Maryland 502S Maryland Heritage Structure Rehabilitation Tax Credit Form

What is the Maryland 502S Heritage Structure Rehabilitation Tax Credit

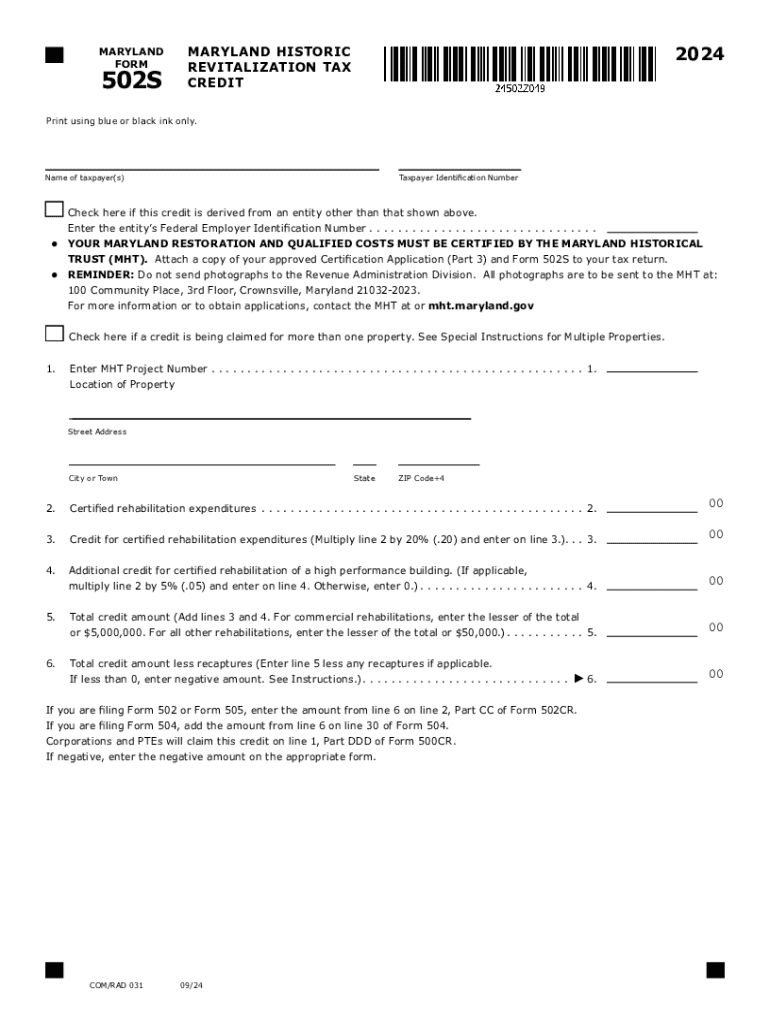

The Maryland 502S form is associated with the Maryland Heritage Structure Rehabilitation Tax Credit, a program designed to encourage the preservation and rehabilitation of historic properties in Maryland. This tax credit is available to property owners who undertake qualified rehabilitation projects on certified heritage structures. By providing a financial incentive, the program aims to promote the conservation of Maryland's rich architectural heritage while enhancing the economic vitality of communities.

Eligibility Criteria for the Maryland 502S Tax Credit

To qualify for the Maryland 502S tax credit, property owners must meet specific eligibility criteria. The property must be a certified heritage structure, recognized for its historical significance. Additionally, the rehabilitation work must adhere to the standards set by the Secretary of the Interior. Eligible projects typically include exterior and interior renovations that restore or preserve the structure's historical character. Property owners should also ensure that they have not previously claimed this credit for the same rehabilitation project.

Steps to Complete the Maryland 502S Tax Credit Application

Completing the Maryland 502S application involves several key steps. First, property owners should gather all necessary documentation, including proof of ownership and detailed project plans. Next, they must fill out the 502S form, providing information about the property and the rehabilitation work undertaken. It is essential to include any required supporting documents, such as photographs of the property before and after rehabilitation. Once the application is complete, it should be submitted to the appropriate state agency for review.

Required Documents for the Maryland 502S Tax Credit

When applying for the Maryland 502S tax credit, specific documents are required to support the application. These typically include:

- Proof of ownership, such as a deed or title

- Detailed project plans and specifications

- Photographs of the property before and after rehabilitation

- Invoices and receipts for all rehabilitation expenses

- A completed 502S application form

Ensuring that all documents are accurate and complete is crucial for a successful application process.

Filing Deadlines for the Maryland 502S Tax Credit

Filing deadlines for the Maryland 502S tax credit vary depending on the specific tax year and the nature of the rehabilitation project. Generally, property owners should submit their applications within a certain timeframe after completing the rehabilitation work. It is advisable to consult the Maryland State Department of Assessments and Taxation for the most current deadlines and any changes that may occur annually.

Examples of Using the Maryland 502S Tax Credit

Property owners can benefit from the Maryland 502S tax credit in various ways. For instance, a homeowner restoring a historic Victorian house may receive a tax credit for expenses related to repairing original windows and restoring decorative moldings. Similarly, a business owner renovating a historic commercial building could claim credits for costs incurred in updating the façade while preserving its historical elements. These examples illustrate how the tax credit can significantly reduce the financial burden of maintaining and enhancing heritage structures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland 502s maryland heritage structure rehabilitation tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 502s in the context of airSlate SignNow?

502s refer to the specific document types that can be managed and signed using airSlate SignNow. This includes contracts, agreements, and forms that require electronic signatures. Understanding 502s is crucial for businesses looking to streamline their document workflows.

-

How does airSlate SignNow handle 502s?

airSlate SignNow simplifies the process of managing 502s by providing an intuitive platform for sending, signing, and storing documents. Users can easily upload their 502s, send them for signatures, and track the signing process in real-time. This efficiency helps businesses save time and reduce errors.

-

What pricing options are available for airSlate SignNow for managing 502s?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for managing 502s. Each plan provides access to essential features for document management and eSigning, ensuring that businesses can choose a solution that fits their budget and requirements.

-

What features does airSlate SignNow offer for 502s?

Key features of airSlate SignNow for handling 502s include customizable templates, automated workflows, and secure storage. These features enhance the user experience by allowing businesses to create, send, and manage their 502s efficiently while ensuring compliance and security.

-

Can airSlate SignNow integrate with other tools for managing 502s?

Yes, airSlate SignNow offers integrations with various third-party applications, making it easy to manage 502s alongside other business tools. This includes CRM systems, cloud storage services, and productivity software, allowing for a seamless workflow and improved efficiency.

-

What are the benefits of using airSlate SignNow for 502s?

Using airSlate SignNow for 502s provides numerous benefits, including faster turnaround times for document signing and enhanced security features. Businesses can also reduce paper usage and streamline their processes, leading to increased productivity and cost savings.

-

Is airSlate SignNow secure for handling sensitive 502s?

Absolutely, airSlate SignNow prioritizes security when managing 502s. The platform employs advanced encryption and compliance with industry standards to ensure that all documents are protected. This gives businesses peace of mind when handling sensitive information.

Get more for Maryland 502S Maryland Heritage Structure Rehabilitation Tax Credit

- State of alabama ma form

- Virtue of a previously executed lease agreement dated 20 hereinafter lease form

- Landlord or authorized agent form

- What is dba and when does your business need one form

- Rule 4 summonsfederal rules of civil procedureus lawlii form

- 2 postal addressing standardspostal explorer form

- Your banks name address city state zip code in accordance with form

- Texas limited power of attorney for sale of real estate form fill out

Find out other Maryland 502S Maryland Heritage Structure Rehabilitation Tax Credit

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free