PA Inactive PA Corporate Net Income Tax Report RCT 101 I Form

Understanding the PA Inactive PA Corporate Net Income Tax Report RCT 101 I

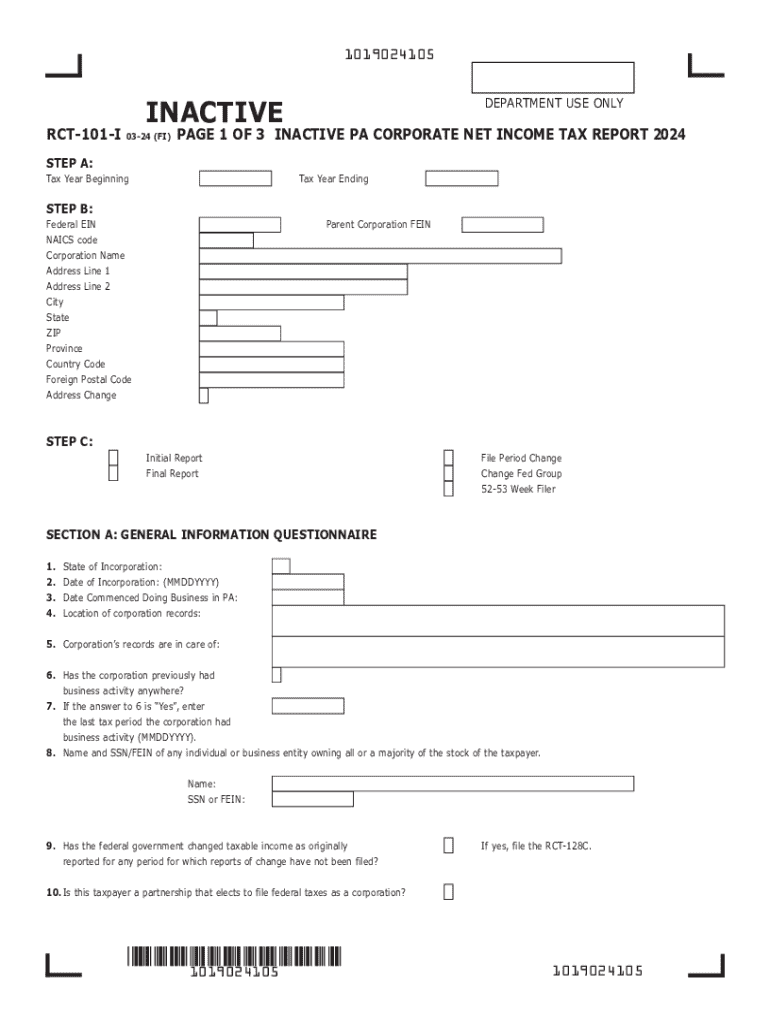

The PA Inactive PA Corporate Net Income Tax Report, commonly referred to as RCT 101 I, is a specific tax form used by corporations in Pennsylvania that are not actively conducting business. This form is essential for reporting the corporate net income tax obligations of inactive entities. It ensures compliance with state tax regulations, even for businesses that are not currently operational. Filing this report helps maintain good standing with the Pennsylvania Department of Revenue and avoids potential penalties.

Steps to Complete the PA Inactive PA Corporate Net Income Tax Report RCT 101 I

Completing the RCT 101 I involves several key steps:

- Gather Necessary Information: Collect all relevant financial data, including any income or expenses incurred during the inactive period.

- Access the Form: Obtain the RCT 101 I from the Pennsylvania Department of Revenue website or through authorized tax software.

- Fill Out the Form: Carefully enter the required information, ensuring accuracy to avoid delays in processing.

- Review the Submission: Double-check all entries for completeness and correctness before submission.

- Submit the Form: File the completed report by the designated deadline using the preferred submission method.

Legal Use of the PA Inactive PA Corporate Net Income Tax Report RCT 101 I

The RCT 101 I serves a legal purpose by fulfilling the statutory requirements for inactive corporations in Pennsylvania. Filing this report is not optional; it is a legal obligation that helps prevent the accumulation of penalties and interest for non-compliance. By submitting the RCT 101 I, corporations demonstrate their commitment to adhering to state tax laws, even when not actively engaged in business operations.

Filing Deadlines for the PA Inactive PA Corporate Net Income Tax Report RCT 101 I

Corporations must be aware of specific deadlines for filing the RCT 101 I. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations that follow the calendar year, this means the form is due by April 15. Missing this deadline can result in penalties, so it is crucial to stay informed and file on time.

Who Issues the PA Inactive PA Corporate Net Income Tax Report RCT 101 I

The Pennsylvania Department of Revenue is responsible for issuing the RCT 101 I. This department oversees the administration of state tax laws and ensures that corporations comply with their tax obligations. It is advisable for corporations to consult the Department of Revenue's resources for guidance on completing and submitting the form accurately.

Required Documents for the PA Inactive PA Corporate Net Income Tax Report RCT 101 I

When preparing to file the RCT 101 I, corporations should have certain documents on hand:

- Financial Statements: Any relevant financial records that reflect the corporation's inactive status.

- Previous Tax Returns: Past filings can provide a useful reference for completing the current report.

- Identification Information: The corporation's Federal Employer Identification Number (FEIN) and other identifying details.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa inactive pa corporate net income tax report rct 101 i

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is rct 101 i and how does it work with airSlate SignNow?

RCT 101 i is a feature within airSlate SignNow that streamlines the document signing process. It allows users to create, send, and manage electronic signatures efficiently. By integrating RCT 101 i, businesses can enhance their workflow and ensure secure document transactions.

-

What are the pricing options for using rct 101 i with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to the rct 101 i feature. Pricing varies based on the number of users and the features required. Businesses can choose a plan that best fits their needs, ensuring they get the most value from rct 101 i.

-

What are the key features of rct 101 i in airSlate SignNow?

RCT 101 i includes features such as customizable templates, real-time tracking, and secure cloud storage. These features help businesses manage their documents more effectively. With rct 101 i, users can also automate workflows, saving time and reducing errors.

-

How can rct 101 i benefit my business?

Implementing rct 101 i can signNowly improve your business's efficiency by reducing the time spent on document management. It enhances collaboration among team members and clients by providing a seamless signing experience. Ultimately, rct 101 i helps businesses close deals faster.

-

Can rct 101 i integrate with other software tools?

Yes, rct 101 i is designed to integrate seamlessly with various software applications. This includes CRM systems, project management tools, and cloud storage services. These integrations enhance the functionality of airSlate SignNow, making it a versatile solution for businesses.

-

Is rct 101 i secure for handling sensitive documents?

Absolutely, rct 101 i prioritizes security and compliance. It uses advanced encryption methods to protect sensitive information during transmission and storage. Businesses can trust rct 101 i to handle their documents securely and in accordance with industry regulations.

-

What types of documents can I manage with rct 101 i?

With rct 101 i, you can manage a wide range of documents, including contracts, agreements, and forms. The flexibility of airSlate SignNow allows users to customize document types to fit their specific needs. This versatility makes rct 101 i suitable for various industries.

Get more for PA Inactive PA Corporate Net Income Tax Report RCT 101 I

Find out other PA Inactive PA Corporate Net Income Tax Report RCT 101 I

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast