A1 R Form

What is the A1 r?

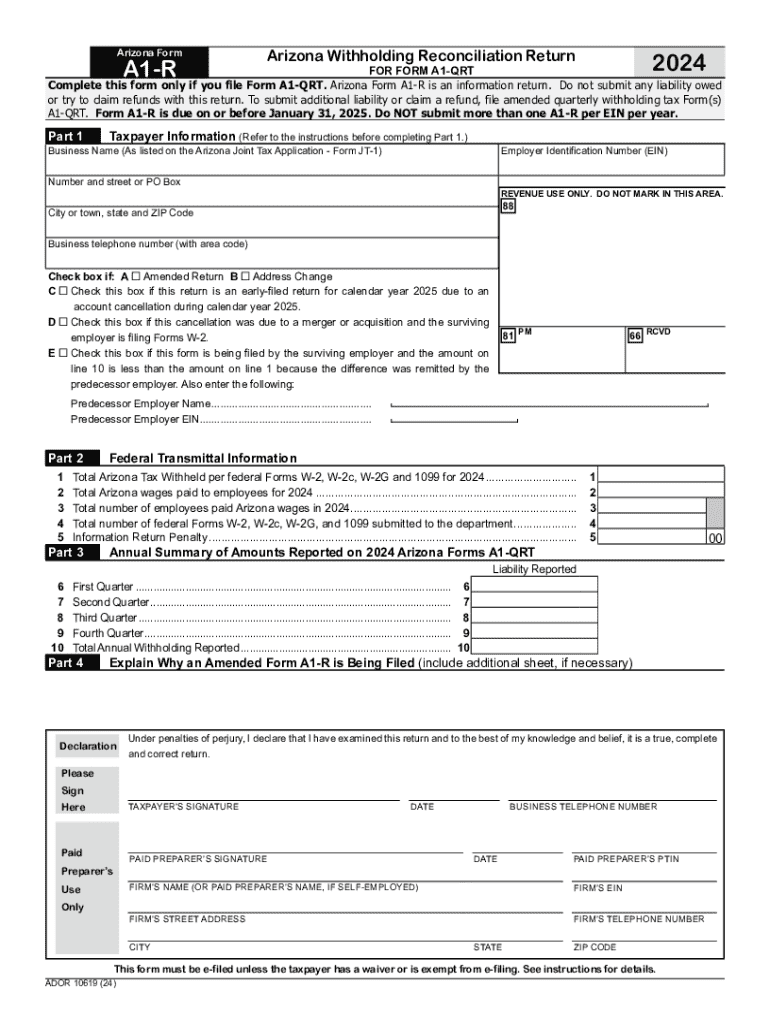

The A1 r is a specific Arizona quarterly tax form used by businesses to report withholding taxes. This form is essential for employers who withhold state income tax from employee wages. It allows the Arizona Department of Revenue to track tax obligations and ensure compliance with state tax laws. Understanding the purpose of the A1 r is crucial for businesses to maintain accurate records and fulfill their tax responsibilities.

Steps to complete the A1 r

Completing the A1 r involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including employee wages and the total amount withheld for state income tax. Next, accurately fill out the form by entering the required details, such as your business name, address, and the period covered by the report. After completing the form, review all entries for accuracy. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the A1 r to avoid late fees or penalties. The Arizona quarterly tax form is typically due on the last day of the month following the end of each quarter. For example, the deadlines for 2024 are as follows:

- First quarter: April 30

- Second quarter: July 31

- Third quarter: October 31

- Fourth quarter: January 31 of the following year

Marking these dates on your calendar can help ensure timely submissions.

Form Submission Methods

The A1 r can be submitted through various methods, providing flexibility for businesses. You can file the form online through the Arizona Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, you may choose to mail a paper copy of the form to the appropriate address. In-person submissions are also accepted at designated state offices. Each method has its own advantages, so choose the one that best fits your business needs.

Penalties for Non-Compliance

Failure to submit the A1 r on time can result in penalties that may impact your business financially. The Arizona Department of Revenue imposes fines for late filings, which can accumulate over time. Additionally, businesses may face interest charges on any unpaid taxes. It is crucial to stay informed about compliance requirements and deadlines to avoid these penalties and maintain good standing with the state.

Eligibility Criteria

To be eligible to file the A1 r, businesses must meet specific criteria set by the Arizona Department of Revenue. Generally, any employer who withholds state income tax from employee wages is required to file this form. This includes various business entity types, such as corporations, partnerships, and sole proprietorships. Understanding your eligibility ensures that you comply with state regulations and fulfill your tax obligations accurately.

Key elements of the A1 r

The A1 r includes several key elements that must be accurately reported. Essential information includes the business name, address, and identification number. You must also report the total wages paid to employees and the amount of state income tax withheld. Additionally, the form requires details about the reporting period and any adjustments for prior periods. Ensuring that all key elements are correctly filled out is vital for accurate tax reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the a1 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Arizona quarterly tax form?

The Arizona quarterly tax form is a document that businesses use to report and pay their estimated income taxes on a quarterly basis. This form helps ensure compliance with state tax regulations and avoids penalties. Using airSlate SignNow, you can easily eSign and submit your Arizona quarterly tax form online.

-

How can airSlate SignNow help with the Arizona quarterly tax form?

airSlate SignNow streamlines the process of completing and submitting the Arizona quarterly tax form by allowing users to eSign documents securely. Our platform simplifies document management, making it easy to track submissions and deadlines. This ensures that your Arizona quarterly tax form is filed accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include features that support the completion and eSigning of documents like the Arizona quarterly tax form. You can choose a plan that best fits your needs and budget, ensuring you have the tools necessary for efficient tax management.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow. You can connect with accounting software and other tools to simplify the process of managing your Arizona quarterly tax form. These integrations help streamline data entry and ensure accuracy in your tax submissions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed for efficient document management, including templates, eSigning, and secure storage. These features are particularly useful when handling the Arizona quarterly tax form, as they allow for quick edits and easy access to your documents. This ensures that your tax forms are always up-to-date and readily available.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents, including the Arizona quarterly tax form. Our platform ensures that your data is safe during transmission and storage, giving you peace of mind when managing your tax obligations.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your documents on the go. This is particularly beneficial for completing and eSigning the Arizona quarterly tax form, as you can handle your tax responsibilities anytime, anywhere. Our mobile-friendly platform ensures you stay productive, even while traveling.

Get more for A1 r

- Suffolk county lodge 124 form

- Cowichan valley regional district cvrdbcca cvrd bc form

- The health card renewal form nova scotia government

- Special admission form k 12 ipsf academy ipsfacademy

- Trick radial blade effect remote power supply installation form

- Application for funds from the bishop degoesbriand appeal for human advancement devotion to god and love of neighbor bring us form

- Page 1 of 4 150 101 040 rev form

- 500ez form department of revenue

Find out other A1 r

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy