1st Quarter FORM NEWARK PAYROLL TAX STATEMENT

What is the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT

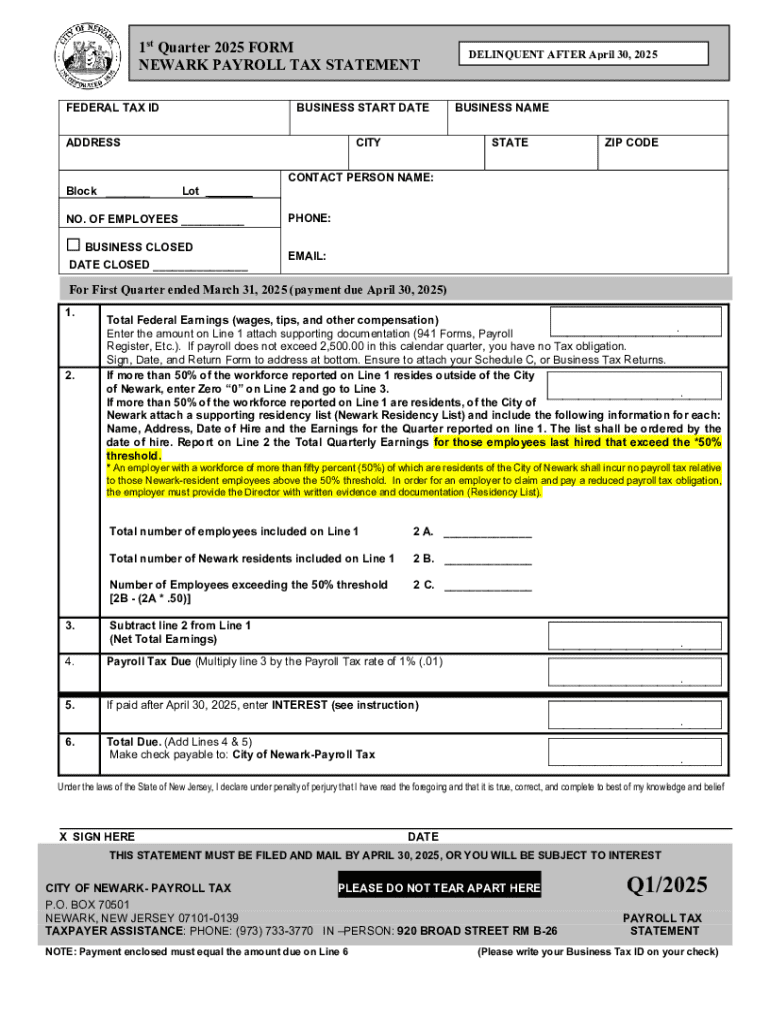

The 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT is a crucial document for employers operating in Newark, New Jersey. This form is used to report payroll taxes withheld from employees' wages during the first quarter of the fiscal year. It ensures that local tax authorities receive accurate information regarding employee earnings and tax withholdings, which is essential for maintaining compliance with state and local tax regulations.

How to use the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT

This form is designed for employers to accurately report the payroll taxes they have withheld from their employees' wages. To use the form, employers must gather the necessary information about their employees, including total wages paid and the amount of tax withheld. Once completed, the form must be submitted to the appropriate local tax authority by the specified deadline to avoid penalties.

Steps to complete the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT

Completing the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT involves several key steps:

- Gather employee payroll information, including total wages and taxes withheld.

- Fill out the form with accurate figures, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the local tax authority by the deadline.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT. Typically, the form is due on or before April 30th for the first quarter, which covers January through March. It is essential to submit the form on time to avoid any potential penalties or interest charges.

Penalties for Non-Compliance

Failure to file the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT on time can result in penalties imposed by local tax authorities. These penalties may include fines, interest on unpaid taxes, and additional charges for late submission. To avoid these consequences, employers should ensure timely and accurate filing of the form.

Who Issues the Form

The 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT is issued by the Newark city government or the local tax authority responsible for payroll tax collection. Employers can obtain the form directly from the city’s official website or through their local tax office. It is important to use the most current version of the form to ensure compliance with local regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1st quarter form newark payroll tax statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

The 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT is a document that businesses in Newark must file to report payroll taxes for the first quarter of the year. This form is essential for compliance with local tax regulations and helps ensure that your business meets its tax obligations.

-

How can airSlate SignNow help with the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

airSlate SignNow simplifies the process of preparing and submitting the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT. Our platform allows you to easily fill out, sign, and send the document electronically, saving you time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solution provides access to features that streamline the completion and submission of the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT, ensuring you get great value for your investment.

-

What features does airSlate SignNow offer for managing the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

airSlate SignNow includes features such as document templates, electronic signatures, and secure cloud storage, all of which are beneficial for managing the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT. These tools enhance efficiency and ensure that your documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

Absolutely! airSlate SignNow offers integrations with various accounting and payroll software, making it easier to manage the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT alongside your existing systems. This seamless integration helps streamline your workflow and reduces manual data entry.

-

What are the benefits of using airSlate SignNow for the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

Using airSlate SignNow for the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and submitted quickly, helping you stay compliant with tax regulations.

-

Is airSlate SignNow user-friendly for completing the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT?

Yes, airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users of all skill levels to easily navigate the platform and complete the 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT without any hassle.

Get more for 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT

- Fin535public insurance adjuster contractadjuster public insurance texas department of insuranceadjuster public insurance texas form

- Public insurance adjuster contract form

- Premium finance form fin165 tdi texas

- Po box 144103 form

- Michael j redmond md faad reviews before and after form

- Kaiser permanente dc enrollment employer form

- Washington state health insurance quotes compare least form

- Ub 04 cms 1450 claim form instructions for nursing home

Find out other 1st Quarter FORM NEWARK PAYROLL TAX STATEMENT

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure