K 47 Kansas Adoption Credit Revised 7 24 Form

Understanding the K-47 Kansas Adoption Credit

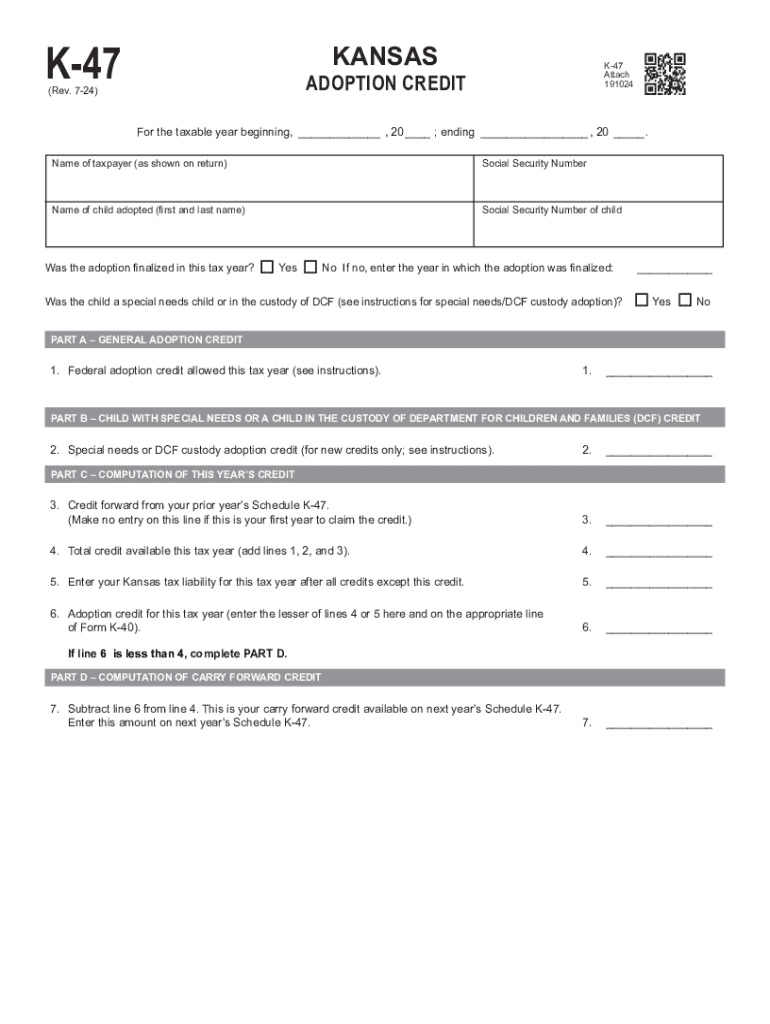

The K-47 Kansas Adoption Credit is a tax credit designed to support families who adopt children. This credit helps offset some of the costs associated with adoption, making it more accessible for families to provide loving homes to children in need. The credit is available to both individual and joint filers who meet specific eligibility criteria. Understanding the details of this credit can help families maximize their tax benefits while navigating the adoption process.

Steps to Complete the K-47 Kansas Adoption Credit

Completing the K-47 form involves several steps to ensure accuracy and compliance with state regulations. First, gather all necessary documentation, including adoption finalization papers and any related expenses. Next, fill out the K-47 form by providing your personal information, details about the adopted child, and the total adoption expenses incurred. After completing the form, review it for any errors before submitting it to the appropriate state agency. It is essential to keep copies of all documents for your records.

Eligibility Criteria for the K-47 Kansas Adoption Credit

To qualify for the K-47 Kansas Adoption Credit, applicants must meet specific eligibility requirements. The credit is available to individuals or couples who have legally adopted a child and incurred qualifying adoption expenses. These expenses may include agency fees, legal fees, and other costs directly related to the adoption process. Additionally, the adopted child must be under the age of eighteen at the time of adoption. It is crucial to review the eligibility criteria carefully to ensure compliance and maximize the potential tax benefits.

Required Documents for the K-47 Kansas Adoption Credit

When applying for the K-47 Kansas Adoption Credit, several documents are required to substantiate your claim. These typically include the final adoption decree, receipts for all qualifying expenses, and any supporting documentation that verifies the adoption process. It is important to ensure that all documents are accurate and complete to avoid delays in processing your credit. Keeping organized records will facilitate a smoother application process and help in case of any inquiries from the state.

State-Specific Rules for the K-47 Kansas Adoption Credit

The K-47 Kansas Adoption Credit is governed by specific state regulations that dictate how the credit can be claimed and the amount available. Kansas law outlines the types of expenses that qualify for the credit and sets limits on the maximum credit amount. Additionally, there may be deadlines for submitting the K-47 form, which are important to adhere to in order to receive the credit. Understanding these state-specific rules is crucial for successful application and compliance.

Examples of Using the K-47 Kansas Adoption Credit

Real-life examples can illustrate how families benefit from the K-47 Kansas Adoption Credit. For instance, a family that incurs $10,000 in adoption-related expenses may be eligible for a credit that significantly reduces their tax liability. This financial relief can help families manage the costs of adoption more effectively. Another example includes a family who adopts a sibling group, allowing them to claim multiple adoption expenses, thereby increasing the total credit received. These scenarios highlight the practical advantages of the K-47 credit in supporting adoptive families.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 47 kansas adoption credit revised 7 24

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is k47 in relation to airSlate SignNow?

The term 'k47' refers to a specific feature set within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely and efficiently.

-

How does airSlate SignNow's k47 feature improve document signing?

The k47 feature in airSlate SignNow simplifies the document signing process by providing an intuitive interface and automated workflows. Users can easily send documents for eSignature, track their status, and receive notifications, ensuring a smooth signing experience.

-

What are the pricing options for airSlate SignNow with k47 features?

airSlate SignNow offers various pricing plans that include access to the k47 features. These plans are designed to cater to different business needs, ensuring that users can find a cost-effective solution that fits their budget while benefiting from advanced document management capabilities.

-

Can I integrate airSlate SignNow's k47 features with other applications?

Yes, airSlate SignNow's k47 features can be seamlessly integrated with a variety of applications, enhancing your overall workflow. This integration allows users to connect with popular tools like CRM systems, project management software, and more, ensuring a cohesive experience.

-

What benefits does the k47 feature provide for businesses?

The k47 feature in airSlate SignNow offers numerous benefits, including increased efficiency, reduced turnaround times for document signing, and enhanced security. By utilizing these features, businesses can improve their operational workflows and focus on core activities.

-

Is training available for using the k47 features in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training resources for users to fully leverage the k47 features. These resources include tutorials, webinars, and customer support to ensure that users can maximize their experience with the platform.

-

How secure is the k47 feature in airSlate SignNow?

The k47 feature in airSlate SignNow is designed with security in mind, employing advanced encryption and compliance measures. This ensures that all documents sent and signed through the platform are protected, giving users peace of mind regarding their sensitive information.

Get more for K 47 Kansas Adoption Credit Revised 7 24

- Objection hearing request and notice of hearing form

- Writ of garnishment and summons earnings form

- Second notice to judgment debtor of garnishment form

- Consumer loan application lampc1 form

- Business account application vail valley ace hardware form

- Collection of zip codes violates california credit card law form

- Demand for promissory note legal formalllaw

- A treatise on the rights remedies and liabilities of form

Find out other K 47 Kansas Adoption Credit Revised 7 24

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself