Form 568, Limited Liability Return of Income

What is the CA Form 568, Limited Liability Return of Income

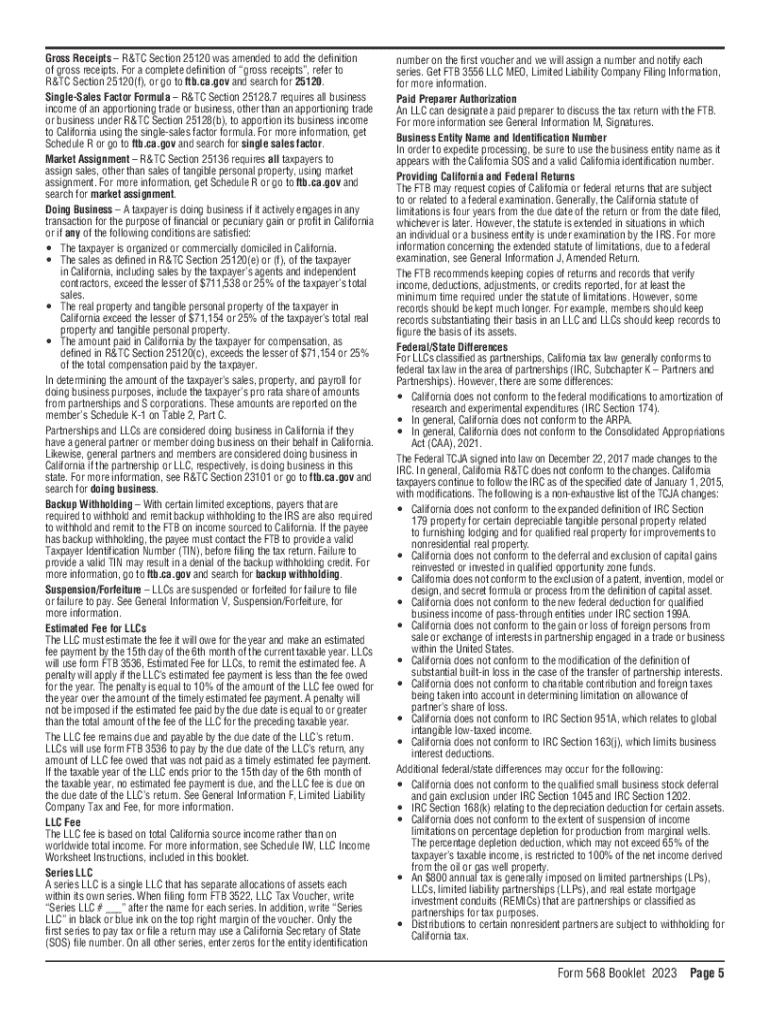

The CA Form 568, also known as the Limited Liability Return of Income, is a tax form used by Limited Liability Companies (LLCs) operating in California. This form is essential for reporting income, deductions, and credits associated with the LLC. It is specifically designed to ensure compliance with California tax laws and to calculate the LLC's annual tax obligations. The form must be filed by all LLCs, regardless of whether they are classified as single-member or multi-member entities.

Steps to Complete the CA Form 568

Completing the CA Form 568 involves several key steps:

- Gather necessary documentation, including financial statements and records of income and expenses.

- Fill out the identification section, which includes the LLC's name, address, and California Secretary of State file number.

- Report the total income earned by the LLC during the tax year, including any applicable deductions.

- Calculate the LLC fee based on total income, if applicable.

- Complete the sections related to credits and other adjustments.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The filing deadline for the CA Form 568 typically aligns with the due date for the LLC's tax return. For most LLCs, this is the 15th day of the fourth month following the close of the taxable year. For example, if the LLC operates on a calendar year, the form is due by April 15 of the following year. It is crucial for LLCs to be aware of these deadlines to avoid penalties and interest on late filings.

Form Submission Methods

LLCs can submit the CA Form 568 through various methods:

- Online: Filing electronically through the California Franchise Tax Board (FTB) website is a convenient option.

- Mail: The completed form can be sent via postal mail to the appropriate FTB mailing address.

- In-Person: Some LLCs may choose to file in person at designated FTB offices.

Key Elements of the CA Form 568

Understanding the key elements of the CA Form 568 is essential for accurate completion. The form includes sections for:

- Identification information for the LLC.

- Income and expense reporting.

- Calculation of the LLC fee based on total income.

- Credits and deductions applicable to the LLC.

- Signature and date lines for authorized representatives.

Legal Use of the CA Form 568

The CA Form 568 serves a legal purpose in ensuring that LLCs comply with California tax obligations. Filing this form accurately and on time helps maintain the LLC's good standing with the state. Failure to file or inaccuracies in the form can lead to penalties, interest, or even dissolution of the LLC. It is important for LLC owners to understand the legal implications of this form to avoid potential issues with state authorities.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 568 limited liability return of income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CA Form 568 extension?

The CA Form 568 extension is a document that allows partnerships and LLCs in California to request an extension for filing their tax returns. This extension provides additional time to prepare and submit the necessary tax information without incurring penalties.

-

How can airSlate SignNow help with the CA Form 568 extension?

airSlate SignNow simplifies the process of preparing and eSigning the CA Form 568 extension. With our user-friendly platform, you can easily fill out the form, gather necessary signatures, and submit it electronically, ensuring compliance and saving time.

-

Is there a cost associated with using airSlate SignNow for the CA Form 568 extension?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses. Our cost-effective solutions provide access to features that streamline the CA Form 568 extension process, making it affordable for all types of organizations.

-

What features does airSlate SignNow offer for managing the CA Form 568 extension?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the management of the CA Form 568 extension. These tools ensure that your documents are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for the CA Form 568 extension?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage the CA Form 568 extension alongside your other financial documents. This integration helps streamline your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the CA Form 568 extension?

Using airSlate SignNow for the CA Form 568 extension provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your business.

-

How secure is airSlate SignNow when handling the CA Form 568 extension?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your documents, including the CA Form 568 extension. You can trust that your sensitive information is safe and secure throughout the signing process.

Get more for Form 568, Limited Liability Return Of Income

Find out other Form 568, Limited Liability Return Of Income

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile