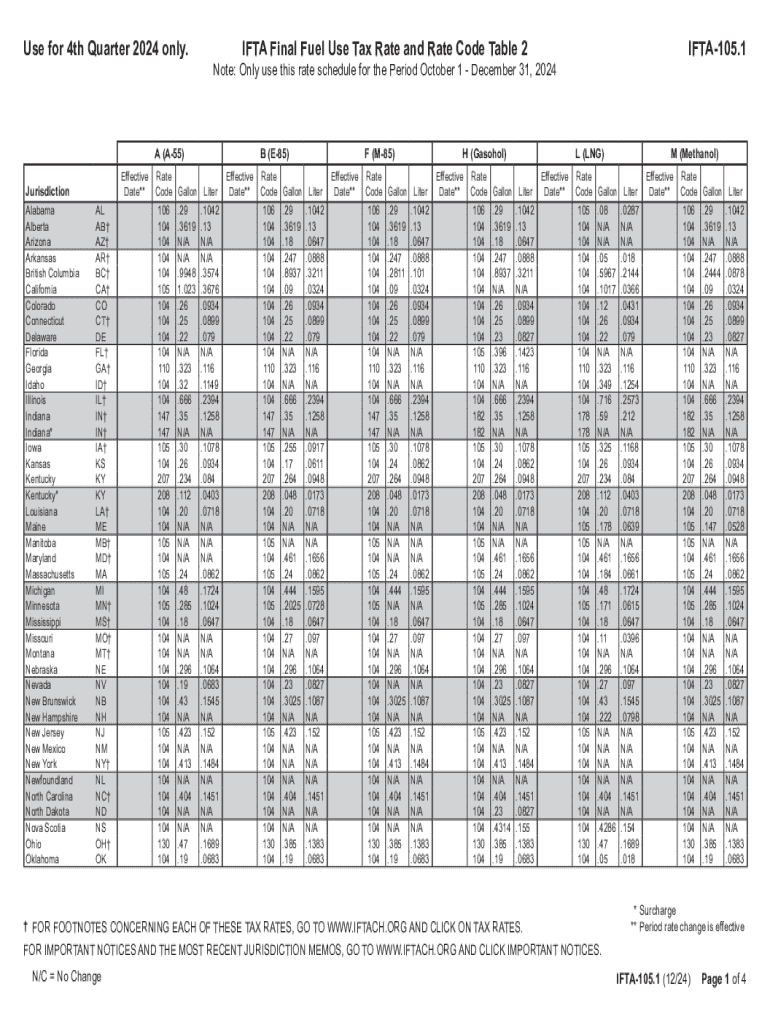

Use for 4th Quarter Only Jurisdiction Alabam Form

What is the IFTA 105 Form?

The IFTA 105 form, also known as the International Fuel Tax Agreement form, is a crucial document used by motor carriers operating in multiple jurisdictions across the United States and Canada. This form is designed to report fuel use and calculate the taxes owed to various states and provinces where the fuel was consumed. It simplifies the reporting process for carriers who operate in multiple states, allowing them to file a single form instead of separate returns for each jurisdiction.

Steps to Complete the IFTA 105 Form

Completing the IFTA 105 form involves several key steps:

- Gather Required Information: Collect data on fuel purchases, miles driven in each jurisdiction, and any other relevant information.

- Fill Out the Form: Input the gathered information into the appropriate sections of the IFTA 105 form, ensuring accuracy to avoid penalties.

- Calculate Taxes: Use the provided formulas to determine the taxes owed based on fuel consumption and mileage.

- Review the Form: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: File the completed IFTA 105 form with the appropriate state agency by the deadline.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA 105 form are typically quarterly. Carriers must submit their forms by the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

It is essential to adhere to these deadlines to avoid penalties and interest on late payments.

Penalties for Non-Compliance

Failure to comply with IFTA regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential audits by state tax authorities, leading to further scrutiny of records.

Maintaining accurate records and filing on time is crucial for avoiding these consequences.

Form Submission Methods

The IFTA 105 form can typically be submitted through various methods, including:

- Online Submission: Many states offer online portals for filing the IFTA 105 form electronically.

- Mail: Carriers can print the completed form and send it via postal service to the appropriate state agency.

- In-Person: Some jurisdictions allow for in-person submissions at designated offices.

Choosing the right submission method can help streamline the filing process.

Who Issues the IFTA 105 Form?

The IFTA 105 form is issued by the International Fuel Tax Agreement governing body, which is comprised of member jurisdictions. Each state or province participating in IFTA has its own agency responsible for administering the agreement and overseeing compliance. Carriers should ensure they are using the most current version of the form as issued by their respective state.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the use for 4th quarter only jurisdiction alabam

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IFTA 105 and how does it relate to airSlate SignNow?

IFTA 105 refers to the International Fuel Tax Agreement form used by commercial vehicle operators to report fuel use. airSlate SignNow simplifies the process of completing and submitting the IFTA 105 by providing an easy-to-use platform for eSigning and managing documents securely.

-

How can airSlate SignNow help with filing IFTA 105 forms?

With airSlate SignNow, you can quickly fill out and eSign your IFTA 105 forms online. The platform streamlines the filing process, ensuring that your documents are completed accurately and submitted on time, reducing the risk of penalties.

-

What are the pricing options for using airSlate SignNow for IFTA 105?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose a plan that fits your needs, whether you are filing a few IFTA 105 forms or managing a large volume of documents, ensuring cost-effectiveness.

-

Are there any features specifically designed for IFTA 105 users?

Yes, airSlate SignNow includes features tailored for IFTA 105 users, such as customizable templates, automated reminders, and secure cloud storage. These features enhance efficiency and ensure that your IFTA 105 forms are always accessible and organized.

-

Can I integrate airSlate SignNow with other software for managing IFTA 105?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and fleet management software. This integration allows you to manage your IFTA 105 forms alongside other business operations, streamlining your workflow.

-

What benefits does airSlate SignNow provide for IFTA 105 filing?

Using airSlate SignNow for IFTA 105 filing offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform's user-friendly interface makes it easy to complete forms, while eSigning ensures that your submissions are legally binding.

-

Is airSlate SignNow secure for handling IFTA 105 documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your IFTA 105 documents are protected. The platform uses advanced encryption and secure storage solutions to safeguard your sensitive information.

Get more for Use For 4th Quarter Only Jurisdiction Alabam

Find out other Use For 4th Quarter Only Jurisdiction Alabam

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy