WH AR Form

What is the WH AR

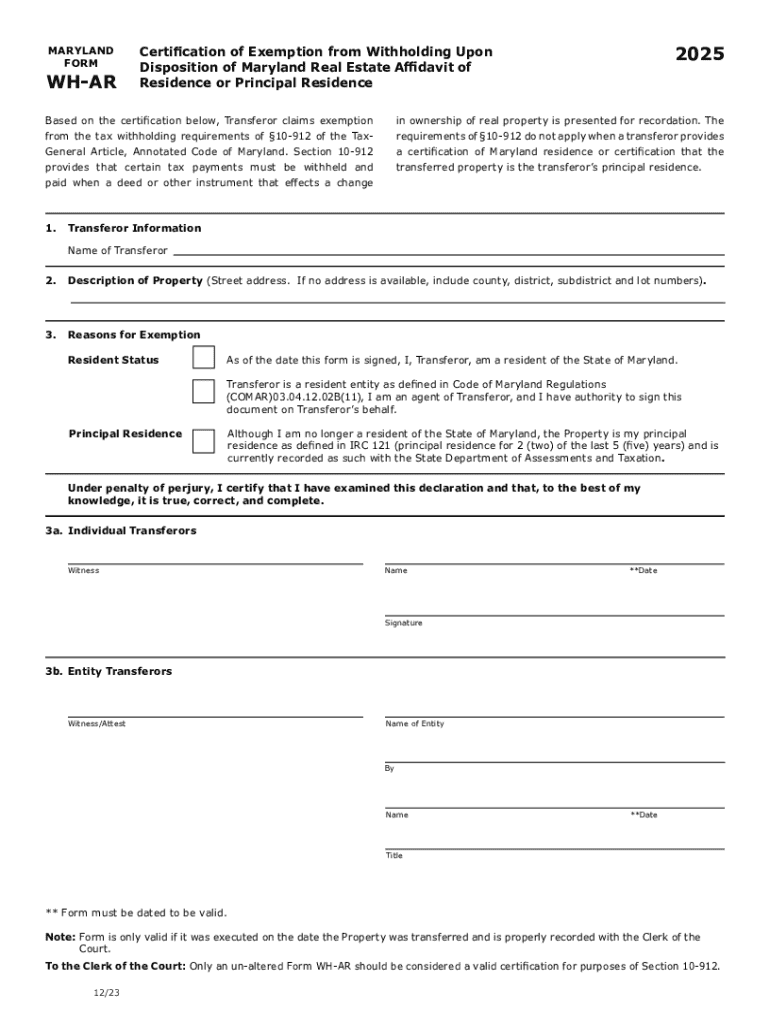

The WH AR is a specific form used for reporting withholding allowances for employees in the United States. This form is essential for employers to determine the appropriate amount of federal income tax to withhold from an employee's paycheck. The WH AR ensures that the withholding aligns with the employee's tax situation, helping to prevent underpayment or overpayment of taxes throughout the year.

How to use the WH AR

To use the WH AR, employees must complete the form accurately and submit it to their employer. The information provided on the form includes personal details, such as the employee's name, Social Security number, and the number of allowances they are claiming. Employers then use this information to calculate the correct withholding amount based on current tax rates and guidelines.

Steps to complete the WH AR

Completing the WH AR involves several straightforward steps:

- Obtain the WH AR form from your employer or download it from a reliable source.

- Fill in your personal information, including your name and Social Security number.

- Determine the number of allowances you wish to claim based on your tax situation.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to your employer for processing.

Legal use of the WH AR

The WH AR is legally recognized as a valid document for tax withholding purposes. Employers are required to maintain accurate records of all WH AR forms submitted by employees. Proper use of this form helps ensure compliance with federal tax laws, thereby reducing the risk of penalties for both employees and employers.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the completion and submission of the WH AR. These guidelines include instructions on how to determine the number of allowances, the importance of updating the form when personal circumstances change, and the necessity of submitting the form at the start of employment or when there are changes in tax status.

Filing Deadlines / Important Dates

While the WH AR itself does not have a specific filing deadline, it is crucial for employees to submit the form to their employer as soon as they begin employment or when their tax situation changes. Employers must process the form promptly to ensure accurate withholding on the employee's first paycheck. Keeping track of any changes and submitting updates in a timely manner is essential for compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wh ar

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it work?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. With its user-friendly interface, airSlate SignNow streamlines the signing process, making it quick and efficient. Users can easily upload documents, add signers, and track the status of their agreements in real-time.

-

How much does airSlate SignNow cost?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. The pricing is competitive and designed to provide a cost-effective solution for eSigning needs. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as document templates, in-person signing, and advanced security options. These features enhance the signing experience and ensure that your documents are handled securely. Additionally, airSlate SignNow allows for seamless collaboration among team members.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations allow for a smoother workflow and help you manage your documents more effectively. By connecting airSlate SignNow with your existing tools, you can enhance productivity and streamline processes.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance. The platform uses advanced encryption methods to protect your documents and ensure that they are safe from unauthorized access. Additionally, airSlate SignNow complies with industry standards, making it a reliable choice for handling sensitive information.

-

How can airSlate SignNow benefit my business?

airSlate SignNow can signNowly improve your business operations by reducing the time and costs associated with traditional paper-based signing processes. With its easy-to-use interface, you can quickly send and receive signed documents, enhancing efficiency. This not only saves time but also helps in maintaining a professional image.

-

What types of documents can I send with airSlate SignNow?

You can send a wide range of documents with airSlate SignNow, including contracts, agreements, and forms. The platform supports various file formats, making it versatile for different business needs. Whether you need to send a simple form or a complex contract, airSlate SignNow has you covered.

Get more for WH AR

- Pension withdrawal form

- Dexknowscomhollister caprinters business formstop 10 business form printers in hollister cadexknowscom

- General risk disclosure colmexprocom form

- Form 549 original licensing application for salesman broker salesman or broker license

- Cupe unit 3 form

- Pdf customer credit application alpco form

- Get new customer authorisation form aviva amii org

- Who lives at 2419 9th ave w williston nd 58801spokeo form

Find out other WH AR

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF