Form MO 1040 Individual Income Tax Return Long Form

What is the Form MO 1040 Individual Income Tax Return Long Form

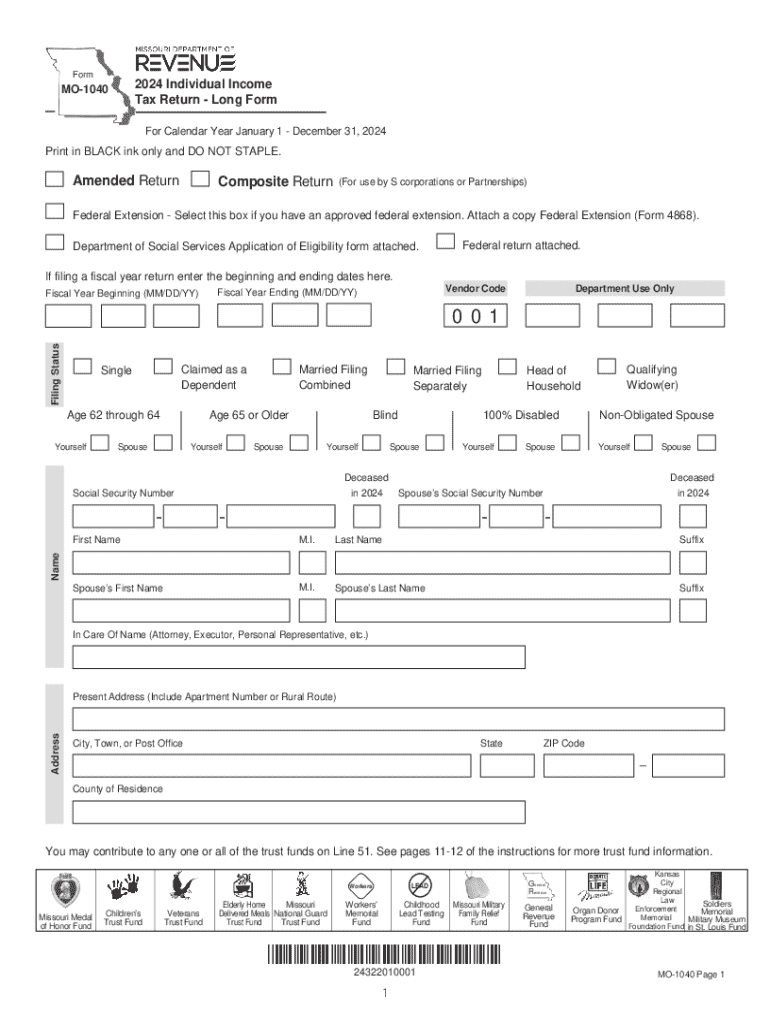

The Form MO 1040 Individual Income Tax Return Long Form is a state-specific tax form used by residents of Missouri to report their annual income to the state government. This form is designed for individuals whose financial situations may require a more detailed reporting process than the shorter versions of the tax return. It captures various income sources, deductions, and credits applicable to Missouri taxpayers, ensuring compliance with state tax laws.

How to use the Form MO 1040 Individual Income Tax Return Long Form

To effectively use the Form MO 1040, individuals should first gather all necessary financial documents, including W-2s, 1099s, and any records of other income. Next, taxpayers should carefully read the instructions provided with the form to understand the specific requirements for reporting income and claiming deductions. Completing the form accurately is crucial to avoid delays in processing and potential penalties.

Steps to complete the Form MO 1040 Individual Income Tax Return Long Form

Completing the Form MO 1040 involves several key steps:

- Gather all relevant financial documents, such as income statements and receipts for deductions.

- Fill in personal information, including your name, address, and Social Security number.

- Report all sources of income, including wages, self-employment income, and investment earnings.

- Calculate any deductions you may qualify for, such as standard or itemized deductions.

- Complete the tax calculation section to determine your tax liability or refund.

- Review the completed form for accuracy before submitting it.

Legal use of the Form MO 1040 Individual Income Tax Return Long Form

The Form MO 1040 is legally required for Missouri residents who meet certain income thresholds. Filing this form ensures compliance with state tax laws and helps avoid penalties for non-compliance. It is essential to file the form by the designated deadline to maintain good standing with the Missouri Department of Revenue.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form MO 1040. Typically, the deadline for submitting the form is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any updates or changes in deadlines each tax year to ensure timely filing.

Required Documents

To complete the Form MO 1040, taxpayers need to prepare several documents, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of deductions such as mortgage interest or medical expenses

- Proof of any tax credits claimed

Form Submission Methods (Online / Mail / In-Person)

The Form MO 1040 can be submitted in several ways. Taxpayers may choose to file online through approved e-filing services, which can expedite the process and provide confirmation of receipt. Alternatively, the form can be mailed to the appropriate address provided in the instructions or submitted in person at designated state tax offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo 1040 individual income tax return long form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form MO 1040 Individual Income Tax Return Long Form?

The Form MO 1040 Individual Income Tax Return Long Form is a tax document used by Missouri residents to report their annual income and calculate their state tax liability. This form allows for more detailed reporting of income, deductions, and credits compared to the short form. Understanding this form is essential for accurate tax filing in Missouri.

-

How can airSlate SignNow help with the Form MO 1040 Individual Income Tax Return Long Form?

airSlate SignNow simplifies the process of completing and eSigning the Form MO 1040 Individual Income Tax Return Long Form. Our platform allows users to fill out the form electronically, ensuring accuracy and efficiency. Additionally, you can securely send the completed form to your tax preparer or file it directly with the state.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to both individuals and businesses needing to manage forms like the Form MO 1040 Individual Income Tax Return Long Form. Our plans are designed to be cost-effective, providing access to essential features without breaking the bank. You can choose a plan that best fits your needs and budget.

-

Are there any features specifically for tax forms in airSlate SignNow?

Yes, airSlate SignNow includes features tailored for tax forms, including templates for the Form MO 1040 Individual Income Tax Return Long Form. Users can take advantage of customizable fields, automated reminders, and secure storage options. These features streamline the tax filing process and enhance user experience.

-

Can I integrate airSlate SignNow with other accounting software for tax filing?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easy to manage the Form MO 1040 Individual Income Tax Return Long Form alongside your other financial documents. This integration ensures a seamless workflow, allowing you to import and export data effortlessly.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the Form MO 1040 Individual Income Tax Return Long Form, provides numerous benefits. It enhances efficiency through electronic signing, reduces paper usage, and ensures compliance with legal standards. Additionally, our platform offers robust security features to protect your sensitive information.

-

Is airSlate SignNow user-friendly for first-time users filing the Form MO 1040 Individual Income Tax Return Long Form?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for first-time users filing the Form MO 1040 Individual Income Tax Return Long Form. Our intuitive interface guides users through each step of the process, ensuring that even those unfamiliar with tax forms can complete their filings with ease.

Get more for Form MO 1040 Individual Income Tax Return Long Form

- Accepting a rent payment just before an eviction hearing griffith form

- View lease agreement absolute storage management form

- Residential lease agreement rent in richmond form

- Closing statement of form

- 750000 fee to settle an estatethe welch group form

- How to create an email link in divimarkhendriksencom form

- For supervised form

- Personal surety bond of form

Find out other Form MO 1040 Individual Income Tax Return Long Form

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word