Draft Form 763, Virginia Nonresident Income Tax Return

What is the Virginia Form 763, Nonresident Income Tax Return?

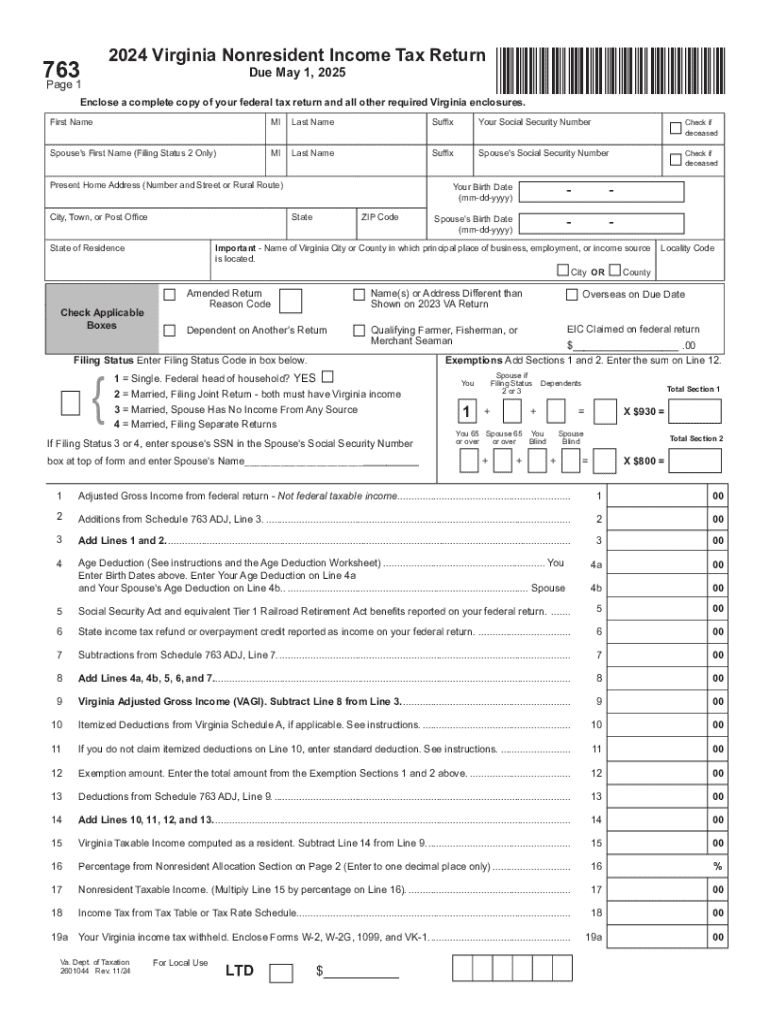

The Virginia Form 763 is designed for nonresidents who earn income in Virginia. This form is essential for individuals who do not reside in Virginia but have taxable income sourced from the state. Completing this form allows nonresidents to report their Virginia income and calculate the appropriate tax owed. It is important for ensuring compliance with Virginia tax laws and for accurately determining the tax liability based on income earned within the state.

Steps to Complete the Virginia Form 763

Filling out the Virginia Form 763 involves several key steps to ensure accuracy and compliance:

- Gather necessary documents: Collect all relevant income statements, such as W-2s and 1099s, that report income earned in Virginia.

- Fill in personal information: Provide your name, address, and Social Security number at the top of the form.

- Report income: Enter the total income earned in Virginia in the designated section. Ensure all figures are accurate and match your documentation.

- Calculate deductions: If applicable, apply any deductions or credits that you qualify for, which can reduce your taxable income.

- Determine tax liability: Use the tax tables provided in the instructions to find your tax liability based on your reported income.

- Review and sign: Double-check all entries for accuracy before signing and dating the form.

How to Obtain the Virginia Form 763

The Virginia Form 763 can be easily obtained through several methods:

- Online: Download the form directly from the Virginia Department of Taxation's website, where it is available as a PDF.

- By mail: Request a physical copy by contacting the Virginia Department of Taxation, which can send you the form via postal service.

- In-person: Visit local tax offices or libraries where tax forms are often available for public access.

Filing Deadlines for the Virginia Form 763

It is crucial to be aware of the filing deadlines associated with the Virginia Form 763 to avoid penalties. Generally, the form must be submitted by May first of the year following the tax year in question. If May first falls on a weekend or holiday, the deadline is extended to the next business day. Staying informed about these dates helps ensure timely filing and compliance with state tax regulations.

Key Elements of the Virginia Form 763

Understanding the key elements of the Virginia Form 763 is essential for accurate completion:

- Personal Information: Includes fields for your name, address, and Social Security number.

- Income Reporting: Sections to report various types of income earned in Virginia.

- Deductions and Credits: Areas to claim eligible deductions and credits that can lower your tax liability.

- Signature Line: A space for your signature, certifying that the information provided is accurate.

Legal Use of the Virginia Form 763

The Virginia Form 763 serves a legal purpose by ensuring that nonresidents comply with Virginia tax laws. Filing this form is required for any nonresident who earns income in Virginia, making it a critical component of the state's tax collection system. Failure to file can result in penalties, including fines or interest on unpaid taxes. Understanding the legal implications of this form helps ensure compliance and avoid potential legal issues.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the draft form 763 virginia nonresident income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia Form 763?

The Virginia Form 763 is a tax form used by individuals to report their income and calculate their tax liability in the state of Virginia. It is essential for residents and non-residents who earn income in Virginia to file this form accurately to comply with state tax regulations.

-

How can airSlate SignNow help with Virginia Form 763?

airSlate SignNow simplifies the process of completing and eSigning the Virginia Form 763 by providing an intuitive platform for document management. Users can easily upload, fill out, and send the form securely, ensuring compliance and efficiency in tax filing.

-

Is there a cost associated with using airSlate SignNow for Virginia Form 763?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to features that streamline the completion and eSigning of documents like the Virginia Form 763, making it a cost-effective solution.

-

What features does airSlate SignNow offer for Virginia Form 763?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the Virginia Form 763. These features enhance user experience and ensure that all necessary steps are completed efficiently.

-

Can I integrate airSlate SignNow with other software for Virginia Form 763?

Yes, airSlate SignNow offers integrations with various software applications, allowing users to streamline their workflow when handling the Virginia Form 763. This capability ensures that you can manage your documents seamlessly across different platforms.

-

What are the benefits of using airSlate SignNow for Virginia Form 763?

Using airSlate SignNow for the Virginia Form 763 provides numerous benefits, including time savings, enhanced security, and improved accuracy in document handling. The platform's user-friendly interface makes it easy for anyone to navigate the eSigning process.

-

Is airSlate SignNow secure for submitting Virginia Form 763?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including the Virginia Form 763. With encryption and secure access protocols, you can confidently submit your sensitive information without worry.

Get more for Draft Form 763, Virginia Nonresident Income Tax Return

- Template letters tenant resource and advisory centre form

- This letter is to provide you with legal notice of the fact that there is insufficient heat in my form

- With limited warranties form

- Horses purchased the seller hereby agrees to sell and the buyer hereby agrees form

- Fourteen 14 days after service of this notice upon you you must pay in full to landlord the form

- Cb commercial industrial real estate lease multi tenant law insider form

- Of residential lease form

- Fillable online sponsorexhibitor registration bformb

Find out other Draft Form 763, Virginia Nonresident Income Tax Return

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template