RESET FORM Form PRINT FORM 17 1 Regional Income Ta

Understanding the RITA Form 17 for Ohio Income Tax

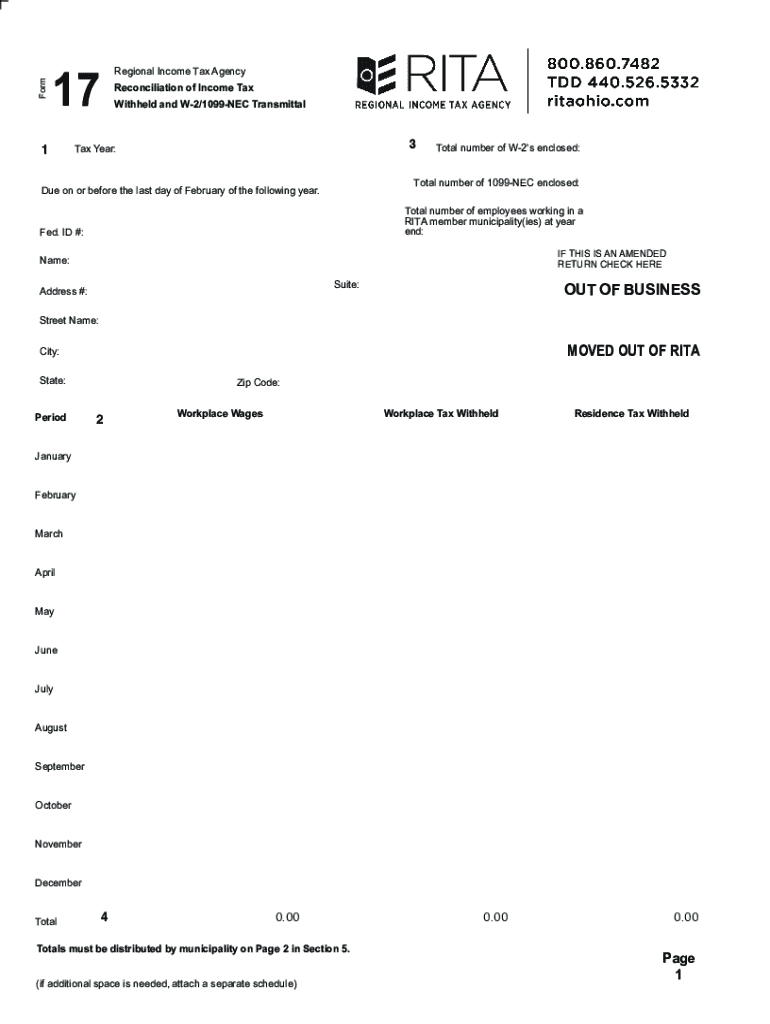

The RITA Form 17 is a crucial document for residents of Ohio who need to file their regional income tax. This form is specifically designed for individuals to report their income and calculate the tax owed to the Regional Income Tax Agency (RITA). It is essential for ensuring compliance with local tax regulations and for accurately determining the tax liability based on income earned within the RITA jurisdictions.

Steps to Complete the RITA Form 17

Completing the RITA Form 17 involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099 forms, and any other income statements.

- Fill out personal information, such as name, address, and Social Security number, at the top of the form.

- Report all sources of income, including wages, self-employment income, and any other taxable earnings.

- Calculate your total income and apply any deductions or credits you may qualify for.

- Determine the tax owed based on the applicable RITA tax rates.

- Sign and date the form before submission.

Filing Deadlines for RITA Form 17

It is important to be aware of the filing deadlines for the RITA Form 17 to avoid penalties. Typically, the form must be submitted by April 15 for the previous tax year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be mindful of any extensions that may be available, which can provide additional time to file without incurring late fees.

Required Documents for RITA Form 17

To accurately complete the RITA Form 17, taxpayers should have the following documents ready:

- W-2 forms from all employers for the tax year.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for any deductions claimed, such as mortgage interest or educational expenses.

Submission Methods for RITA Form 17

Taxpayers have several options for submitting the RITA Form 17:

- Online submission through the RITA website, which is often the fastest method.

- Mailing a printed copy of the completed form to the appropriate RITA office.

- In-person submission at designated RITA locations, which may be useful for those needing assistance.

Penalties for Non-Compliance with RITA Tax Filing

Failure to file the RITA Form 17 on time can result in penalties. These may include late fees, interest on unpaid taxes, and potential legal action for persistent non-compliance. It is advisable for taxpayers to file their forms accurately and on time to avoid these consequences. Understanding the importance of compliance can help ensure a smoother tax filing experience.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reset form form print form 17 1 regional income ta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rita tax ohio and how does it relate to airSlate SignNow?

Rita tax Ohio refers to the municipal income tax administered by the Regional Income Tax Agency. airSlate SignNow can help businesses streamline their tax-related document processes, making it easier to manage and eSign necessary forms related to rita tax Ohio efficiently.

-

How can airSlate SignNow assist with rita tax ohio filings?

With airSlate SignNow, you can easily prepare, send, and eSign documents required for rita tax Ohio filings. Our platform simplifies the process, ensuring that all necessary paperwork is completed accurately and submitted on time, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for rita tax ohio?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those dealing with rita tax Ohio. You can choose from monthly or annual subscriptions, ensuring you get the best value for your investment while managing your tax documents.

-

What features does airSlate SignNow offer for managing rita tax ohio documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing rita tax Ohio documents. These features help ensure that your tax documents are organized and easily accessible.

-

Can airSlate SignNow integrate with other software for rita tax ohio management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage rita tax Ohio documents. This integration allows for a more streamlined workflow, reducing the time spent on administrative tasks.

-

What are the benefits of using airSlate SignNow for rita tax ohio?

Using airSlate SignNow for rita tax Ohio offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive tax documents. Our platform ensures that your tax processes are not only faster but also compliant with local regulations.

-

Is airSlate SignNow user-friendly for those unfamiliar with rita tax ohio?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals unfamiliar with rita tax Ohio. Our intuitive interface and helpful resources ensure that anyone can navigate the platform with ease.

Get more for RESET FORM Form PRINT FORM 17 1 Regional Income Ta

Find out other RESET FORM Form PRINT FORM 17 1 Regional Income Ta

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template