Form INT 4 Credit Union Tax Return

What is the Form INT 4 Credit Union Tax Return

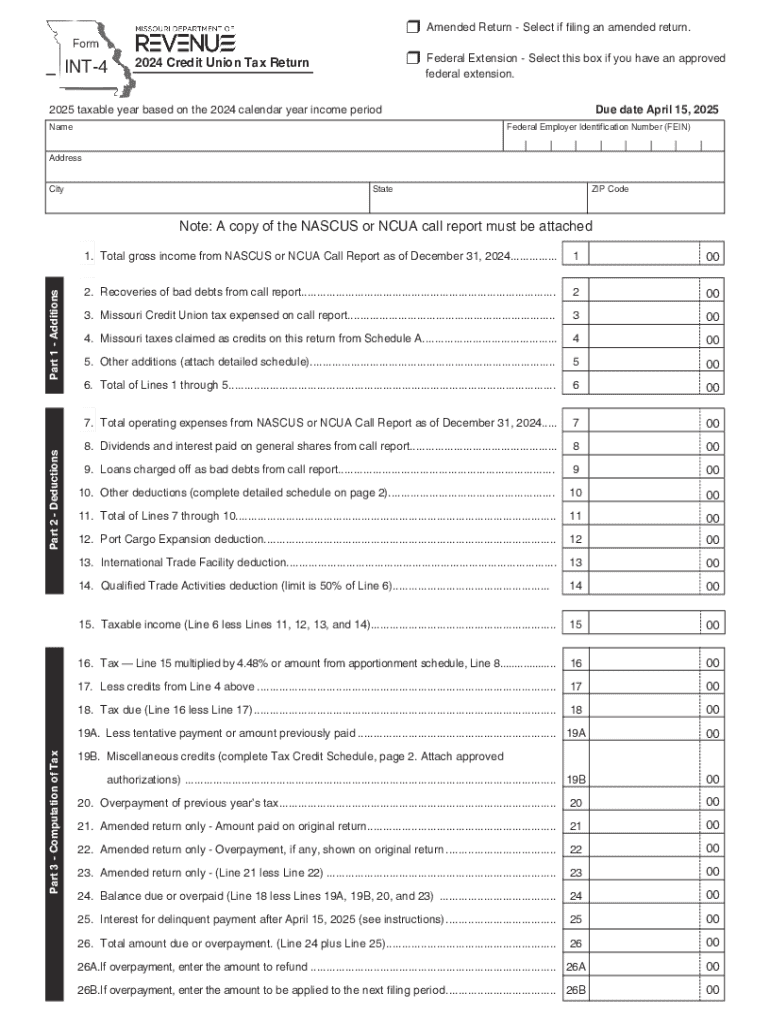

The Form INT 4 Credit Union Tax Return is a specific tax document used by credit unions in the United States to report their income, expenses, and other financial information to the Internal Revenue Service (IRS). This form is essential for credit unions to comply with federal tax regulations and ensure accurate reporting of their financial activities. It helps determine the tax obligations of the credit union and is crucial for maintaining transparency and accountability in their operations.

How to use the Form INT 4 Credit Union Tax Return

Using the Form INT 4 Credit Union Tax Return involves several key steps. First, credit unions must gather all necessary financial data, including income statements, balance sheets, and details of any deductions or credits applicable. Next, they should fill out the form accurately, ensuring that all sections are completed in accordance with IRS guidelines. After completing the form, it must be submitted to the IRS by the designated deadline, either electronically or via mail, depending on the credit union's preference and eligibility.

Steps to complete the Form INT 4 Credit Union Tax Return

Completing the Form INT 4 Credit Union Tax Return requires a systematic approach. Follow these steps:

- Collect financial statements, including income and expenses for the reporting period.

- Identify applicable deductions and credits that may reduce the tax liability.

- Carefully fill out each section of the form, ensuring accuracy and completeness.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the specified deadline, choosing the appropriate submission method.

Key elements of the Form INT 4 Credit Union Tax Return

The Form INT 4 Credit Union Tax Return includes several key elements that are crucial for accurate reporting. These elements typically consist of:

- Identification information for the credit union, including name, address, and Employer Identification Number (EIN).

- Income details, including interest income, fees, and other revenue sources.

- Expense categories, such as operating expenses, employee salaries, and other costs incurred during the tax year.

- Information on deductions and credits that the credit union is eligible for.

- Signature and verification section, confirming that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form INT 4 Credit Union Tax Return are critical for compliance. Generally, credit unions must file their tax returns by the fifteenth day of the fourth month following the end of their tax year. For example, if a credit union operates on a calendar year basis, the due date would be April 15. It is important for credit unions to be aware of any potential extensions or changes in deadlines announced by the IRS to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form INT 4 Credit Union Tax Return on time or submitting inaccurate information can result in significant penalties. The IRS may impose fines based on the length of time the return is late and the amount of tax owed. Additionally, non-compliance can lead to increased scrutiny from the IRS, which may result in audits or further legal action. It is essential for credit unions to adhere to all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form int 4 credit union tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form INT 4 Credit Union Tax Return?

The Form INT 4 Credit Union Tax Return is a tax document used by credit unions to report interest income to the IRS. It is essential for ensuring compliance with tax regulations and accurately reporting earnings. Understanding this form is crucial for credit unions and their members.

-

How can airSlate SignNow help with the Form INT 4 Credit Union Tax Return?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form INT 4 Credit Union Tax Return. Our solution simplifies the process, ensuring that all necessary signatures are obtained quickly and securely. This streamlines your tax reporting process and enhances compliance.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic features or advanced functionalities for handling the Form INT 4 Credit Union Tax Return, we have a plan that fits your budget. Explore our pricing page for detailed information on our offerings.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage the Form INT 4 Credit Union Tax Return efficiently. These integrations help streamline document management and improve productivity.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers a range of features designed for effective tax document management, including customizable templates, secure eSigning, and automated workflows. These features make it easy to handle the Form INT 4 Credit Union Tax Return and ensure that all documents are processed efficiently. Our platform prioritizes user-friendliness and security.

-

How does airSlate SignNow ensure the security of my tax documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure cloud storage to protect your documents, including the Form INT 4 Credit Union Tax Return. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

-

Can I track the status of my Form INT 4 Credit Union Tax Return?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including the Form INT 4 Credit Union Tax Return. You can easily monitor the status of your documents, see who has signed, and receive notifications when actions are completed, ensuring you stay informed throughout the process.

Get more for Form INT 4 Credit Union Tax Return

Find out other Form INT 4 Credit Union Tax Return

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation