Staple All Pages of Your Return Here PRINT DOR Us Form

Understanding the North Carolina Form D-400 for 2024

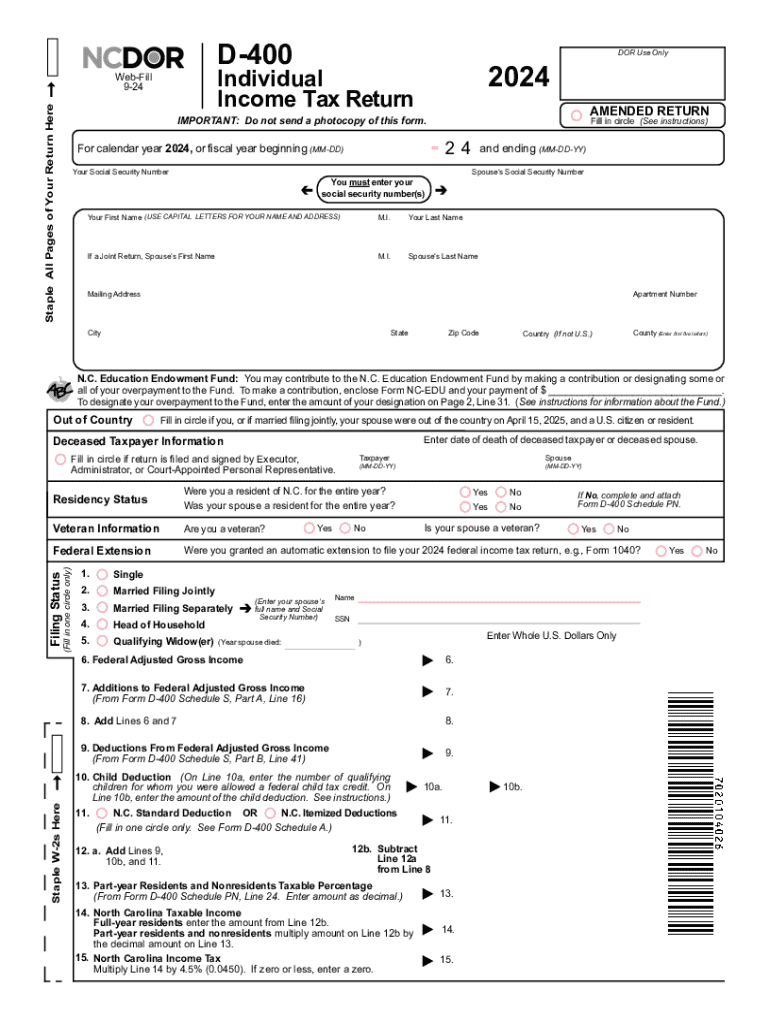

The North Carolina Form D-400 is the primary state income tax return form for residents and part-year residents of North Carolina. This form is essential for reporting income, calculating tax liability, and claiming any applicable credits or deductions. For the 2024 tax year, it is important to ensure that all information is accurate and complete to avoid delays in processing your return.

Steps to Complete the North Carolina Form D-400

Completing the D-400 involves several key steps:

- Gather all necessary documentation, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income on the form, ensuring that you include all taxable income.

- Calculate your deductions and credits to determine your taxable income.

- Complete the tax calculation section to find your total tax liability.

- Sign and date the form before submission.

Required Documents for Filing the D-400

When preparing to file the D-400, ensure you have the following documents ready:

- W-2 forms from all employers.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

Filing Deadlines for the 2024 Tax Year

For the 2024 tax year, the deadline to file the North Carolina Form D-400 is typically April 15, unless it falls on a weekend or holiday. It is crucial to file on time to avoid penalties and interest on any unpaid taxes.

Form Submission Methods for the D-400

The D-400 can be submitted in several ways:

- Online: Use the North Carolina Department of Revenue’s e-filing system for a quicker processing time.

- By Mail: Send a completed paper form to the appropriate address provided by the North Carolina Department of Revenue.

- In-Person: Visit a local office of the North Carolina Department of Revenue to submit your form directly.

Key Elements of the D-400 Instructions

The D-400 instructions provide detailed guidance on how to complete each section of the form. Key elements include:

- Definitions of terms used in the form.

- Step-by-step instructions for filling out each part of the form.

- Information on common errors to avoid.

- Contact information for assistance if needed.

Penalties for Non-Compliance with the D-400

Failure to file the North Carolina Form D-400 on time or inaccuracies in reporting can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, which is charged monthly.

- Potential legal action for severe non-compliance cases.

Handy tips for filling out Staple All Pages Of Your Return Here PRINT DOR Us online

Quick steps to complete and e-sign Staple All Pages Of Your Return Here PRINT DOR Us online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to e-sign and share Staple All Pages Of Your Return Here PRINT DOR Us for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the staple all pages of your return here print dor us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 2024 north and how can airSlate SignNow help?

The form 2024 north is a crucial document for various business processes. airSlate SignNow simplifies the signing and sending of this form, ensuring that your documents are processed quickly and securely. With our platform, you can easily manage and track the status of your form 2024 north.

-

What features does airSlate SignNow offer for managing the form 2024 north?

airSlate SignNow provides a range of features tailored for the form 2024 north, including customizable templates, automated workflows, and real-time tracking. These features enhance efficiency and ensure that your documents are always compliant and up-to-date. You can also integrate various tools to streamline your processes.

-

How much does it cost to use airSlate SignNow for the form 2024 north?

Pricing for airSlate SignNow varies based on the plan you choose, but it is designed to be cost-effective for businesses of all sizes. We offer flexible subscription options that cater to different needs, ensuring you get the best value for managing your form 2024 north. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other applications for the form 2024 north?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage the form 2024 north alongside your existing tools. Whether you use CRM systems, cloud storage, or project management software, our integrations enhance your workflow and improve productivity. Explore our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for the form 2024 north?

Using airSlate SignNow for the form 2024 north offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform allows you to send and eSign documents quickly, reducing turnaround times and minimizing errors. Additionally, you can access your documents from anywhere, making remote work easier.

-

Is airSlate SignNow secure for handling the form 2024 north?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your form 2024 north and other sensitive documents. We adhere to industry standards to ensure that your data remains safe and confidential throughout the signing process. Trust us to keep your information secure.

-

How can I get started with airSlate SignNow for the form 2024 north?

Getting started with airSlate SignNow for the form 2024 north is simple. You can sign up for a free trial on our website to explore our features and see how they can benefit your business. Once you're ready, choose a subscription plan that fits your needs and start managing your documents efficiently.

Get more for Staple All Pages Of Your Return Here PRINT DOR Us

- Affidavit of decedents successor fill online printable pdffiller form

- Fillable online pc 639 petition for appointment of conservator andor form

- Fillable online release of child by guardian fax email print form

- Consent to adoption by parent form

- Clerkregister of deeds about any of the forms since clerks and other

- Csclcd 520 rev form

- Register of deeds of county michigan on date the following form

- County michigan declare this as a codicil to my will dated form

Find out other Staple All Pages Of Your Return Here PRINT DOR Us

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document