Form 770ES, Virginia Estimated Income Tax Payment

What is the Form 770ES, Virginia Estimated Income Tax Payment

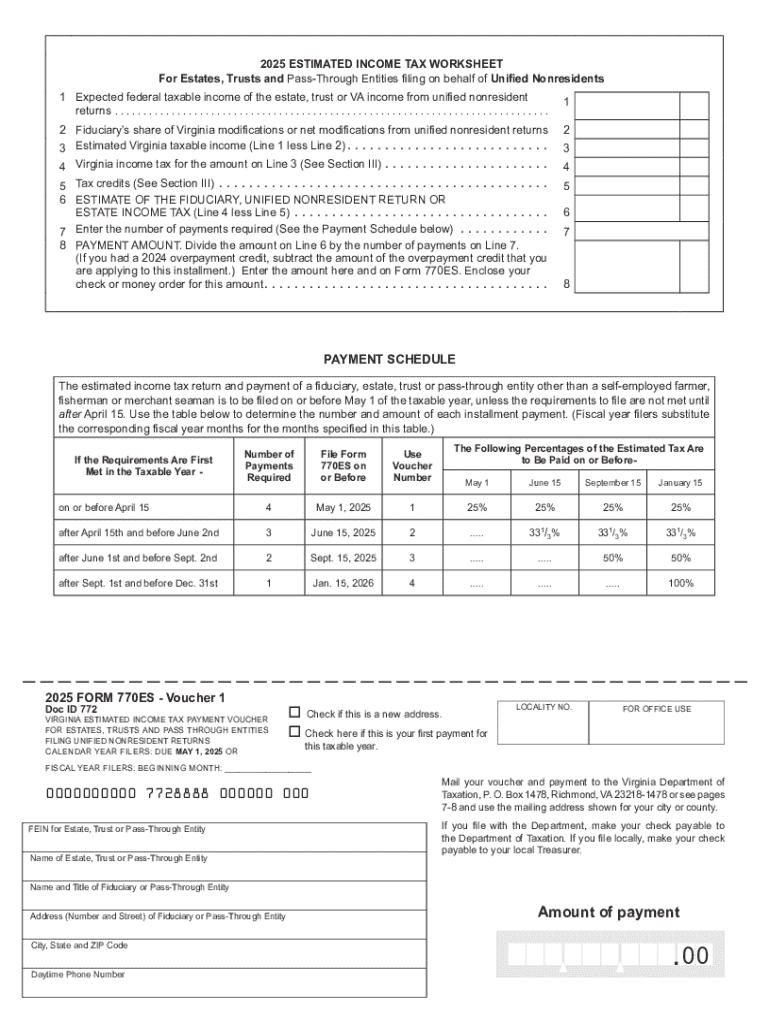

The Form 770ES is a document used by Virginia taxpayers to make estimated income tax payments. This form is essential for individuals who expect to owe tax of $1,000 or more when they file their annual return. It is particularly relevant for self-employed individuals, retirees, and those with significant income not subject to withholding. By submitting the 770ES, taxpayers can spread their tax liability throughout the year, helping to avoid a large tax bill at the end of the year.

Steps to complete the Form 770ES, Virginia Estimated Income Tax Payment

Completing the Form 770ES involves several key steps. First, gather your financial information, including your expected income, deductions, and credits for the year. Next, calculate your estimated tax liability using the current Virginia tax rates. Fill out the form by providing your personal information, including your name, address, and Social Security number. Indicate the amount you wish to pay with each installment. Finally, review the form for accuracy before submitting it to ensure compliance with state tax regulations.

Filing Deadlines / Important Dates

Timely submission of the Form 770ES is crucial to avoid penalties. Estimated tax payments are generally due on the fifteenth day of April, June, September, and January of the following year. It is important to mark these dates on your calendar and ensure that payments are made on time. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Staying aware of these deadlines can help maintain compliance with Virginia tax laws.

How to obtain the Form 770ES, Virginia Estimated Income Tax Payment

The Form 770ES can be easily obtained through the Virginia Department of Taxation's official website. Taxpayers can download a printable version of the form directly from the site. Additionally, physical copies may be available at local tax offices or public libraries. It is advisable to ensure you are using the most current version of the form to avoid any issues with your estimated payments.

Key elements of the Form 770ES, Virginia Estimated Income Tax Payment

Key elements of the Form 770ES include personal identification information, estimated income calculations, and payment amounts. The form requires taxpayers to provide their name, address, and Social Security number. Additionally, it includes sections for estimating income, deductions, and credits to determine the total tax liability. Taxpayers must also specify the payment amount for each installment, ensuring that they meet the minimum payment requirements set by the state.

Penalties for Non-Compliance

Failure to file the Form 770ES or to make estimated payments can result in penalties and interest charges. If you do not pay enough tax throughout the year, the Virginia Department of Taxation may impose a penalty based on the amount owed. Additionally, interest will accrue on any unpaid tax balance. It is essential to adhere to the filing requirements and payment schedules to avoid these financial repercussions.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 770es virginia estimated income tax payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Virginia 770ES payment process?

The Virginia 770ES payment process allows businesses to make estimated tax payments electronically. By using airSlate SignNow, you can easily prepare and eSign your 770ES forms, ensuring timely submissions and compliance with state regulations.

-

How can airSlate SignNow help with Virginia 770ES payments?

airSlate SignNow streamlines the Virginia 770ES payment process by providing an intuitive platform for document management. You can quickly create, send, and eSign your payment forms, reducing the time spent on paperwork and enhancing accuracy.

-

Are there any fees associated with using airSlate SignNow for Virginia 770ES payments?

While airSlate SignNow offers a cost-effective solution for document signing, there may be subscription fees depending on the plan you choose. However, the efficiency gained in managing your Virginia 770ES payments can offset these costs signNowly.

-

What features does airSlate SignNow offer for Virginia 770ES payments?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for your Virginia 770ES payments. These tools help ensure that your documents are processed quickly and securely.

-

Can I integrate airSlate SignNow with other accounting software for Virginia 770ES payments?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your Virginia 770ES payments. This integration allows for automatic data transfer, reducing manual entry and potential errors.

-

What are the benefits of using airSlate SignNow for Virginia 770ES payments?

Using airSlate SignNow for your Virginia 770ES payments offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the entire process, allowing you to focus on your business operations.

-

Is airSlate SignNow secure for handling Virginia 770ES payments?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents and personal information during the Virginia 770ES payment process. You can trust that your data is safe and compliant with industry standards.

Get more for Form 770ES, Virginia Estimated Income Tax Payment

Find out other Form 770ES, Virginia Estimated Income Tax Payment

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation