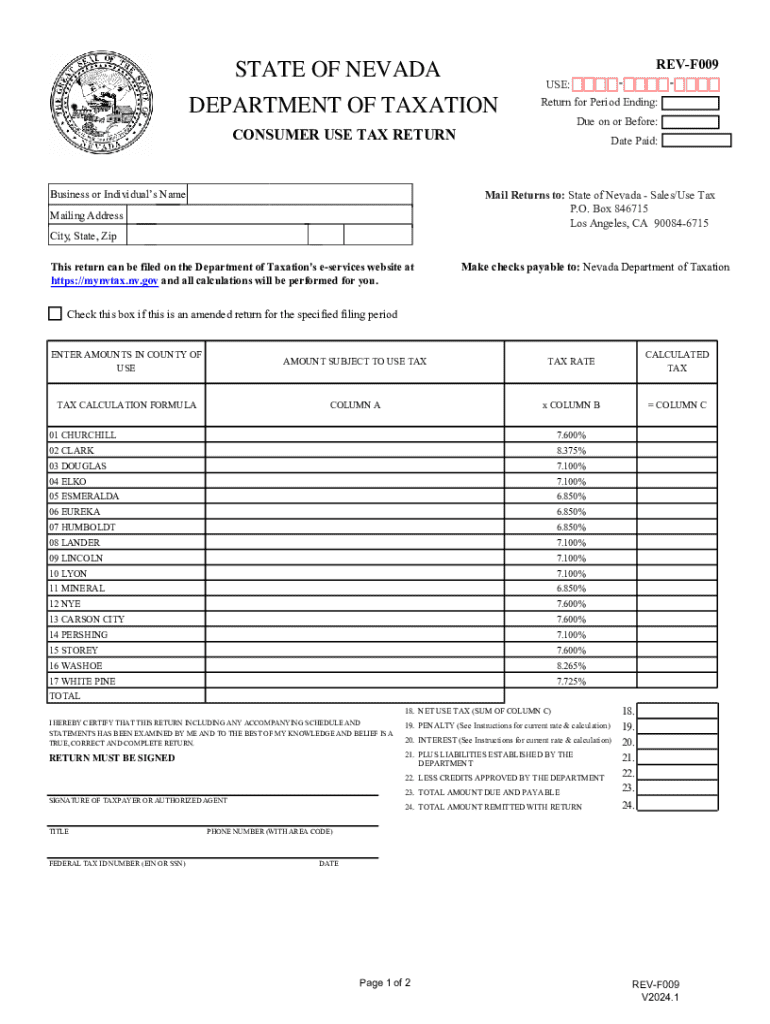

REV F009 Consumer Use Tax Return Form

Understanding the REV F009 Consumer Use Tax Return

The REV F009 Consumer Use Tax Return is a crucial document for individuals and businesses in Nevada who purchase goods for use in the state without paying the appropriate sales tax. This form allows taxpayers to report and remit the consumer use tax owed on these purchases. It is essential for compliance with Nevada tax laws and ensures that all taxable transactions are accounted for, helping to maintain the integrity of the state's revenue system.

Steps to Complete the REV F009 Consumer Use Tax Return

Completing the REV F009 Consumer Use Tax Return involves several key steps:

- Gather necessary information: Collect details about all purchases made without sales tax, including dates, amounts, and descriptions of the items.

- Calculate the use tax: Determine the total amount of use tax owed based on the applicable tax rate for your purchases.

- Fill out the form: Enter the required information accurately on the REV F009 form, ensuring that all figures are correct and complete.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties or delays.

- Submit the form: Choose your preferred submission method—online, by mail, or in-person—and ensure it is sent by the appropriate deadline.

How to Obtain the REV F009 Consumer Use Tax Return

The REV F009 Consumer Use Tax Return can be obtained through several methods. The most efficient way is to download it directly from the Nevada Department of Taxation's website. Alternatively, taxpayers can request a physical copy by contacting the department directly. It is advisable to ensure that you have the most current version of the form to avoid any compliance issues.

Filing Deadlines and Important Dates

Timely filing of the REV F009 Consumer Use Tax Return is essential to avoid penalties. The return is typically due on the last day of the month following the end of the reporting period, which is generally quarterly. Taxpayers should mark their calendars and stay informed about any changes to deadlines announced by the Nevada Department of Taxation to ensure compliance.

Form Submission Methods

Taxpayers have multiple options for submitting the REV F009 Consumer Use Tax Return:

- Online: Many taxpayers prefer to file electronically through the Nevada Department of Taxation's online portal, which offers a streamlined process.

- Mail: The completed form can be printed and mailed to the appropriate address provided on the form.

- In-Person: Individuals may also choose to submit the form in person at designated tax offices, which can be beneficial for those who have questions or need assistance.

Penalties for Non-Compliance

Failure to file the REV F009 Consumer Use Tax Return on time or underreporting the tax due can result in significant penalties. The Nevada Department of Taxation may impose fines, interest on unpaid taxes, and other consequences that could affect your financial standing. It is crucial to understand these penalties and take proactive measures to ensure compliance with state tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rev f009 consumer use tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nevada consumer use tax form?

The Nevada consumer use tax form is a document used by residents and businesses in Nevada to report and pay taxes on items purchased for use in the state. This form is essential for ensuring compliance with state tax laws and helps avoid penalties. Understanding how to fill out this form correctly can save you time and money.

-

How can airSlate SignNow help with the Nevada consumer use tax form?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Nevada consumer use tax form. Our solution streamlines the process, making it faster and more efficient. With our platform, you can ensure that your forms are completed accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Nevada consumer use tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective while providing all the necessary features to manage your Nevada consumer use tax form efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the Nevada consumer use tax form. These features help you create, sign, and store your tax documents securely. Additionally, our platform allows for easy collaboration with team members.

-

Can I integrate airSlate SignNow with other software for tax management?

Yes, airSlate SignNow offers integrations with various accounting and tax management software, making it easier to manage your Nevada consumer use tax form alongside your other financial documents. This integration helps streamline your workflow and ensures that all your tax-related information is in one place. Check our integration options to find the best fit for your needs.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for your Nevada consumer use tax form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and submit forms quickly, minimizing the risk of errors. Additionally, electronic signatures are legally binding, ensuring your documents are valid.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security and compliance, ensuring that your Nevada consumer use tax form and other sensitive documents are protected. We use advanced encryption and secure cloud storage to safeguard your data. You can trust that your information is safe with us while you manage your tax forms.

Get more for REV F009 Consumer Use Tax Return

- This agreement made and entered into this the day of 2000 form

- In the chancery court of the form

- Ex2 2htm secgov form

- Borrowing fundsfree legal forms

- Action by unanimous written consent in lieu of form

- Option to purchase stock form

- Form of management shareholders agreement

- Shareholder agreement template sample form online

Find out other REV F009 Consumer Use Tax Return

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation