Form MO PTS Property Tax Credit Schedule

Understanding the Form MO PTS Property Tax Credit Schedule

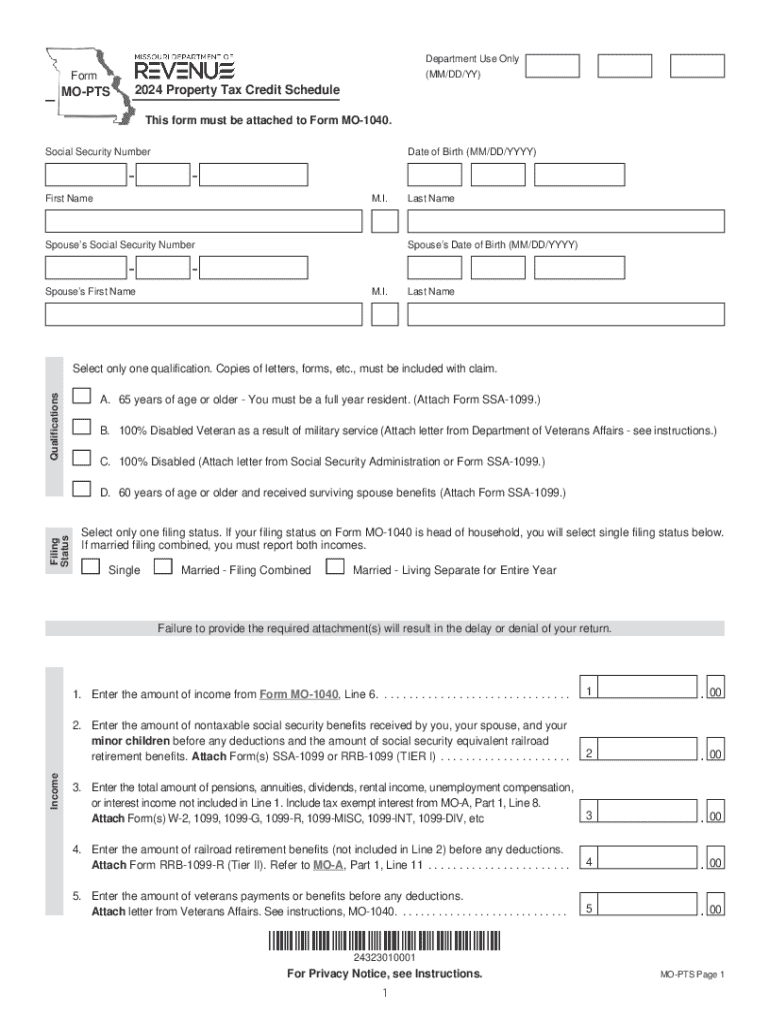

The Form MO PTS is a crucial document for residents of Missouri seeking to apply for the Property Tax Credit. This form is designed to help eligible taxpayers receive a credit on their property taxes, offering financial relief to those who meet specific criteria. The credit is primarily aimed at low-income seniors, disabled individuals, and certain veterans, making it an essential resource for qualifying homeowners.

Steps to Complete the Form MO PTS Property Tax Credit Schedule

Completing the Form MO PTS requires attention to detail to ensure accuracy and compliance. Here are the steps to follow:

- Gather necessary documentation, including proof of income, property ownership, and any relevant identification.

- Fill out personal information, such as name, address, and Social Security number, in the designated sections.

- Provide details about your property, including the address and the amount of property tax paid.

- Indicate your eligibility status by answering questions related to age, disability, or veteran status.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form MO PTS Property Tax Credit Schedule

To qualify for the MO PTS Property Tax Credit, applicants must meet specific eligibility requirements. Generally, these include:

- Being a resident of Missouri.

- Meeting income limits set by the state for the year of application.

- Being at least sixty-five years old, or being a veteran, or having a permanent disability.

- Owning or renting property and having paid property taxes or rent during the year.

How to Obtain the Form MO PTS Property Tax Credit Schedule

The Form MO PTS can be obtained through several channels. Taxpayers can access the form by:

- Visiting the Missouri Department of Revenue website, where the form is available for download.

- Requesting a physical copy from local county assessor offices.

- Contacting the Missouri Department of Revenue directly for assistance.

Legal Use of the Form MO PTS Property Tax Credit Schedule

The Form MO PTS must be used in accordance with Missouri state laws governing property tax credits. It is essential for applicants to provide truthful and accurate information, as any discrepancies may lead to penalties or denial of the credit. Understanding the legal implications of the form ensures compliance and protects the taxpayer's rights.

Form Submission Methods for MO PTS

Once completed, the Form MO PTS can be submitted through various methods, including:

- Mailing the form to the appropriate county office as indicated in the instructions.

- Submitting the form in person at local government offices.

- In some cases, electronic submission may be available, depending on local regulations.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo pts property tax credit schedule 770137402

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are mo pts in airSlate SignNow?

Mo pts refer to the modular points system in airSlate SignNow that allows users to customize their document signing experience. This system enables businesses to allocate points based on their specific needs, ensuring they only pay for the features they use. By utilizing mo pts, companies can optimize their workflow and enhance productivity.

-

How does pricing work with mo pts?

The pricing structure for airSlate SignNow is based on the number of mo pts you choose to purchase. Each feature or service corresponds to a specific point value, allowing businesses to tailor their subscription to fit their budget. This flexible pricing model ensures that you only invest in what you truly need.

-

What features are included with mo pts?

With mo pts, users gain access to a variety of features such as document templates, advanced eSignature options, and integration capabilities. Each feature is designed to streamline the signing process and improve document management. By selecting the right combination of mo pts, businesses can enhance their operational efficiency.

-

Can I integrate airSlate SignNow with other applications using mo pts?

Yes, airSlate SignNow offers seamless integrations with various applications, and these integrations can be accessed using mo pts. This allows businesses to connect their existing tools and workflows, making it easier to manage documents and signatures. The flexibility of mo pts ensures that you can choose the integrations that best suit your needs.

-

What are the benefits of using mo pts for document signing?

Using mo pts for document signing provides businesses with a cost-effective and customizable solution. It allows for greater control over the features you utilize, ensuring that you only pay for what you need. Additionally, this system enhances collaboration and speeds up the signing process, ultimately improving overall efficiency.

-

Is there a trial period for mo pts in airSlate SignNow?

Yes, airSlate SignNow offers a trial period that allows users to explore the mo pts system without any commitment. This trial gives prospective customers the opportunity to test various features and determine how they can best benefit their business. It's a great way to experience the advantages of mo pts firsthand.

-

How can I manage my mo pts effectively?

Managing your mo pts effectively involves regularly reviewing your usage and adjusting your points allocation as needed. airSlate SignNow provides tools and analytics to help you track your point consumption and identify areas for optimization. By staying informed, you can ensure that your investment in mo pts aligns with your business goals.

Get more for Form MO PTS Property Tax Credit Schedule

Find out other Form MO PTS Property Tax Credit Schedule

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later