Irs Form 8936 PDF Documents

What is the IRS Form 8936?

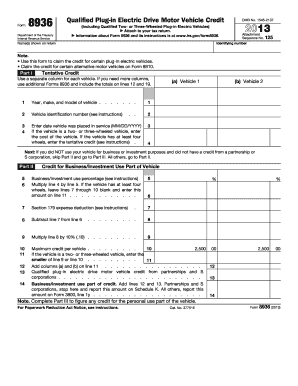

The IRS Form 8936 is a tax document used by individual taxpayers in the United States to claim a credit for qualified plug-in electric drive motor vehicles. This form is essential for those who have purchased or leased eligible electric vehicles and wish to receive a tax incentive for their environmentally friendly choice. The form helps taxpayers report the necessary information to the IRS, ensuring they receive the correct credit amount when filing their annual tax returns.

How to obtain the IRS Form 8936 PDF

Obtaining the IRS Form 8936 PDF is a straightforward process. Taxpayers can download the form directly from the official IRS website. It is available in a fillable PDF format, allowing users to complete the form electronically. Additionally, the form can be printed for manual completion if preferred. Ensure that you are using the most current version of the form to avoid any issues during filing.

Steps to complete the IRS Form 8936

Completing the IRS Form 8936 involves several key steps:

- Gather necessary information: Collect details about the vehicle, including make, model, and vehicle identification number (VIN).

- Determine eligibility: Verify that the vehicle qualifies for the credit based on IRS guidelines.

- Fill out the form: Input the required information in the designated fields, ensuring accuracy.

- Calculate the credit: Use the provided instructions to determine the amount of credit you are eligible to claim.

- Review and sign: Double-check all entries for correctness before signing and dating the form.

Key elements of the IRS Form 8936

The IRS Form 8936 includes several critical sections that taxpayers must complete:

- Taxpayer information: This section requires personal details, including name, address, and taxpayer identification number.

- Vehicle information: Here, taxpayers must provide specifics about the electric vehicle, including its make, model, and VIN.

- Credit calculation: This part of the form helps taxpayers determine the amount of credit they can claim based on the vehicle's specifications and eligibility.

Filing deadlines for the IRS Form 8936

Taxpayers must be aware of the filing deadlines associated with the IRS Form 8936. Generally, the form should be submitted along with the annual tax return by April 15 of the following year. If taxpayers require additional time, they can file for an extension, but it is essential to ensure that the form is included in the extended return submission to avoid penalties.

Eligibility criteria for the IRS Form 8936

To qualify for the tax credit claimed on the IRS Form 8936, taxpayers must meet specific eligibility criteria:

- The vehicle must be a qualified plug-in electric drive motor vehicle.

- The vehicle must be purchased or leased for personal use, not for resale.

- The vehicle must meet certain battery capacity requirements as defined by the IRS.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 8936 pdf documents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Irs Form 8936 PDF Documents?

Irs Form 8936 PDF Documents are official tax forms used to claim a credit for qualified plug-in electric drive motor vehicles. These documents are essential for taxpayers looking to benefit from tax incentives related to electric vehicles. Understanding how to fill out and submit these forms can help maximize your tax benefits.

-

How can airSlate SignNow help with Irs Form 8936 PDF Documents?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning Irs Form 8936 PDF Documents. Our user-friendly interface allows you to easily manage your documents, ensuring that you can complete your tax filings efficiently. With our solution, you can save time and reduce errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for Irs Form 8936 PDF Documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage your Irs Form 8936 PDF Documents without breaking the bank. You can choose a plan that fits your budget while enjoying all the essential features.

-

What features does airSlate SignNow offer for managing Irs Form 8936 PDF Documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for Irs Form 8936 PDF Documents. These tools help you streamline your workflow and ensure that your documents are handled securely and efficiently. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other software for Irs Form 8936 PDF Documents?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage your Irs Form 8936 PDF Documents seamlessly. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect with your existing tools to enhance your productivity.

-

What are the benefits of using airSlate SignNow for Irs Form 8936 PDF Documents?

Using airSlate SignNow for Irs Form 8936 PDF Documents provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime, anywhere. This convenience allows you to focus on your business while we handle your document needs.

-

How secure is airSlate SignNow when handling Irs Form 8936 PDF Documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your Irs Form 8936 PDF Documents from unauthorized access. You can trust that your sensitive information is safe while using our platform.

Get more for Irs Form 8936 PDF Documents

Find out other Irs Form 8936 PDF Documents

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile