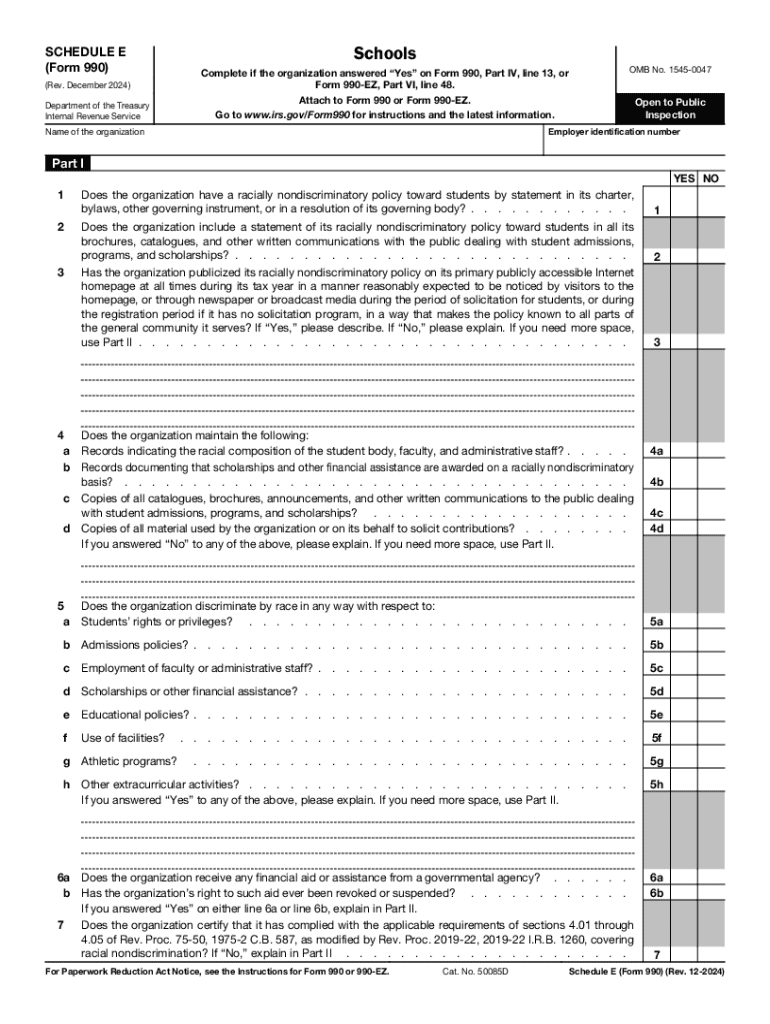

Complete If the Organization Answered Yes on Form 990, Part IV, Line 13, or

Understanding the Complete If The Organization Answered Yes On Form 990, Part IV, Line 13

The section titled "Complete If The Organization Answered Yes On Form 990, Part IV, Line 13" pertains to specific disclosures required by the IRS for organizations that have answered affirmatively to certain questions on their Form 990. This form is essential for tax-exempt organizations to report their financial activities and ensure compliance with federal regulations. It is crucial for organizations to understand the implications of their responses in Part IV, as this section can trigger additional reporting requirements.

Steps to Complete the Form 990, Part IV, Line 13

Completing the relevant section of Form 990 requires careful attention to detail. Here are the key steps:

- Review the questions in Part IV to determine if your organization answered "yes" to any.

- Gather necessary documentation that supports your affirmative responses, including financial records and agreements.

- Fill out the additional schedules or attachments required based on your answers.

- Ensure that all information is accurate and complete before submission.

Key Elements of the Form 990, Part IV, Line 13

When addressing the requirements of Part IV, Line 13, organizations should focus on several key elements:

- Identification of the specific questions answered "yes."

- Detailed explanations of the activities or transactions related to those affirmative answers.

- Any financial implications or impacts on the organization’s tax-exempt status.

IRS Guidelines for Form 990, Part IV, Line 13

The IRS provides guidelines that detail how organizations should approach Form 990, particularly Part IV, Line 13. These guidelines emphasize the importance of transparency and accuracy in reporting. Organizations must ensure that they comply with all IRS requirements to maintain their tax-exempt status. This includes understanding the specific disclosures required for various types of activities, such as fundraising or grants.

Filing Deadlines for Form 990

Organizations must be aware of the filing deadlines for Form 990 to avoid penalties. Typically, Form 990 is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May fifteenth. It is essential to plan ahead to ensure all necessary information is gathered and submitted on time.

Required Documents for Form 990 Submission

To complete Form 990 accurately, organizations need to compile several documents:

- Financial statements, including balance sheets and income statements.

- Records of contributions and grants received.

- Documentation of any affirmative responses in Part IV, including contracts or agreements.

Penalties for Non-Compliance with Form 990 Requirements

Failure to comply with Form 990 requirements can result in significant penalties. The IRS may impose fines for late submissions or inaccuracies in reporting. Additionally, non-compliance can jeopardize an organization’s tax-exempt status, leading to further financial and operational challenges. It is vital for organizations to prioritize compliance to avoid these risks.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the complete if the organization answered yes on form 990 part iv line 13 or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or'?

This phrase refers to specific compliance requirements for organizations that have indicated certain activities on their Form 990. Completing this section accurately is crucial for maintaining transparency and adhering to IRS regulations. airSlate SignNow can help streamline this process by providing templates and eSigning capabilities.

-

How can airSlate SignNow assist with Form 990 compliance?

airSlate SignNow offers tools that simplify the document signing process, ensuring that all necessary forms, including those related to Form 990, are completed accurately and efficiently. By using our platform, organizations can easily manage their compliance documentation and ensure they 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or.'

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of various organizations. Our plans are designed to be cost-effective while offering robust features that help you 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or.' You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are designed to help organizations efficiently manage their documents and ensure they 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or.' with ease and accuracy.

-

Can airSlate SignNow integrate with other software tools?

Yes, airSlate SignNow offers integrations with various software applications, including CRM systems and cloud storage services. This allows organizations to streamline their workflows and ensure they can 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or.' without switching between multiple platforms.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption and authentication measures to protect your documents. This ensures that when you 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or.,' your sensitive information remains secure.

-

How does airSlate SignNow improve the eSigning process?

airSlate SignNow enhances the eSigning experience by providing a user-friendly interface and fast processing times. This efficiency is particularly beneficial for organizations needing to 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or.' quickly and accurately, reducing delays in document handling.

Get more for Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or

- Dv 250 proof of service by mail clets domestic violence prevention spanish judicial council forms

- Dv 500 info can a domestic violence restraining order form

- Dv 500 info can a domestic violence restraining order help me domestic violence prevention chinese judicial council forms

- Attorney and court interview hotdocs market form

- Dv 500 info can a domestic violence restraining order help me domestic violence prevention vietnamese judicial council forms

- Dv 505 info how do i ask for a temporary restraining order form

- Dv 510 info i filled out the formswhat now domestic violence prevention judicial council forms

- Notice this form is to be completed and a copy furnished to

Find out other Complete If The Organization Answered Yes On Form 990, Part IV, Line 13, Or

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement