Form Rew 5

What is the Form REW-5?

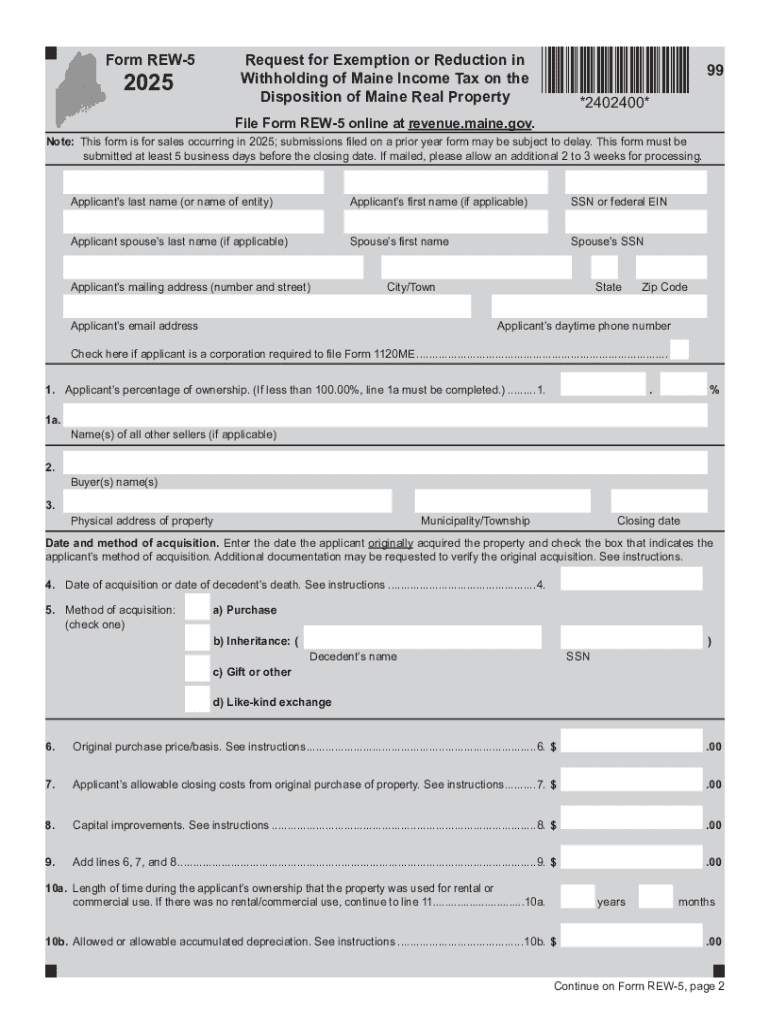

The Form REW-5 is a tax exemption request form used in Maine. This form allows individuals or businesses to request an exemption from withholding tax on certain types of income. It is particularly relevant for those who may qualify based on their income level or specific circumstances. Understanding the purpose of this form is essential for ensuring compliance with state tax regulations while maximizing potential tax benefits.

How to Obtain the Form REW-5

The Form REW-5 can be obtained through the Maine Revenue Services website or by contacting their office directly. It is important to ensure that you are using the most current version of the form, as outdated versions may not be accepted. Additionally, some tax professionals may provide access to this form through their services, making it easier to obtain for those who prefer assistance.

Steps to Complete the Form REW-5

Completing the Form REW-5 involves several key steps:

- Gather necessary personal and financial information, including your Social Security number or Employer Identification Number.

- Indicate the type of income for which you are requesting an exemption.

- Provide details related to your eligibility for the exemption, such as income level or specific circumstances.

- Sign and date the form to validate your request.

Ensure that all information is accurate and complete to avoid delays in processing your exemption request.

Key Elements of the Form REW-5

The Form REW-5 includes several important sections that must be filled out correctly. Key elements include:

- Personal Information: This section requires your name, address, and identification numbers.

- Income Type: Specify the type of income for which you are requesting withholding exemption.

- Eligibility Criteria: You must provide information supporting your eligibility for the exemption.

- Signature: Your signature is required to certify that the information provided is true and accurate.

Legal Use of the Form REW-5

The Form REW-5 is legally recognized by the state of Maine for tax purposes. It is essential to use this form in accordance with state tax laws to ensure compliance. Misuse of the form or providing false information can lead to penalties or legal repercussions. Understanding the legal implications of using the REW-5 is crucial for individuals and businesses seeking to manage their tax obligations responsibly.

Filing Deadlines / Important Dates

When submitting the Form REW-5, it is important to be aware of relevant filing deadlines. Typically, the form should be submitted before the start of the tax year for which the exemption is being requested. Keeping track of these dates helps ensure that you do not miss out on potential tax benefits. Always check with the Maine Revenue Services for the most current deadlines and any updates that may affect your filing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form rew 5 771708195

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the me rew 5 exemption and how does it apply to airSlate SignNow?

The me rew 5 exemption refers to specific tax exemptions that can benefit businesses using electronic signatures. With airSlate SignNow, you can streamline your document signing process while ensuring compliance with these exemptions, making it easier to manage your tax obligations.

-

How much does airSlate SignNow cost for businesses looking to utilize the me rew 5 exemption?

airSlate SignNow offers various pricing plans tailored to different business needs. By choosing the right plan, you can maximize the benefits of the me rew 5 exemption while enjoying cost-effective solutions for your document management.

-

What features does airSlate SignNow provide to support the me rew 5 exemption?

airSlate SignNow includes features such as customizable templates, secure eSigning, and compliance tracking, all of which can help you leverage the me rew 5 exemption effectively. These tools ensure that your documents are not only signed but also compliant with relevant regulations.

-

Can airSlate SignNow integrate with other software to enhance the me rew 5 exemption process?

Yes, airSlate SignNow integrates seamlessly with various software applications, including CRM and accounting tools. This integration can help you manage documents related to the me rew 5 exemption more efficiently, ensuring a smooth workflow across your business operations.

-

What are the benefits of using airSlate SignNow for the me rew 5 exemption?

Using airSlate SignNow for the me rew 5 exemption allows businesses to save time and reduce paperwork. The platform's user-friendly interface and robust features help ensure that you can easily manage your documents while taking advantage of potential tax savings.

-

Is airSlate SignNow secure for handling documents related to the me rew 5 exemption?

Absolutely! airSlate SignNow prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents, including those related to the me rew 5 exemption, are protected throughout the signing process.

-

How can I get started with airSlate SignNow to utilize the me rew 5 exemption?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore the features and see how they can help you manage documents related to the me rew 5 exemption effectively. Once you're ready, choose a plan that fits your business needs.

Get more for Form Rew 5

- Bomb threat checklist federal emergency management agency form

- Section 1 organisational structure roles and form

- Hospitalmedical expense reimbursement coverages and benefits form

- Check request form requester fills in date of request pe

- Career planning policy form

- Instructions for completing csi forms cgs medicare

- Positive drug test results what you need to know foley form

- City state zip rural roundup form

Find out other Form Rew 5

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile