It 204 Ll Form

What is the IT-204-LL?

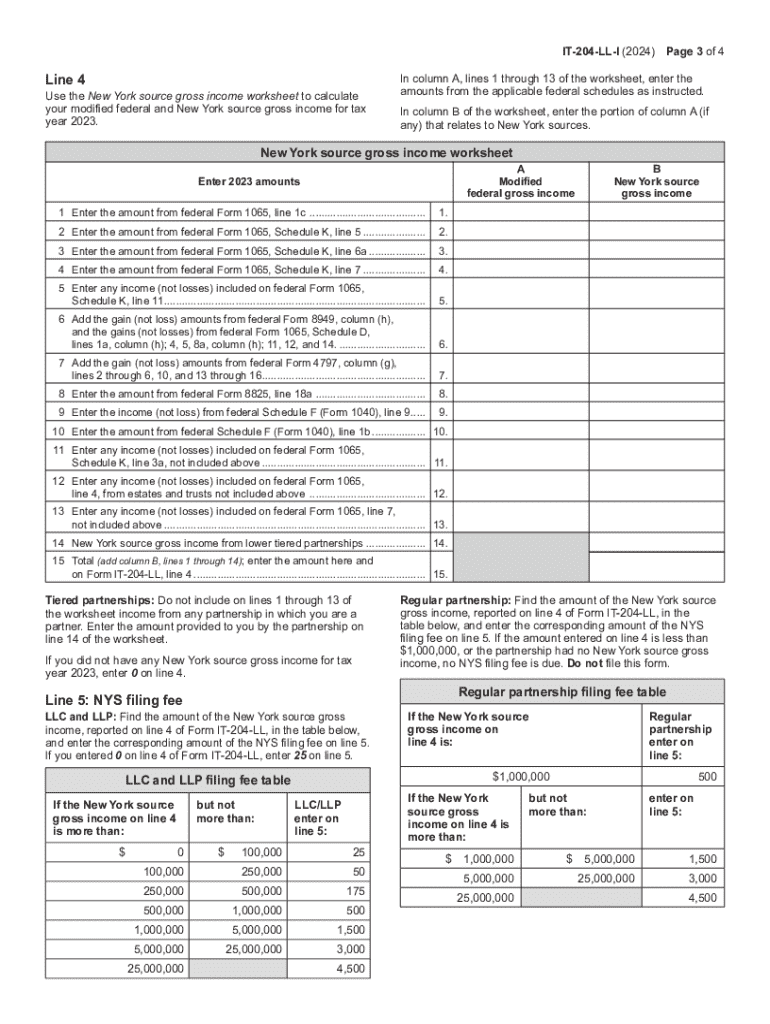

The IT-204-LL is a tax form used in New York State for Limited Liability Companies (LLCs) that are treated as partnerships for tax purposes. This form is specifically designed to report the annual filing fee owed by LLCs, which is based on the entity's gross income. Understanding this form is crucial for LLCs to ensure compliance with state tax regulations and avoid penalties.

How to Use the IT-204-LL

To use the IT-204-LL, LLCs must first determine their gross income for the tax year. This information is essential as it dictates the amount of the annual filing fee. After calculating the gross income, the LLC should complete the form by providing necessary information, including the entity's name, address, and income details. Once completed, the form must be submitted to the New York State Department of Taxation and Finance.

Steps to Complete the IT-204-LL

Completing the IT-204-LL involves several key steps:

- Gather financial records to determine the gross income for the year.

- Fill out the form with the required information, including the LLC's name and address.

- Calculate the filing fee based on the gross income as outlined in the form instructions.

- Review the completed form for accuracy and completeness.

- Submit the form by the due date to avoid any penalties.

Legal Use of the IT-204-LL

The IT-204-LL is a legally mandated form for LLCs in New York State. Filing this form is necessary to comply with state tax laws. Failure to file can result in penalties, including late fees and interest on unpaid amounts. It is important for LLCs to understand their obligations regarding this form to maintain good standing with the state.

Filing Deadlines / Important Dates

LLCs must be aware of the filing deadlines for the IT-204-LL to avoid penalties. The form is typically due by the 15th day of the fourth month following the end of the tax year. For most LLCs operating on a calendar year, this means the form is due by April 15. Keeping track of these dates is essential for timely compliance.

Required Documents

When completing the IT-204-LL, LLCs should have the following documents ready:

- Financial statements that detail gross income.

- Previous year's IT-204-LL form, if applicable.

- Any additional documentation that supports income calculations.

Form Submission Methods

The IT-204-LL can be submitted in several ways. LLCs may choose to file the form online through the New York State Department of Taxation and Finance website, or they can mail a paper copy of the completed form. In-person submissions are also an option at designated state offices. Each method has its own processing times, so it is advisable to plan accordingly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it 204 ll 770536008

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the instructions it 204 ll for using airSlate SignNow?

The instructions it 204 ll for using airSlate SignNow involve a straightforward process of uploading your document, adding signers, and sending it for eSignature. Our platform provides step-by-step guidance to ensure you can easily navigate through the signing process. You can also access detailed tutorials and customer support for any additional help.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, with options designed to fit different business needs. The instructions it 204 ll for pricing can be found on our website, where you can compare features and select the best plan for your organization. We also offer a free trial to help you evaluate our services.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a variety of features such as document templates, real-time tracking, and customizable workflows. The instructions it 204 ll for utilizing these features are designed to enhance your document management experience. Our platform is built to streamline the signing process and improve overall efficiency.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce costs associated with traditional document signing methods. The instructions it 204 ll highlight how our solution can improve productivity and enhance customer satisfaction through faster turnaround times. Embracing eSignatures can also help you stay compliant with legal standards.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, including CRM systems and cloud storage services. The instructions it 204 ll for setting up these integrations are user-friendly, allowing you to connect your existing tools seamlessly. This enhances your workflow and ensures a smooth document management process.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. The instructions it 204 ll for ensuring document security are clearly outlined in our resources. You can trust that your sensitive information is protected throughout the signing process.

-

Can I customize my documents in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your documents with various fields, branding options, and templates. The instructions it 204 ll for document customization are straightforward, enabling you to create a personalized signing experience for your clients. This feature helps maintain your brand identity while streamlining the signing process.

Get more for It 204 ll

- Cs 1067 form

- The purpose for requesting this information from you is to provide the

- Tc689 online intermediaries form

- Aq10 form

- Dss 5295 form

- Dd form 2807 2

- Affidavit for salary declaration form

- If this is an event for a daily license catering authorization or miscellaneous use show the area where sales and form

Find out other It 204 ll

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe