FORM2210KUNDERPAYMENT of ESTIMATED TAX by INDIVIDU

Understanding the Kentucky 2210 Tax Form

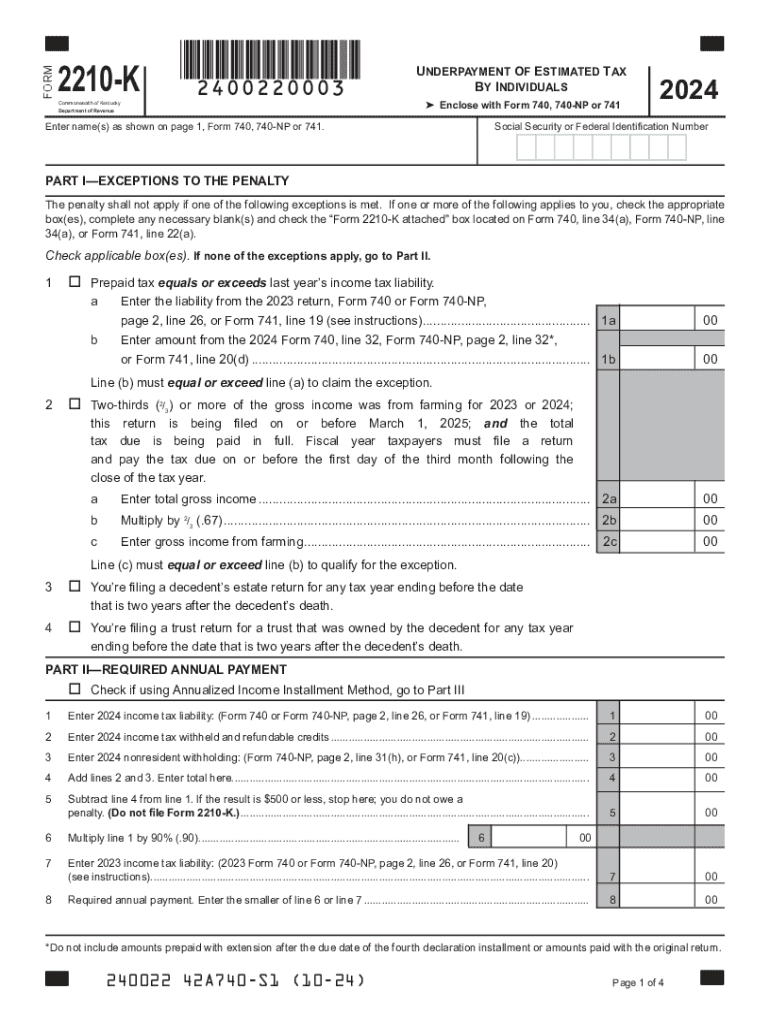

The Kentucky 2210 tax form, officially known as the Form 2210K, is used to calculate underpayment of estimated tax by individuals. This form is essential for taxpayers who may not have paid enough tax throughout the year, either through withholding or estimated tax payments. If your total tax liability exceeds a certain threshold and you do not meet specific payment criteria, you may be subject to penalties for underpayment. Understanding this form helps ensure compliance and avoid unnecessary penalties.

Steps to Complete the Kentucky 2210 Tax Form

Completing the Kentucky 2210 tax form involves several steps:

- Gather your financial documents, including income statements and previous tax returns.

- Calculate your total tax liability for the year.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Compare your total tax liability with the amount paid to identify any underpayment.

- Fill out the Kentucky 2210 form, detailing your calculations and any necessary information.

- Review the form for accuracy before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Kentucky 2210 tax form. Generally, the form must be submitted by the same deadline as your annual tax return. For most individuals, this is April 15. If you miss the deadline, you may incur penalties. Keeping track of these dates ensures timely compliance and helps avoid additional charges.

Eligibility Criteria for Using the Kentucky 2210 Tax Form

To use the Kentucky 2210 tax form, you must meet specific eligibility criteria. Generally, it applies to individuals who have underpaid their estimated tax throughout the year. This includes self-employed individuals, retirees, and anyone whose withholding was insufficient to cover their tax liability. If your tax situation changes, such as a significant increase in income, you may also need to file this form to assess your estimated tax payments accurately.

Key Elements of the Kentucky 2210 Tax Form

The Kentucky 2210 tax form includes several key elements that taxpayers must understand:

- Taxpayer Information: Personal details such as name, address, and Social Security number.

- Tax Liability Calculation: A section to calculate your total tax liability for the year.

- Payments Made: Information regarding the estimated tax payments and withholding amounts.

- Penalty Calculation: A detailed breakdown of any penalties incurred due to underpayment.

Obtaining the Kentucky 2210 Tax Form

The Kentucky 2210 tax form can be obtained from the Kentucky Department of Revenue's website or through various tax preparation services. It is available in PDF format, allowing for easy printing and completion. Ensure you have the most current version of the form to comply with the latest tax regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form2210kunderpayment of estimated tax by individu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kentucky 2210 tax form?

The Kentucky 2210 tax form is used by taxpayers in Kentucky to calculate and report underpayment of estimated tax. This form helps ensure that individuals and businesses meet their tax obligations throughout the year. Understanding the Kentucky 2210 tax can help you avoid penalties and interest on unpaid taxes.

-

How can airSlate SignNow assist with Kentucky 2210 tax documents?

airSlate SignNow provides a seamless platform for sending and eSigning Kentucky 2210 tax documents. With our user-friendly interface, you can easily manage your tax forms and ensure they are signed and submitted on time. This efficiency can save you time and reduce stress during tax season.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those dealing with Kentucky 2210 tax forms. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing Kentucky 2210 tax documents. These features streamline the process, making it easier to handle your tax paperwork efficiently. You can also collaborate with team members in real-time.

-

Is airSlate SignNow compliant with Kentucky tax regulations?

Yes, airSlate SignNow is designed to comply with Kentucky tax regulations, including those related to the Kentucky 2210 tax form. Our platform ensures that your documents meet the necessary legal standards, providing peace of mind when handling sensitive tax information. Compliance is a top priority for us.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage your Kentucky 2210 tax documents. This integration allows for a smoother workflow, ensuring that all your tax-related tasks are connected and efficient. You can enhance your productivity with these integrations.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for your Kentucky 2210 tax documents offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, allowing you to focus on your business rather than administrative tasks. Experience the convenience of digital document management.

Get more for FORM2210KUNDERPAYMENT OF ESTIMATED TAX BY INDIVIDU

- Landlord tenant sublease package mississippi form

- Buy sell agreement package mississippi form

- Option to purchase package mississippi form

- Amendment of lease package mississippi form

- Annual financial checkup package mississippi form

- Mississippi bill sale 497315728 form

- Living wills and health care package mississippi form

- Mississippi will 497315730 form

Find out other FORM2210KUNDERPAYMENT OF ESTIMATED TAX BY INDIVIDU

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now