Form MO NRI Missouri Income Percentage

What is the Form MO NRI Missouri Income Percentage

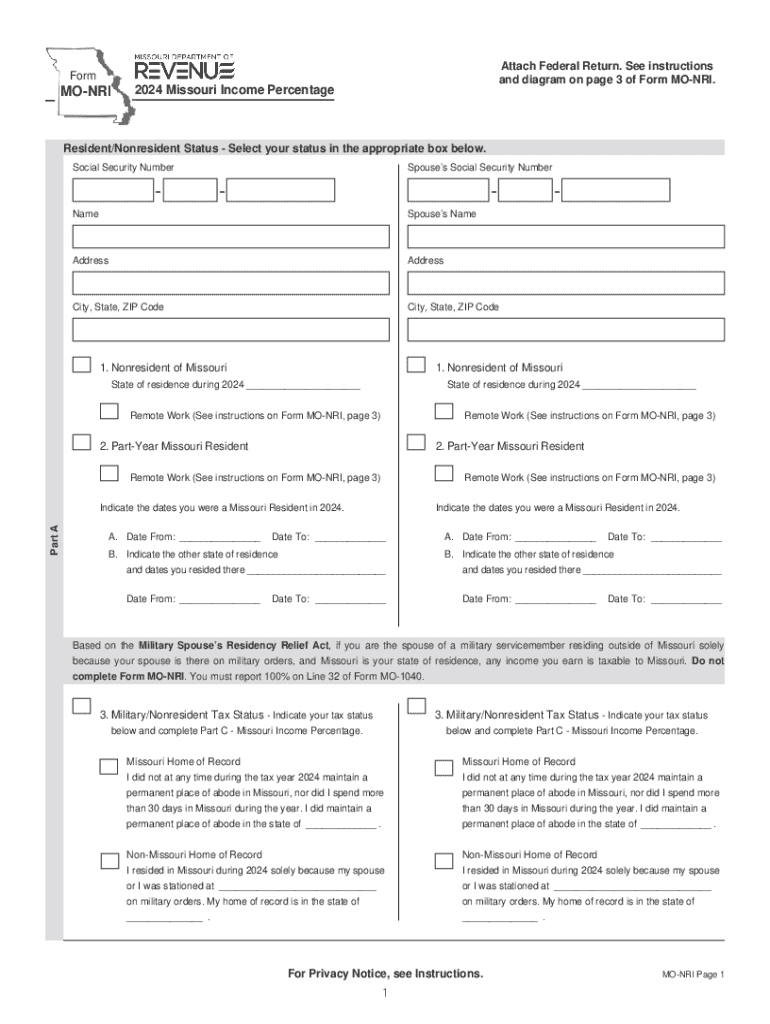

The Form MO NRI, also known as the Missouri Non-Resident Income Percentage form, is a tax document used by individuals who earn income in Missouri but reside in another state. This form helps determine the proportion of income earned in Missouri, allowing non-residents to accurately report their taxable income. It is essential for ensuring compliance with Missouri tax laws and for calculating the correct amount of tax owed to the state.

How to use the Form MO NRI Missouri Income Percentage

The Form MO NRI is used to report income earned by non-residents in Missouri. To use the form effectively, individuals must first gather all relevant income information, including wages, salaries, and any other earnings sourced from Missouri. Once the income details are compiled, the individual can fill out the form, ensuring that they accurately calculate the Missouri income percentage based on their total income. This percentage is then applied to determine the amount of tax owed to the state.

Steps to complete the Form MO NRI Missouri Income Percentage

Completing the Form MO NRI involves several key steps:

- Gather all income documentation, including W-2s and 1099s.

- Determine the total income earned in Missouri.

- Calculate the total income from all sources, including out-of-state income.

- Divide the Missouri income by the total income to find the Missouri income percentage.

- Fill out the form with the calculated percentage and other required information.

- Review the form for accuracy before submission.

Key elements of the Form MO NRI Missouri Income Percentage

The Form MO NRI includes several important elements that must be completed accurately. These elements typically consist of personal identification information, the total income earned in Missouri, the total income from all sources, and the calculated Missouri income percentage. Additionally, the form may require signatures and dates to ensure authenticity and compliance with state regulations.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form MO NRI. Typically, the form must be submitted by the same deadline as the federal tax return, which is usually April 15 for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Keeping track of these dates helps ensure timely compliance and avoids potential penalties.

Eligibility Criteria

To be eligible to use the Form MO NRI, individuals must be non-residents of Missouri who have earned income within the state. This includes individuals who work in Missouri but maintain their primary residence in another state. It is important for applicants to verify their residency status and ensure that their income qualifies under Missouri tax regulations to use the form correctly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form mo nri missouri income percentage 772045256

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a MO NRI form and why is it important?

The MO NRI form is a crucial document for Non-Resident Indians (NRIs) to manage their financial transactions in India. It helps in the seamless transfer of funds and ensures compliance with Indian regulations. Understanding this form is essential for NRIs to avoid legal complications.

-

How can airSlate SignNow help with the MO NRI form?

airSlate SignNow simplifies the process of filling and signing the MO NRI form by providing an intuitive platform for eSigning documents. With our solution, you can easily upload, edit, and send the form securely. This streamlines the process, saving you time and effort.

-

What are the pricing options for using airSlate SignNow for the MO NRI form?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. You can choose from monthly or annual subscriptions, with options that provide access to features specifically designed for handling documents like the MO NRI form. Visit our pricing page for detailed information.

-

Are there any features specifically designed for the MO NRI form?

Yes, airSlate SignNow includes features that enhance the experience of managing the MO NRI form. These features include customizable templates, secure storage, and the ability to track document status. This ensures that your important forms are handled efficiently and securely.

-

Can I integrate airSlate SignNow with other applications for the MO NRI form?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the MO NRI form alongside your other business tools. Whether you use CRM systems or cloud storage solutions, our platform can seamlessly connect to enhance your workflow.

-

What are the benefits of using airSlate SignNow for the MO NRI form?

Using airSlate SignNow for the MO NRI form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to eSign documents from anywhere, ensuring that you can manage your financial affairs without delays.

-

Is airSlate SignNow secure for handling the MO NRI form?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling the MO NRI form. We use advanced encryption and authentication measures to protect your sensitive information, ensuring that your documents remain confidential and secure.

Get more for Form MO NRI Missouri Income Percentage

- Fill training letter layout 2013 form

- Formulario b res 075

- How to fill canadore college international form

- Marriott employee discount form pdf

- Registration application for internresidentfellow or house physician form

- Government of the district of columbia notice washington dc otr cfo dc form

- Nj designation form

Find out other Form MO NRI Missouri Income Percentage

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template