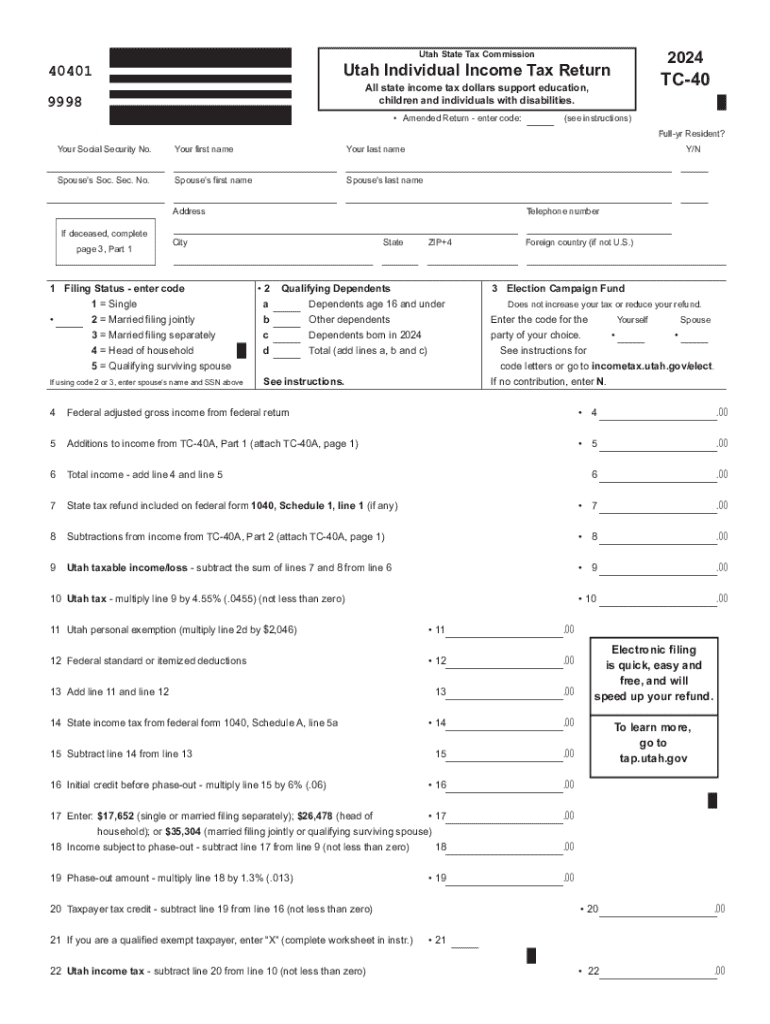

Utah TC 40 Individual Income Tax Return Form

What is the Utah TC 40 Individual Income Tax Return Form

The Utah TC 40 form is the official Individual Income Tax Return used by residents of Utah to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to comply with state tax regulations. The TC 40 is designed to capture various income types, deductions, and credits available to taxpayers in Utah, ensuring accurate reporting and compliance with state tax laws.

How to use the Utah TC 40 Individual Income Tax Return Form

To effectively use the Utah TC 40 form, taxpayers should gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income sources, deductions, and credits. Taxpayers should carefully follow the instructions provided on the form to ensure accurate completion. Once filled out, the form can be submitted either electronically or via mail, depending on the taxpayer's preference.

Steps to complete the Utah TC 40 Individual Income Tax Return Form

Completing the Utah TC 40 form involves several key steps:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income as instructed on the form.

- Claim any eligible deductions and credits available to you.

- Calculate your total tax liability based on the provided guidelines.

- Review the completed form for accuracy before submission.

Required Documents

When completing the Utah TC 40 form, taxpayers must have certain documents on hand to ensure accurate reporting. Essential documents include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Any other income documentation relevant to your financial situation

Filing Deadlines / Important Dates

Taxpayers in Utah should be aware of important deadlines related to the TC 40 form. Typically, the filing deadline for the Utah Individual Income Tax Return coincides with the federal tax deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is crucial to check the Utah State Tax Commission website for any updates or changes to these dates.

Form Submission Methods

The Utah TC 40 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Electronic filing through approved software

- Mailing a paper form to the appropriate state tax office

- In-person submission at designated tax offices

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the utah tc 40 individual income tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Utah state tax forms printable through airSlate SignNow?

Utah state tax forms printable through airSlate SignNow include various essential documents required for filing taxes in Utah. Our platform allows you to easily access, fill out, and eSign these forms, ensuring a smooth filing process. With airSlate SignNow, you can manage all your tax documentation efficiently.

-

How can I access Utah state tax forms printable?

You can access Utah state tax forms printable directly on the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the specific Utah tax forms you need. Our user-friendly interface makes it easy to find and download the necessary documents.

-

Are there any costs associated with using airSlate SignNow for Utah state tax forms printable?

airSlate SignNow offers a cost-effective solution for accessing Utah state tax forms printable. While there may be subscription fees depending on the plan you choose, the value provided through our features and integrations makes it a worthwhile investment for your tax needs. Check our pricing page for detailed information.

-

Can I eSign Utah state tax forms printable with airSlate SignNow?

Yes, you can eSign Utah state tax forms printable using airSlate SignNow. Our platform provides a secure and legally binding eSignature solution, allowing you to sign your tax documents electronically. This feature saves time and ensures that your forms are submitted promptly.

-

What features does airSlate SignNow offer for managing Utah state tax forms printable?

airSlate SignNow offers a variety of features for managing Utah state tax forms printable, including document templates, collaboration tools, and secure storage. You can easily customize forms, share them with others for review, and keep all your tax documents organized in one place. These features enhance your overall tax filing experience.

-

Is airSlate SignNow compatible with other software for Utah state tax forms printable?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Utah state tax forms printable alongside your existing tools. Whether you use accounting software or document management systems, our integrations help streamline your workflow and improve efficiency.

-

What benefits does airSlate SignNow provide for handling Utah state tax forms printable?

Using airSlate SignNow for handling Utah state tax forms printable offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the entire process, allowing you to focus on your business while ensuring compliance with tax regulations. Experience the convenience of digital document management today.

Get more for Utah TC 40 Individual Income Tax Return Form

- General warranty deed from husband and wife to a trust north carolina form

- General warranty deed nc 497316801 form

- Quitclaim deed from husband to himself and wife north carolina form

- Quitclaim deed from husband and wife to husband and wife north carolina form

- General warranty deed from husband and wife to husband and wife north carolina form

- North carolina postnuptial agreement form

- Nc postnuptial form

- Nc postnuptial 497316807 form

Find out other Utah TC 40 Individual Income Tax Return Form

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online