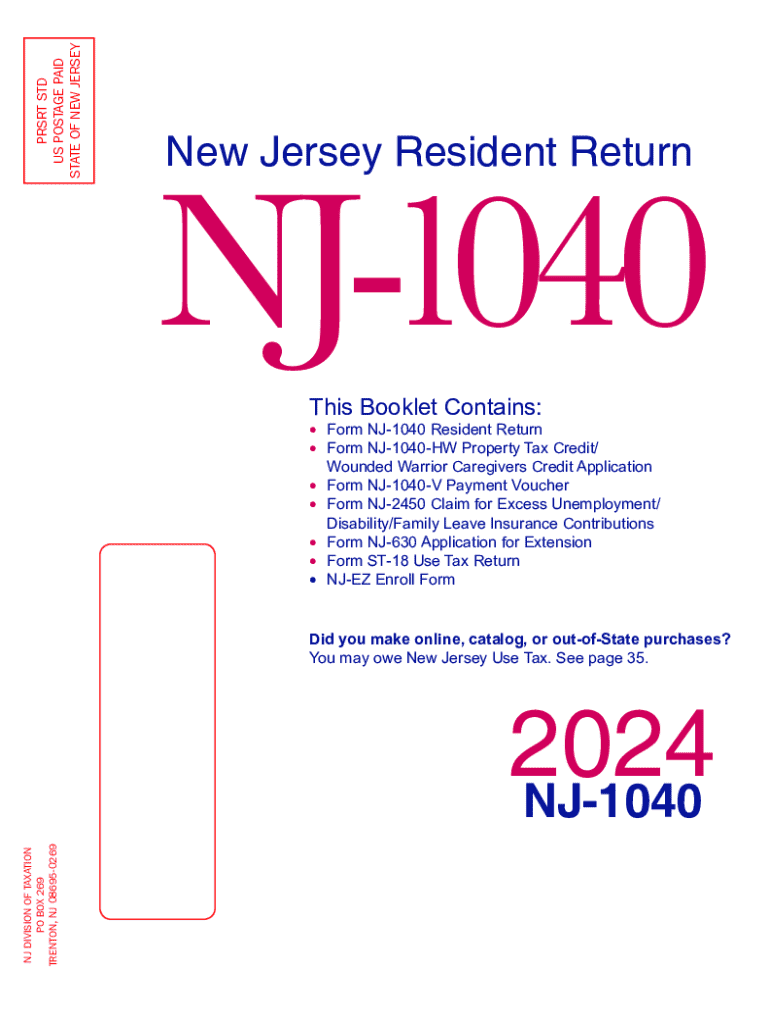

NJ 1040 Instructions Form

What are NJ 1040 Instructions?

The NJ 1040 Instructions provide detailed guidance for residents of New Jersey who need to file their state income tax returns. This document outlines the necessary steps, forms, and requirements to accurately complete the NJ 1040 form. It is essential for taxpayers to understand these instructions to ensure compliance with state tax laws and to avoid potential penalties.

Steps to Complete the NJ 1040 Instructions

Completing the NJ 1040 involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other relevant income records.

- Review the NJ 1040 Instructions to understand the specific requirements for your filing status.

- Fill out the NJ 1040 form accurately, ensuring all income and deductions are reported correctly.

- Calculate your total tax liability using the provided tax tables or online calculators.

- Double-check all entries for accuracy before submitting the form.

Key Elements of the NJ 1040 Instructions

The NJ 1040 Instructions include several critical components that taxpayers must be aware of:

- Filing Status: Understand the different filing statuses available, such as single, married filing jointly, or head of household.

- Income Reporting: Guidelines on what constitutes taxable income and how to report it.

- Deductions and Credits: Information on available deductions and tax credits that can reduce your overall tax liability.

- Payment Options: Instructions on how to pay any taxes owed, including online payment methods.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the NJ 1040. Generally, the deadline for filing is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions that may apply and ensure they file their returns on or before the due date to avoid penalties.

Required Documents

To complete the NJ 1040, taxpayers need to gather several key documents:

- W-2 forms from employers, which detail annual income and withheld taxes.

- 1099 forms for any additional income sources, such as freelance work or interest earned.

- Documentation for any deductions claimed, such as receipts for medical expenses or charitable contributions.

- Previous year's tax return for reference and to ensure consistency in reporting.

Form Submission Methods

Taxpayers have several options for submitting their NJ 1040 forms:

- Online Submission: Many taxpayers choose to file electronically using approved software, which can streamline the process.

- Mail: Completed forms can be printed and mailed to the appropriate state tax office address.

- In-Person: Some individuals may prefer to deliver their forms directly to a tax office for assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 instructions 771947993

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the nj 1040 instructions for filing my taxes?

The nj 1040 instructions provide detailed guidance on how to complete your New Jersey income tax return. They cover essential topics such as eligibility, required forms, and deadlines. Following these instructions ensures that you accurately report your income and claim any deductions or credits.

-

How can airSlate SignNow help with nj 1040 instructions?

airSlate SignNow simplifies the process of signing and sending documents related to your nj 1040 instructions. With our platform, you can easily eSign your tax forms and share them securely with your accountant or tax preparer. This streamlines your filing process and ensures compliance with New Jersey tax regulations.

-

Are there any costs associated with using airSlate SignNow for nj 1040 instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our cost-effective solutions provide access to features that enhance your document management, including eSigning and secure storage. You can choose a plan that best fits your requirements for handling nj 1040 instructions.

-

What features does airSlate SignNow offer for managing nj 1040 instructions?

airSlate SignNow includes features such as customizable templates, automated workflows, and real-time tracking for your documents. These tools help you manage your nj 1040 instructions efficiently, ensuring that you never miss a deadline. Additionally, our platform allows for easy collaboration with team members or tax professionals.

-

Can I integrate airSlate SignNow with other software for nj 1040 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including accounting and tax preparation tools. This integration allows you to streamline your workflow when dealing with nj 1040 instructions, making it easier to manage your documents and data in one place.

-

What are the benefits of using airSlate SignNow for nj 1040 instructions?

Using airSlate SignNow for your nj 1040 instructions offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows you to eSign documents quickly, ensuring that your tax filings are submitted on time. Additionally, the secure storage of your documents provides peace of mind regarding sensitive information.

-

Is airSlate SignNow user-friendly for those following nj 1040 instructions?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, regardless of technical expertise. The intuitive interface guides you through the process of eSigning and managing your nj 1040 instructions effortlessly. You can focus on your tax preparation without getting bogged down by complicated software.

Get more for NJ 1040 Instructions

- Physical medicine progress report f245 453 000 physical medicine progress report f245 453 000 form

- Appeals citt tcce form

- Ccrc inc form

- Accident questionnaire form partners mgu

- Form psc 1813 reference request for applicants to the commissioned corps of the us public health service

- Wsib order form 0688a

- Australia post reply paid form

- Charity mail application 8838713 charity mail application 8838713 form

Find out other NJ 1040 Instructions

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later