Form MO 2210 Underpayment of Estimated Tax by Individuals

What is the Form MO 2210 Underpayment Of Estimated Tax By Individuals

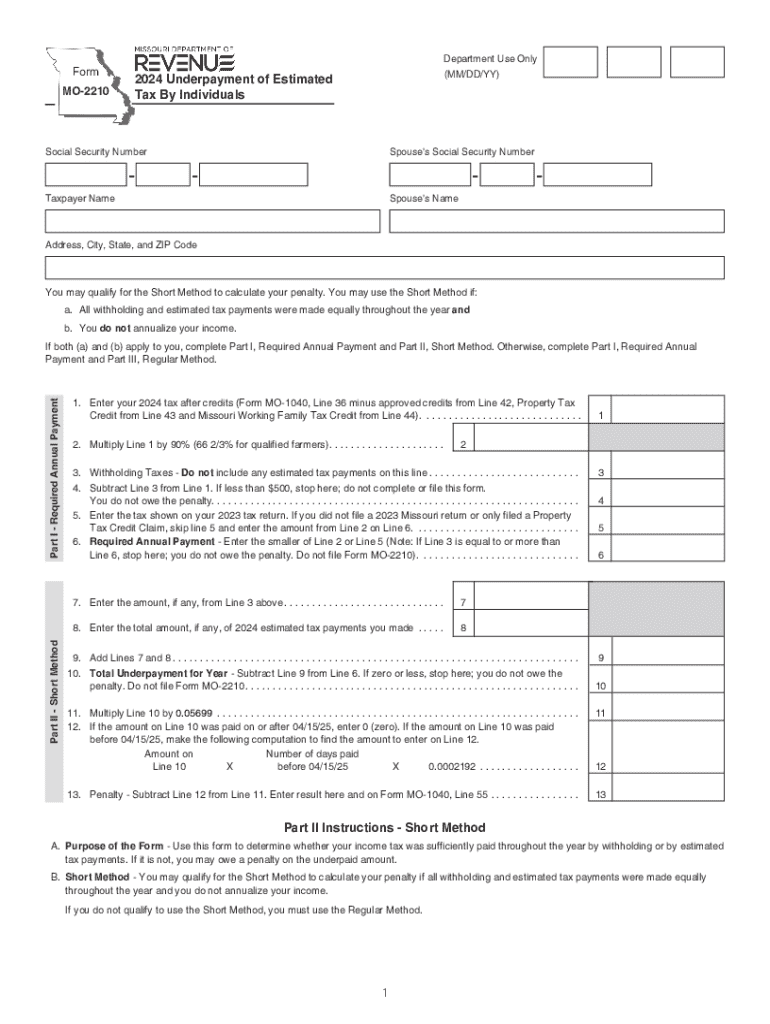

The MO 2210 tax form is designed for individuals in Missouri who may have underpaid their estimated state income taxes. This form helps taxpayers calculate any penalties due for not meeting the required estimated tax payments throughout the year. It is essential for those who do not have enough tax withheld from their income or who have income that is not subject to withholding, such as self-employment income. By using the MO 2210 form, individuals can determine if they owe a penalty and how much it is, ensuring compliance with state tax regulations.

How to use the Form MO 2210 Underpayment Of Estimated Tax By Individuals

To use the MO 2210 form, individuals must first gather their income information and any tax payments made during the year. The form requires details such as total income, tax liability, and the amount of estimated tax payments made. After filling out the necessary sections, taxpayers can calculate their potential penalty for underpayment. It is crucial to ensure that all figures are accurate to avoid additional penalties. Once completed, the form can be submitted along with the individual’s state tax return.

Steps to complete the Form MO 2210 Underpayment Of Estimated Tax By Individuals

Completing the MO 2210 form involves several steps:

- Gather all relevant income documentation and records of estimated tax payments.

- Fill out the personal information section at the top of the form.

- Calculate your total tax liability for the year.

- Determine the amount of estimated tax payments made.

- Use the provided tables on the form to assess any underpayment penalties.

- Sign and date the form before submitting it with your tax return.

Key elements of the Form MO 2210 Underpayment Of Estimated Tax By Individuals

The MO 2210 form includes several key elements that are important for accurate completion:

- Personal Information: Name, address, and Social Security number.

- Income Information: Total income, tax liability, and estimated tax payments.

- Penalty Calculation: Sections to calculate the penalty for underpayment based on the provided tables.

- Signature: Required to validate the form and confirm the accuracy of the information provided.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the MO 2210 form. Typically, the form must be submitted by the same deadline as the Missouri state tax return, which is usually April 15 for most taxpayers. However, if you file for an extension, the deadline may vary. It is advisable to check the Missouri Department of Revenue website for any updates or changes to these dates, especially for the current tax year.

Penalties for Non-Compliance

Failing to file the MO 2210 form or underpaying estimated taxes can result in penalties imposed by the Missouri Department of Revenue. These penalties may include a percentage of the underpaid amount, which can accumulate over time. Additionally, interest may accrue on any unpaid taxes. To avoid these penalties, it is crucial to accurately assess your tax liability and make timely payments throughout the year.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo 2210 underpayment of estimated tax by individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the mo 2210 tax form?

The mo 2210 tax form is a document used by taxpayers in Missouri to calculate any underpayment of estimated tax. It helps individuals determine if they owe a penalty for not paying enough tax throughout the year. Understanding this form is crucial for accurate tax filing and avoiding penalties.

-

How can airSlate SignNow help with the mo 2210 tax form?

airSlate SignNow provides an efficient platform for electronically signing and sending the mo 2210 tax form. With our user-friendly interface, you can easily fill out and submit your tax documents securely. This streamlines the process, ensuring you meet deadlines without hassle.

-

Is there a cost associated with using airSlate SignNow for the mo 2210 tax form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions ensure that you can manage your documents, including the mo 2210 tax form, without breaking the bank. Explore our pricing options to find the best fit for your requirements.

-

What features does airSlate SignNow offer for managing the mo 2210 tax form?

airSlate SignNow includes features such as document templates, real-time collaboration, and secure eSigning, all of which enhance the management of the mo 2210 tax form. These tools simplify the process, making it easier to complete and submit your tax documents efficiently.

-

Can I integrate airSlate SignNow with other software for the mo 2210 tax form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the mo 2210 tax form alongside your existing tools. This integration enhances workflow efficiency and ensures that all your documents are easily accessible in one place.

-

What are the benefits of using airSlate SignNow for the mo 2210 tax form?

Using airSlate SignNow for the mo 2210 tax form offers numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform ensures that your documents are signed and sent quickly, reducing the risk of errors and missed deadlines.

-

Is airSlate SignNow secure for handling the mo 2210 tax form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the mo 2210 tax form. We utilize advanced encryption and security protocols to protect your sensitive information, ensuring that your tax documents are secure throughout the process.

Get more for Form MO 2210 Underpayment Of Estimated Tax By Individuals

- D0688 department of veteransamp39 affairs dva gov form

- D2669 lifestyle questionnaire department of veterans39 affairs dva gov form

- Annexation application form city of orlando cityoforlando

- Lynn city hall birth certificate form

- Disclosure report revised vs10 9 13 city of st peters missouri stpetersmo form

- Backflow prevention test form the city of wentzville missouri wentzvillemo

- Ohio affidavit financial form

- Affidavit of non responsibility form

Find out other Form MO 2210 Underpayment Of Estimated Tax By Individuals

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online