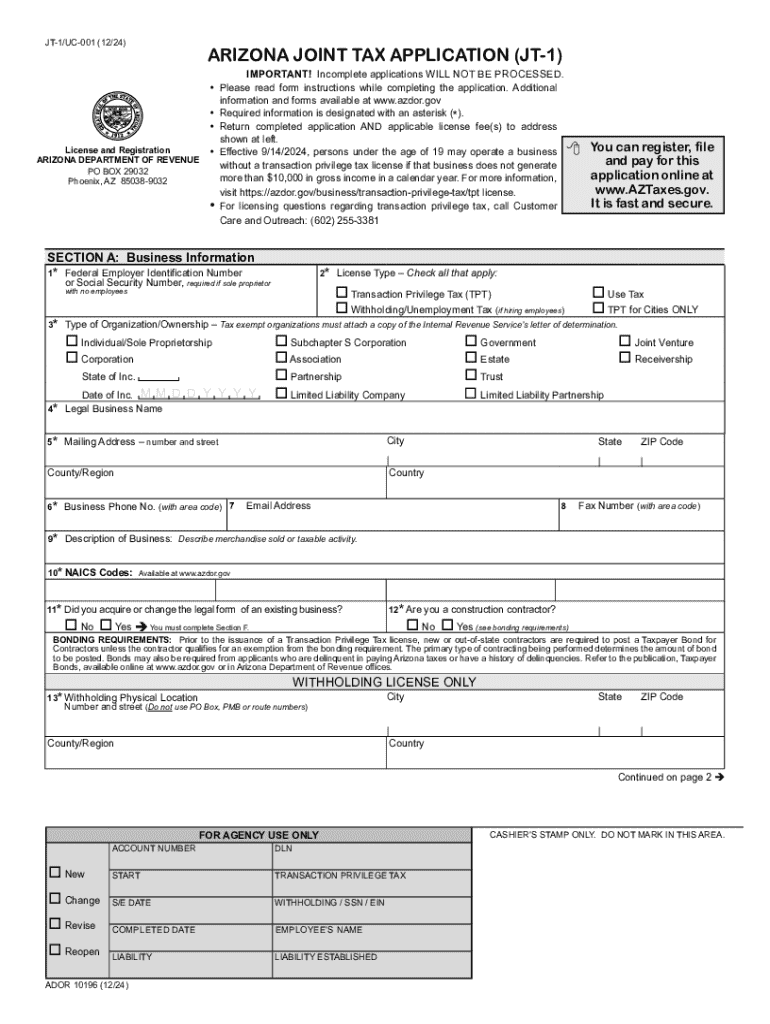

JT 1UC 001 1224 ARIZONA JOINT TAX APPLICATION Form

What is the Arizona Joint Tax Application JT 1?

The Arizona Joint Tax Application, commonly referred to as the JT 1, is a tax form used by couples filing jointly in Arizona. This form allows taxpayers to report their combined income and claim deductions and credits applicable to their joint tax situation. The JT 1 is essential for ensuring that both partners' incomes are accurately reported and assessed for state tax purposes.

How to Obtain the Arizona Joint Tax Application JT 1

The Arizona Joint Tax Application can be obtained through the Arizona Department of Revenue's official website. It is available in both printable and fillable formats, allowing users to choose their preferred method of completion. Additionally, the form can be requested at local tax offices or through certified tax professionals who assist with tax preparation.

Steps to Complete the Arizona Joint Tax Application JT 1

Completing the Arizona Joint Tax Application involves several key steps:

- Gather necessary documentation, including W-2s, 1099s, and any other income statements for both partners.

- Fill out personal information, including names, Social Security numbers, and filing status.

- Report total income from all sources, ensuring accuracy in the combined amounts.

- Claim applicable deductions and credits, such as those for dependents or education expenses.

- Review the completed form for accuracy before submission.

Legal Use of the Arizona Joint Tax Application JT 1

The Arizona Joint Tax Application is legally binding and must be completed accurately to avoid penalties. It is important for taxpayers to understand their obligations under Arizona tax law, including the requirement to report all income and claim only eligible deductions. Misrepresentation or failure to file can lead to legal repercussions, including fines and interest on unpaid taxes.

Eligibility Criteria for the Arizona Joint Tax Application JT 1

To be eligible to use the Arizona Joint Tax Application, both individuals must meet certain criteria:

- Both partners must be legally married as of the end of the tax year.

- Both individuals must agree to file jointly, which includes sharing responsibility for the tax return.

- Each partner must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN).

Form Submission Methods for the Arizona Joint Tax Application JT 1

The Arizona Joint Tax Application can be submitted through various methods:

- Online: Taxpayers can file the JT 1 electronically through the Arizona Department of Revenue's e-filing system.

- Mail: Completed forms can be printed and mailed to the appropriate address specified by the Arizona Department of Revenue.

- In-Person: Taxpayers may also choose to submit the form in person at designated tax offices.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the jt 1uc 001 1224 arizona joint tax application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is az jt 1 and how does it relate to airSlate SignNow?

Az jt 1 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By integrating az jt 1, businesses can improve efficiency and reduce turnaround times.

-

How much does airSlate SignNow cost with az jt 1 features?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective even with az jt 1 features included. Users can select from different tiers that best fit their needs, ensuring they get the most value for their investment. For detailed pricing, visit our website.

-

What are the key benefits of using az jt 1 in airSlate SignNow?

Using az jt 1 in airSlate SignNow offers numerous benefits, including enhanced security, faster document processing, and improved collaboration. This feature allows users to manage documents more effectively, ensuring that all parties can sign and access documents seamlessly. Overall, it boosts productivity and user satisfaction.

-

Can I integrate az jt 1 with other software applications?

Yes, az jt 1 can be easily integrated with various software applications, enhancing the functionality of airSlate SignNow. This integration allows for a smoother workflow, enabling users to connect their existing tools with our eSigning solution. Check our integration page for a list of compatible applications.

-

Is there a free trial available for airSlate SignNow with az jt 1?

Yes, airSlate SignNow offers a free trial that includes access to az jt 1 features. This allows prospective customers to explore the platform and see how it can benefit their business before committing to a paid plan. Sign up on our website to start your free trial today.

-

How does az jt 1 improve document security in airSlate SignNow?

Az jt 1 enhances document security by implementing advanced encryption and authentication measures within airSlate SignNow. This ensures that all documents are protected during transmission and storage, giving users peace of mind. With az jt 1, you can trust that your sensitive information is secure.

-

What types of documents can I send using az jt 1 in airSlate SignNow?

With az jt 1 in airSlate SignNow, you can send a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. This flexibility allows users to manage all their document signing needs in one place.

Get more for JT 1UC 001 1224 ARIZONA JOINT TAX APPLICATION

- Printable sign language form

- Please fill in the blanks and attach a copy of your abstract poster description invitation to a talk or other form

- Grade appeal form chemeketa community college chemeketa

- Student volunteer hours verification return this form to the houstonisd

- San diego attendance verification form

- Financial aid amp scholarship services reconsideration request form

- Schedule approval form

- Time management for students form

Find out other JT 1UC 001 1224 ARIZONA JOINT TAX APPLICATION

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement