Constructive Ownership of Form

Understanding Constructive Ownership

Constructive ownership refers to a situation where an individual is considered to own an asset even if the legal title of that asset is held by another party. This concept is important for tax purposes, especially when dealing with partnerships and corporations. The IRS uses constructive ownership rules to determine the tax implications for individuals who may not directly hold an ownership interest but can influence or control the asset in question.

How to Utilize Constructive Ownership

To effectively utilize the concept of constructive ownership, individuals must assess their relationships with other owners and the nature of their interests in the asset. This involves understanding the specific IRS guidelines that define constructive ownership, including family attribution rules and ownership through entities such as corporations or partnerships. By identifying these relationships, individuals can ensure compliance with tax regulations and accurately report their interests.

Steps to Complete Constructive Ownership Documentation

Completing documentation related to constructive ownership involves several key steps:

- Identify all parties involved in the ownership structure.

- Determine the nature of the ownership interests held by each party.

- Gather necessary documentation, including partnership agreements and corporate bylaws.

- Complete any required IRS forms that pertain to the reporting of ownership interests.

- Review the completed documentation for accuracy and compliance with IRS guidelines.

Legal Considerations for Constructive Ownership

Constructive ownership has significant legal implications, particularly in tax law. The IRS may scrutinize ownership structures to ensure that individuals are not avoiding tax liabilities through indirect ownership. It is crucial to maintain accurate records and consult with a tax professional to navigate the complexities of constructive ownership, ensuring compliance with all applicable laws and regulations.

IRS Guidelines on Constructive Ownership

The IRS provides specific guidelines regarding constructive ownership, detailing how ownership is determined and reported. These guidelines include rules on family attribution, which can expand ownership interests to include relatives, and rules governing ownership through various business entities. Familiarity with these guidelines is essential for individuals and businesses to avoid potential penalties and ensure proper tax reporting.

Filing Deadlines and Important Dates

When dealing with constructive ownership, it is important to be aware of relevant filing deadlines. The IRS typically sets specific dates for the submission of forms related to ownership interests, which may vary based on the type of entity involved. Keeping track of these deadlines helps ensure compliance and avoids late filing penalties.

Required Documents for Constructive Ownership Reporting

To report constructive ownership accurately, several documents may be required, including:

- Partnership agreements

- Corporate bylaws

- IRS forms related to ownership reporting

- Financial statements that reflect ownership interests

Having these documents organized and readily available can facilitate the reporting process and ensure compliance with IRS regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the constructive ownership of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

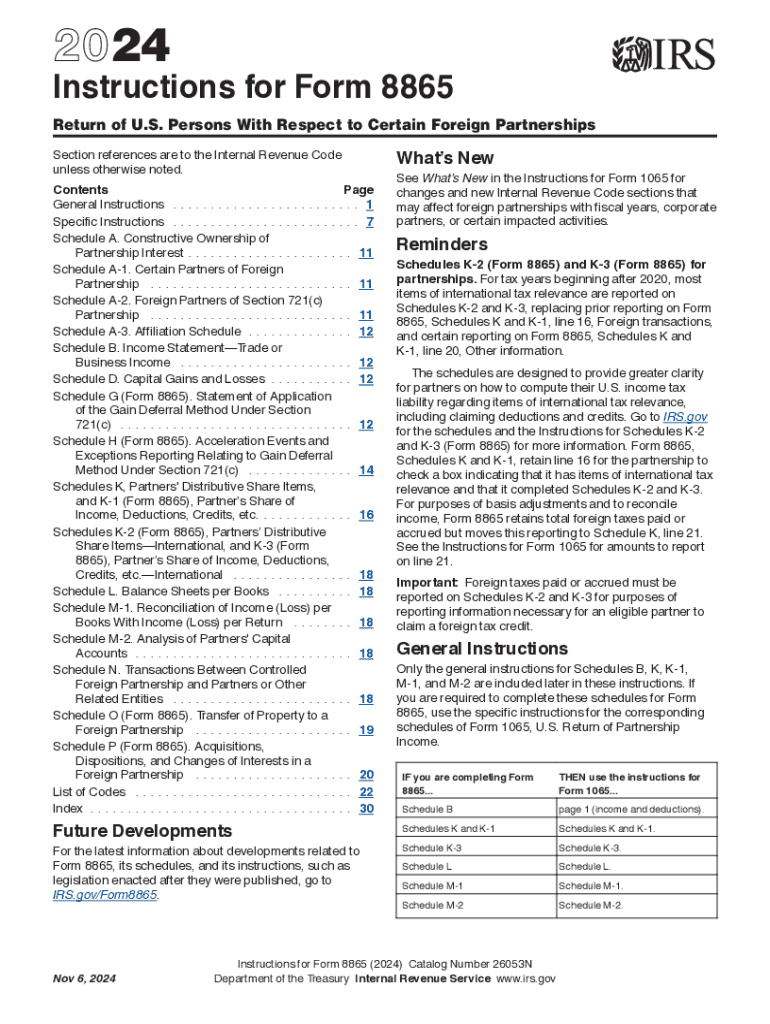

What is the 8865 instructions template?

The 8865 instructions template is a structured document designed to help users accurately complete IRS Form 8865. This template simplifies the process by providing clear guidelines and sections to fill out, ensuring compliance with tax regulations.

-

How can I access the 8865 instructions template?

You can easily access the 8865 instructions template through the airSlate SignNow platform. Simply sign up for an account, and you will find the template available for download or direct use within our document management system.

-

Is the 8865 instructions template customizable?

Yes, the 8865 instructions template is fully customizable to meet your specific needs. You can edit the template to include your business information and any additional details required for your tax submission.

-

What are the benefits of using the 8865 instructions template?

Using the 8865 instructions template streamlines the tax filing process, reduces errors, and saves time. It provides a clear framework that helps ensure all necessary information is included, making compliance easier for businesses.

-

Are there any costs associated with the 8865 instructions template?

The 8865 instructions template is part of the airSlate SignNow subscription, which offers various pricing plans. Depending on your chosen plan, you can access the template at a competitive rate, providing great value for your business.

-

Can I integrate the 8865 instructions template with other software?

Yes, the 8865 instructions template can be integrated with various accounting and tax software. This integration allows for seamless data transfer, making it easier to manage your tax documents and filings.

-

How does airSlate SignNow ensure the security of my 8865 instructions template?

airSlate SignNow prioritizes the security of your documents, including the 8865 instructions template. We use advanced encryption and secure cloud storage to protect your sensitive information from unauthorized access.

Get more for Constructive Ownership Of

- State of montana family or group child care application checklist form

- Medical history and admission examination dphhs home form

- Montana genetic testing financial assistance application genetic testing application form

- 93 dbhds authorization for usedisclosure of form

- Extension request application medicaidgov form

- Request for deceased patient records request for deceased patient records form

- North carolina minor child power of attorney form

- Permissible practices documentation for dental assistants form dental ohio

Find out other Constructive Ownership Of

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors