Complete If the Organization Answered Yes on Form 990, Part IV, Line 25a, 25b, 26, 27,

Understanding the Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27

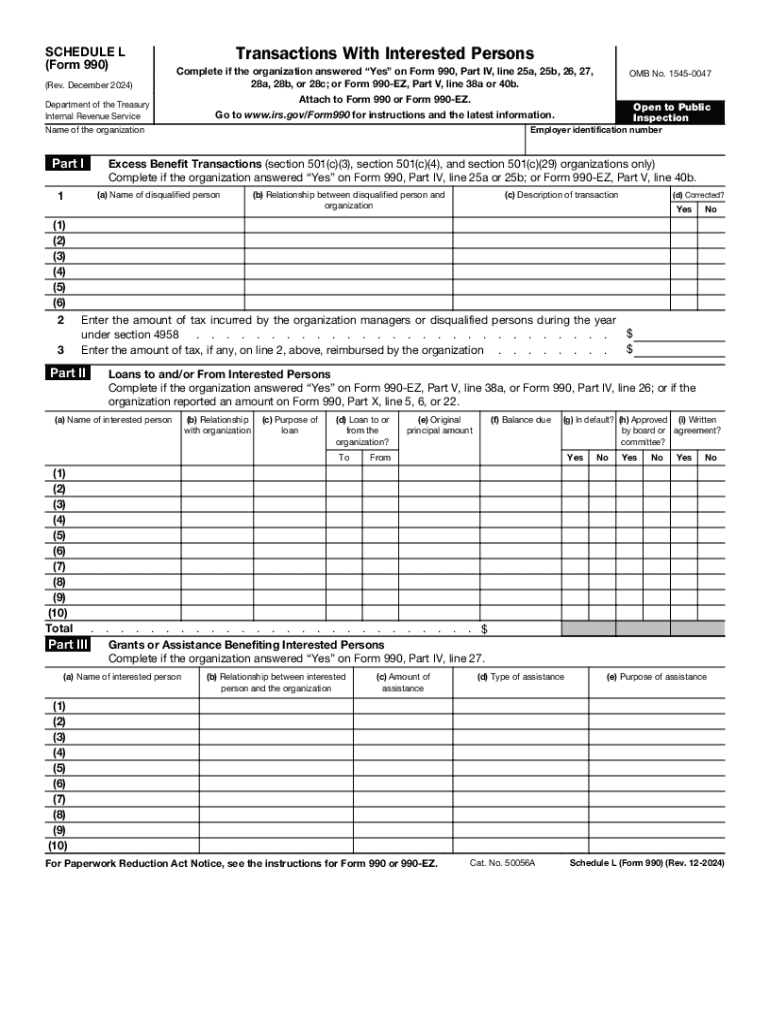

The section titled "Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27" is crucial for organizations that have indicated specific activities or transactions on their Form 990. This part of the form requires detailed disclosures about certain financial relationships, governance practices, and operational activities that may affect the organization's tax-exempt status. Organizations must carefully consider the implications of their responses and ensure accurate reporting to maintain compliance with IRS regulations.

Steps to Complete the Form 990, Part IV, Line 25a, 25b, 26, 27

Completing this section of Form 990 involves several key steps:

- Review the questions on lines 25a, 25b, 26, and 27 to understand what is being asked.

- Gather relevant documentation and information regarding the activities or transactions that prompted a "yes" answer.

- Provide detailed descriptions of each activity or transaction, including the nature of the relationship, amounts involved, and any relevant dates.

- Ensure that all information is accurate and complete to avoid potential penalties.

Legal Considerations for Form 990, Part IV, Line 25a, 25b, 26, 27

Organizations must be aware of the legal implications of their disclosures on Form 990. Failing to provide accurate information can lead to penalties from the IRS, including loss of tax-exempt status. It is essential to understand the laws governing nonprofit organizations and the specific requirements related to financial reporting. Consulting with a legal expert in nonprofit law can provide guidance on compliance and best practices.

Key Elements to Include in the Form 990, Part IV, Line 25a, 25b, 26, 27

When completing this section, organizations should focus on the following key elements:

- Detailed descriptions of the activities or transactions that led to a "yes" response.

- Identification of related parties involved in the transactions.

- Quantitative data, such as amounts paid or received, to provide a clear financial picture.

- Documentation supporting the reported activities, such as contracts or agreements.

Examples of Relevant Disclosures for Form 990, Part IV, Line 25a, 25b, 26, 27

Examples of disclosures that may be required in this section include:

- Transactions with board members or key employees, including compensation agreements.

- Loans or grants provided to or received from related organizations.

- Partnerships or joint ventures that involve financial commitments.

- Any significant changes in governance or operational practices that affect financial reporting.

IRS Guidelines for Completing Form 990, Part IV, Line 25a, 25b, 26, 27

The IRS provides specific guidelines for completing Form 990, including this section. Organizations should refer to the IRS instructions for Form 990, which detail what constitutes a "yes" answer and the necessary disclosures. Adhering to these guidelines helps ensure compliance and reduces the risk of audits or penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the complete if the organization answered yes on form 990 part iv line 25a 25b 26 27

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does it mean to 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,'?

This phrase refers to specific disclosures required by the IRS for organizations that have answered affirmatively on certain lines of Form 990. Completing these sections accurately is crucial for compliance and transparency. airSlate SignNow can help streamline this process by providing templates and eSigning capabilities.

-

How can airSlate SignNow assist with Form 990 compliance?

airSlate SignNow offers tools that simplify the document signing process, ensuring that all necessary forms, including those related to Form 990, are completed and signed efficiently. By using our platform, organizations can ensure they meet the requirements for 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,'.

-

What features does airSlate SignNow provide for document management?

Our platform includes features such as customizable templates, secure eSigning, and document tracking. These tools are designed to help organizations manage their documents effectively, especially when they need to 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,'.

-

Is airSlate SignNow cost-effective for small organizations?

Yes, airSlate SignNow offers competitive pricing plans that cater to organizations of all sizes, including small nonprofits. By choosing our solution, small organizations can efficiently 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,' without breaking the bank.

-

Can airSlate SignNow integrate with other software tools?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This integration capability is particularly beneficial for organizations needing to 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,' while using their existing tools.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. These advantages are essential for organizations that must 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,'.

-

How secure is the airSlate SignNow platform?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect your documents and data. This level of security is vital for organizations that need to 'Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,'.

Get more for Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,

- Dv 520 info get ready for your hearing for protected person form

- Dv 520 info get ready for the court hearing korean judicial council forms

- Audiencia nacional excmo e ilmos sres a c t a n 751 d form

- Dv 520 info get ready for the court hearing vietnamese judicial council forms

- Get copies form

- Fillable online hyde ampamp district fax email print pdffiller form

- Rdenes de restriccin hacer cumplir su orden de custodia en form

- Chng i nhim v v hiu lc ca b lut dn s form

Find out other Complete If The Organization Answered Yes On Form 990, Part IV, Line 25a, 25b, 26, 27,

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document