MICHIGAN Pension Schedule Form 4884

Understanding the Michigan Pension Schedule Form 4884

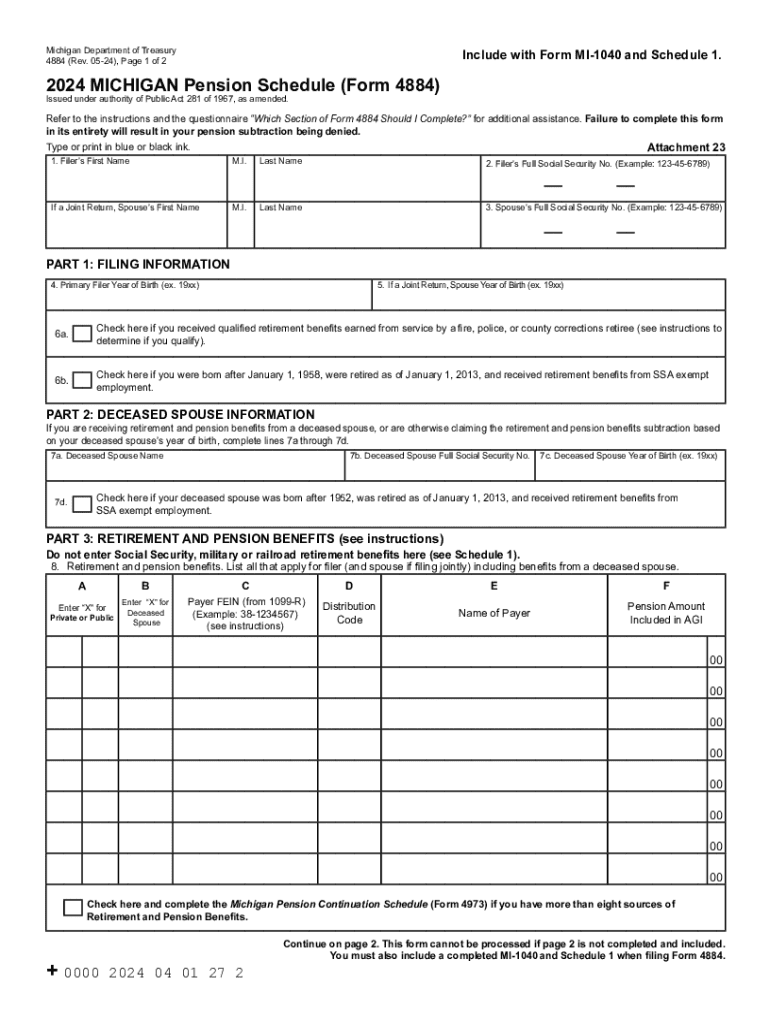

The Michigan Pension Schedule Form 4884 is a crucial document for residents who receive pension income. This form is designed to help taxpayers report their pension and retirement benefits accurately. It allows individuals to claim exemptions on certain types of pension income, ensuring they are taxed appropriately according to state laws. Understanding the purpose and function of this form is essential for anyone looking to navigate their tax responsibilities effectively.

Steps to Complete the Michigan Pension Schedule Form 4884

Completing the Michigan Pension Schedule Form 4884 involves several key steps:

- Gather Necessary Information: Collect all relevant documents, including pension statements and previous tax returns.

- Fill Out Personal Information: Provide your name, address, and Social Security number at the top of the form.

- Report Pension Income: Enter the total amount of pension income received during the tax year.

- Claim Exemptions: Identify any exemptions you qualify for and fill in the appropriate sections to claim them.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

Obtaining the Michigan Pension Schedule Form 4884

The Michigan Pension Schedule Form 4884 can be obtained through several methods. It is available for download from the Michigan Department of Treasury's official website. Alternatively, taxpayers can request a physical copy by contacting their local tax office. Many tax preparation services also provide access to this form as part of their offerings, ensuring that individuals can easily obtain it when needed.

Filing Deadlines for the Michigan Pension Schedule Form 4884

It is important to be aware of the filing deadlines associated with the Michigan Pension Schedule Form 4884. Typically, the form must be submitted by April fifteenth of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Keeping track of these dates is essential to avoid penalties and ensure timely processing of your tax return.

Legal Use of the Michigan Pension Schedule Form 4884

The Michigan Pension Schedule Form 4884 is legally recognized for reporting pension income and claiming exemptions. It is important to use the form correctly to comply with state tax regulations. Failure to accurately report pension income or to submit the form may result in penalties or additional taxes owed. Understanding the legal implications of this form can help taxpayers avoid unnecessary complications.

Key Elements of the Michigan Pension Schedule Form 4884

Several key elements are essential to understand when filling out the Michigan Pension Schedule Form 4884:

- Pension Income Reporting: Clearly state the total pension income received.

- Exemption Claims: Identify and claim any applicable exemptions based on your situation.

- Signature Requirement: Ensure the form is signed to validate the information provided.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the michigan pension schedule form 4884 771960407

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Michigan Form 4884?

Michigan Form 4884 is a tax form used by businesses to report their corporate income tax. It is essential for ensuring compliance with state tax regulations. Understanding how to fill out Michigan Form 4884 correctly can help businesses avoid penalties and streamline their tax filing process.

-

How can airSlate SignNow help with Michigan Form 4884?

airSlate SignNow provides an efficient platform for electronically signing and sending Michigan Form 4884. With its user-friendly interface, businesses can easily manage their document workflows, ensuring that all necessary signatures are obtained promptly. This can signNowly reduce the time spent on tax-related paperwork.

-

Is there a cost associated with using airSlate SignNow for Michigan Form 4884?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that simplify the signing and management of documents like Michigan Form 4884. Investing in this solution can save businesses time and resources in the long run.

-

What features does airSlate SignNow offer for managing Michigan Form 4884?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, all of which are beneficial for managing Michigan Form 4884. These features enhance efficiency and ensure that documents are handled securely and professionally. Users can also track the status of their forms in real-time.

-

Can I integrate airSlate SignNow with other software for Michigan Form 4884?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to incorporate Michigan Form 4884 into your existing workflows. This integration capability allows businesses to streamline their processes and enhance productivity by connecting with tools they already use.

-

What are the benefits of using airSlate SignNow for Michigan Form 4884?

Using airSlate SignNow for Michigan Form 4884 offers numerous benefits, including faster turnaround times for document signing and improved accuracy in tax filings. The platform also enhances collaboration among team members, ensuring that everyone involved in the process can access and review the form easily. Overall, it simplifies the tax preparation process.

-

Is airSlate SignNow secure for handling Michigan Form 4884?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents like Michigan Form 4884. The platform employs advanced encryption and security protocols to protect your data. Users can have peace of mind knowing their information is secure while using the service.

Get more for MICHIGAN Pension Schedule Form 4884

Find out other MICHIGAN Pension Schedule Form 4884

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile