct. It is important to double-check all entries to avoid delays in processing.

Steps to complete the Form 14135 Rev 11

Completing the Form 14135 Rev 11 requires careful attention to detail. Follow these steps:

- Gather necessary information, including your tax identification number and details of the lien.

- Fill in your personal information accurately.

- Provide specifics about the tax lien, including the date it was filed.

- Review the completed form for accuracy.

- Sign and date the form to confirm your submission.

Once completed, the form can be submitted according to the guidelines provided.

Required Documents

When submitting the Form 14135 Rev 11, certain documents may be required to support your request. These typically include:

- Proof of payment for any outstanding taxes associated with the lien.

- Documentation showing your current financial status, if applicable.

- Any correspondence related to the lien from the IRS or state tax authority.

Having these documents ready can help expedite the processing of your discharge request.

Eligibility Criteria

To be eligible for discharge of a tax lien using the Form 14135 Rev 11, you must meet specific criteria. Generally, you should have paid off the tax liability related to the lien or have entered into a payment agreement with the IRS. Additionally, you must not have any other outstanding tax debts. Understanding these criteria is essential to ensure that your application is valid and can be processed without issues.

Form Submission Methods

The Form 14135 Rev 11 can be submitted through various methods, depending on your preference and the requirements of the tax authority. Common submission methods include:

- Online submission via the IRS website, if applicable.

- Mailing the completed form to the appropriate IRS address.

- In-person submission at local IRS offices.

Choosing the right submission method can affect the speed of processing, so consider your options carefully.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14135 rev 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to discharge a tax lien?

To discharge a tax lien means to remove the legal claim the government has on your property due to unpaid taxes. This process allows you to regain full control over your assets. Using airSlate SignNow, you can easily manage the necessary documents to discharge a tax lien efficiently.

-

How can airSlate SignNow help me discharge a tax lien?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning documents required to discharge a tax lien. Our user-friendly interface ensures that you can complete the necessary paperwork quickly and accurately. This saves you time and reduces the stress associated with the process.

-

What are the costs associated with discharging a tax lien using airSlate SignNow?

The costs to discharge a tax lien using airSlate SignNow are competitive and designed to fit various budgets. We offer flexible pricing plans that cater to both individuals and businesses. By choosing our service, you can save money while ensuring your documents are handled professionally.

-

Are there any specific features in airSlate SignNow that assist with discharging a tax lien?

Yes, airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking that are essential for discharging a tax lien. These tools help you manage your documents efficiently and ensure compliance with legal requirements. Our platform simplifies the entire process.

-

What benefits can I expect from using airSlate SignNow to discharge a tax lien?

Using airSlate SignNow to discharge a tax lien offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete the process from anywhere, making it convenient for busy professionals. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other tools to help discharge a tax lien?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to discharge a tax lien. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure that your workflow remains uninterrupted. This connectivity simplifies document management.

-

Is airSlate SignNow compliant with legal standards for discharging a tax lien?

Yes, airSlate SignNow is fully compliant with legal standards required for discharging a tax lien. Our platform adheres to industry regulations, ensuring that your documents are legally binding and secure. You can trust us to handle your sensitive information with the utmost care.

Get more for Form 14135 Rev 11

- Supplement to certificate of insurance form

- Po box 5200 binghamton ny 13902 5200 form

- Pamphlet 400 476743242 form

- Employment of children alaska department of labor and form

- Email statewide form

- Mac app ilovepdf v1180 download form

- 8775330337 form

- For class of employees for whom disability benefits are not required by law form

Find out other Form 14135 Rev 11

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement