PA Schedule RK 1 Resident Schedule of ShareholderPartnerBeneficiary Pass through Income, Loss and Credits PA 20SPA 65 RK 1 Form

Understanding the PA Schedule RK 1

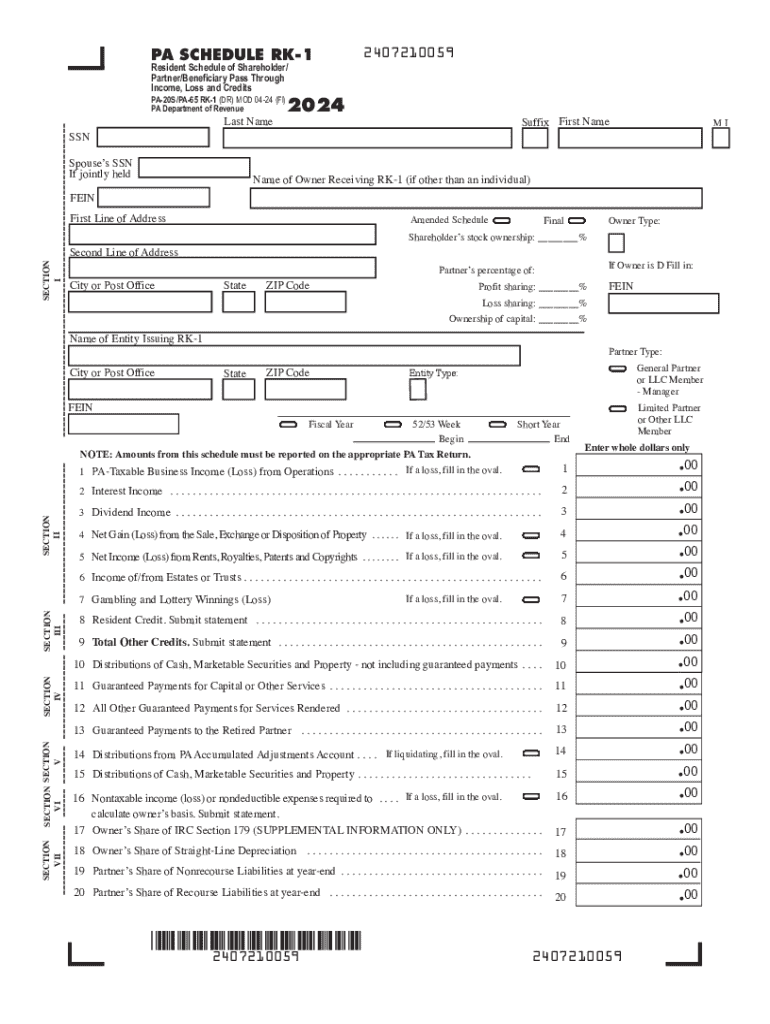

The PA Schedule RK 1, formally known as the Resident Schedule of Shareholder, Partner, Beneficiary Pass Through Income, Loss and Credits, is a tax form used in Pennsylvania. This form is essential for individuals who receive income from pass-through entities such as partnerships, S corporations, or estates. It allows taxpayers to report their share of income, losses, and credits from these entities on their personal tax returns. Understanding this form is crucial for accurate tax reporting and compliance with state regulations.

Steps to Complete the PA Schedule RK 1

Completing the PA Schedule RK 1 involves several steps to ensure accuracy and compliance. Start by gathering all necessary documentation related to your income from pass-through entities. This includes K-1 forms from partnerships or S corporations. Next, accurately report your share of income, losses, and any credits on the form. Ensure that you follow the instructions carefully, as errors can lead to delays or penalties. Finally, review your completed form for accuracy before submission.

Legal Use of the PA Schedule RK 1

The PA Schedule RK 1 is legally required for residents of Pennsylvania who receive pass-through income. This form must be submitted alongside your personal income tax return to ensure compliance with state tax laws. Failure to file this form when required can result in penalties, including fines and interest on unpaid taxes. It is important to understand the legal implications of this form to avoid potential issues with the Pennsylvania Department of Revenue.

Key Elements of the PA Schedule RK 1

Several key elements are essential when filling out the PA Schedule RK 1. These include:

- Identification Information: This section requires your name, address, and Social Security number.

- Income Reporting: Report your share of income, losses, and credits from each pass-through entity.

- Tax Credits: Include any applicable tax credits that can reduce your overall tax liability.

- Signature: Ensure you sign and date the form to validate your submission.

Obtaining the PA Schedule RK 1

The PA Schedule RK 1 can be obtained from the Pennsylvania Department of Revenue's website or through tax preparation software. It is important to use the most current version of the form to ensure compliance with any updates to tax laws. If you are working with a tax professional, they can also provide you with the necessary form and guidance on how to complete it accurately.

Filing Deadlines for the PA Schedule RK 1

Filing deadlines for the PA Schedule RK 1 align with the general Pennsylvania personal income tax return deadlines. Typically, the deadline is April 15 for the previous tax year. If you require additional time, you may file for an extension, but it is crucial to pay any taxes owed by the original deadline to avoid penalties and interest.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa schedule rk 1 resident schedule of shareholderpartnerbeneficiary pass through income loss and credits pa 20spa 65 rk 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pa schedule rk 1 feature in airSlate SignNow?

The pa schedule rk 1 feature in airSlate SignNow allows users to efficiently manage and schedule document signing processes. This feature ensures that all parties involved can sign documents at their convenience, streamlining workflows and enhancing productivity.

-

How does airSlate SignNow's pricing structure work for the pa schedule rk 1 feature?

airSlate SignNow offers flexible pricing plans that include access to the pa schedule rk 1 feature. Depending on your business needs, you can choose a plan that fits your budget while still providing essential eSigning capabilities.

-

What are the benefits of using the pa schedule rk 1 feature?

Using the pa schedule rk 1 feature in airSlate SignNow enhances efficiency by allowing users to set specific signing times. This reduces delays in document processing and ensures that all stakeholders are aligned, ultimately improving overall business operations.

-

Can I integrate the pa schedule rk 1 feature with other applications?

Yes, airSlate SignNow supports integrations with various applications, allowing you to incorporate the pa schedule rk 1 feature into your existing workflows. This flexibility helps businesses maintain seamless operations across different platforms.

-

Is the pa schedule rk 1 feature user-friendly?

Absolutely! The pa schedule rk 1 feature in airSlate SignNow is designed with user experience in mind. Its intuitive interface makes it easy for users of all skill levels to schedule document signings without any technical difficulties.

-

How can the pa schedule rk 1 feature improve my team's collaboration?

The pa schedule rk 1 feature fosters better collaboration by allowing team members to coordinate signing times effectively. This ensures that everyone is on the same page, reducing the chances of miscommunication and enhancing teamwork.

-

What types of documents can I use with the pa schedule rk 1 feature?

You can use the pa schedule rk 1 feature with a wide range of documents, including contracts, agreements, and forms. This versatility makes it an ideal solution for various industries looking to streamline their document signing processes.

Get more for PA Schedule RK 1 Resident Schedule Of ShareholderPartnerBeneficiary Pass Through Income, Loss And Credits PA 20SPA 65 RK 1

- Scale drawing word problems worksheet with answers form

- Dbia 535 form

- Biggest loser rules printable form

- Correlation vs causation worksheet 94795253 form

- Brookside terrace apartments form

- Onepath nz permanent emigration withdrawal form

- Dr rawlinson south australia form

- Wisconsin fixed rate note form 3250 pdf

Find out other PA Schedule RK 1 Resident Schedule Of ShareholderPartnerBeneficiary Pass Through Income, Loss And Credits PA 20SPA 65 RK 1

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast