PIT X *240160200* NEW MEXICO PERSONAL INCOME Form

Understanding the PIT X for New Mexico Personal Income Tax

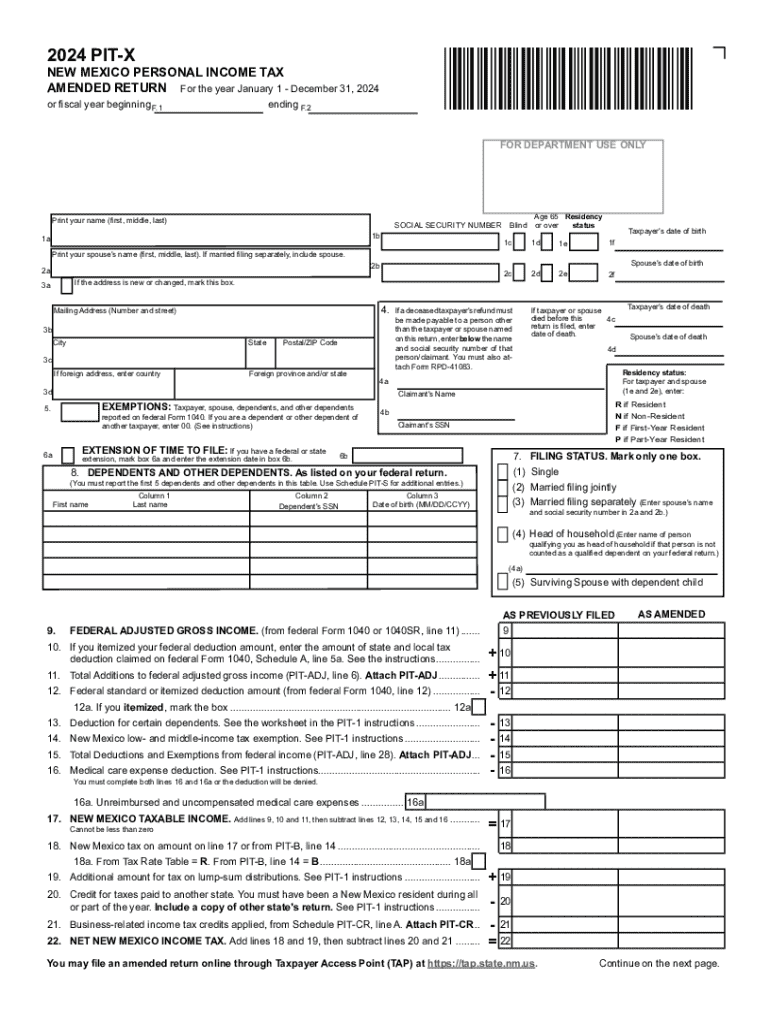

The PIT X, or Personal Income Tax Form X, is a critical document for individuals and businesses in New Mexico. This form is used to report personal income and calculate the amount of tax owed to the state. The PIT X is specifically designed to accommodate various income types, ensuring that taxpayers can accurately report their earnings. Understanding the purpose and requirements of the PIT X is essential for compliance with New Mexico tax laws.

Steps to Complete the PIT X for New Mexico Personal Income Tax

Completing the PIT X involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, including your Social Security number and filing status. Calculate your total income and any deductions or credits you may qualify for. Finally, review the completed form for accuracy before submitting it to the New Mexico Taxation and Revenue Department.

Filing Deadlines and Important Dates for the PIT X

Timely filing of the PIT X is crucial to avoid penalties. For most taxpayers, the deadline to submit the PIT X is April 15 of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Taxpayers should also be aware of any extensions that may apply and ensure they are familiar with any changes in deadlines for the current tax year.

Required Documents for the PIT X Submission

To successfully file the PIT X, taxpayers must gather specific documents. Required documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits claimed

- Proof of residency in New Mexico

Having these documents ready will facilitate a smoother filing process and help ensure that all income is accurately reported.

Form Submission Methods for the PIT X

Taxpayers in New Mexico have multiple options for submitting the PIT X. The form can be filed online through the New Mexico Taxation and Revenue Department's website, which offers a streamlined process for electronic submissions. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address or submit them in person at local tax offices. Each method has its own processing times, so it is advisable to choose the one that best suits your needs.

Penalties for Non-Compliance with the PIT X

Failure to file the PIT X by the deadline can result in significant penalties. Taxpayers may face fines based on the amount of tax owed and the duration of the delay. Additionally, interest may accrue on any unpaid taxes, further increasing the total amount due. It is important for taxpayers to understand these consequences and to file their forms accurately and on time to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pit x 240160200 new mexico personal income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to New Mexico personal income tax?

airSlate SignNow is a digital solution that allows businesses to send and eSign documents efficiently. For those dealing with New Mexico personal income tax, it simplifies the process of signing tax documents and forms, ensuring compliance and accuracy.

-

How can airSlate SignNow help with filing New Mexico personal income tax?

Using airSlate SignNow, you can easily prepare and sign your New Mexico personal income tax documents online. This streamlines the filing process, allowing you to focus on ensuring your tax returns are accurate and submitted on time.

-

What are the pricing options for airSlate SignNow for New Mexico residents?

airSlate SignNow offers various pricing plans to accommodate different needs, including options suitable for individuals and businesses in New Mexico. Each plan provides access to essential features that can assist with managing New Mexico personal income tax documents efficiently.

-

What features does airSlate SignNow offer that are beneficial for New Mexico personal income tax?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking, which are particularly beneficial for managing New Mexico personal income tax documents. These features help ensure that your tax documents are completed accurately and securely.

-

Is airSlate SignNow compliant with New Mexico personal income tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to New Mexico personal income tax. This ensures that your eSigned documents are legally binding and meet the necessary requirements for tax submissions.

-

Can I integrate airSlate SignNow with other tools for managing New Mexico personal income tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your New Mexico personal income tax documents alongside your financial records. This integration enhances efficiency and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for New Mexico personal income tax?

Using airSlate SignNow for New Mexico personal income tax offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform allows you to manage your tax documents digitally, reducing the hassle of paper-based processes.

Get more for PIT X *240160200* NEW MEXICO PERSONAL INCOME

- 5113 128 notice of hearing on interested party kansasjudicialcouncil form

- 75 764 6969379 form

- 5113 324 in the district court of county kansas in the matter of name juvenile year of birth a male female case no form

- Revised 1013 kansas judicial council kansasjudicialcouncil 6969262 form

- Caption allegation of reason for omitting party kansasjudicialcouncil form

- Domestic relations affidavit form

- Page 1 of 6 louisiana state bar examination lascba form

Find out other PIT X *240160200* NEW MEXICO PERSONAL INCOME

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation