Form it 213 Claim for Empire State Child Credit Tax Year

What is the Form IT-213 Claim for Empire State Child Credit Tax Year

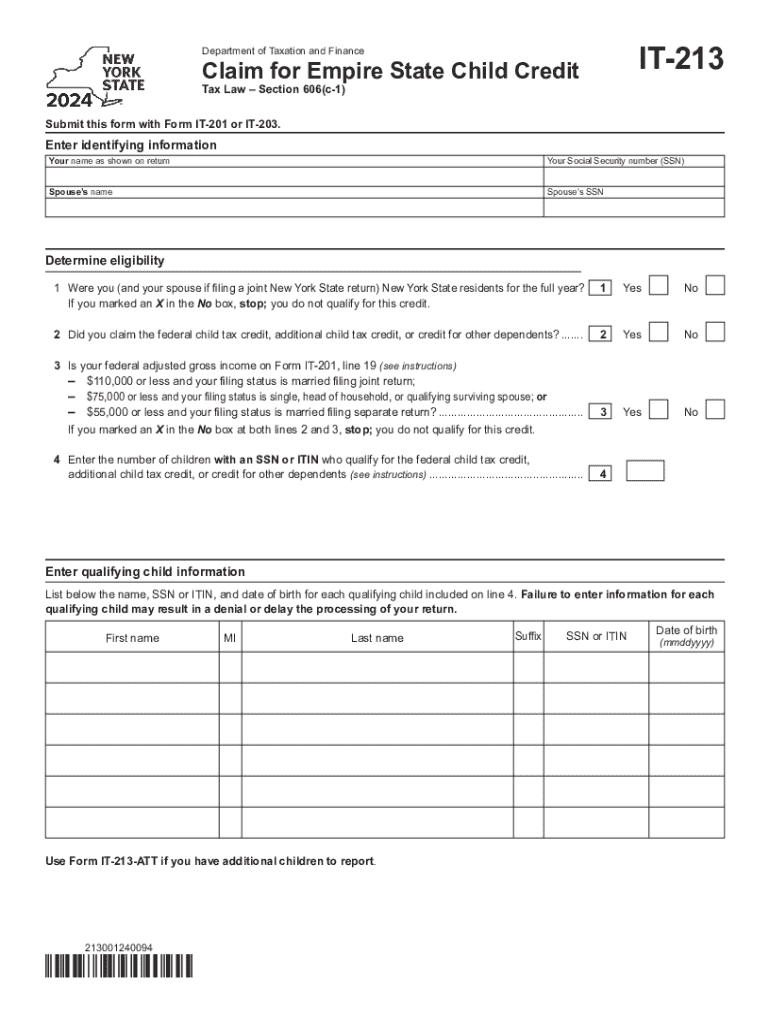

The Form IT-213 is a specific tax form used by residents of New York to claim the Empire State Child Credit. This credit is designed to provide financial assistance to families with qualifying children. It is available for tax years when the taxpayer has dependent children under the age of 17. The credit can help reduce the overall tax liability, making it an important consideration for eligible families when filing their state taxes.

How to Use the Form IT-213 Claim for Empire State Child Credit Tax Year

To use the Form IT-213, taxpayers must first ensure they meet the eligibility criteria, which includes having qualifying children and meeting income limitations. Once eligibility is confirmed, the form should be completed with accurate information regarding the taxpayer’s income, number of dependents, and any other required details. After filling out the form, it must be submitted along with the New York State tax return to claim the credit effectively.

Steps to Complete the Form IT-213 Claim for Empire State Child Credit Tax Year

Completing the Form IT-213 involves several clear steps:

- Gather necessary documentation, including Social Security numbers for all dependents.

- Fill out personal information, including the taxpayer's name, address, and filing status.

- Indicate the number of qualifying children and their respective details.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Eligibility Criteria for the Form IT-213 Claim for Empire State Child Credit Tax Year

Eligibility for the Empire State Child Credit involves specific criteria that must be met by the taxpayer. To qualify, the taxpayer must be a resident of New York State and have dependent children who are under the age of 17 at the end of the tax year. Additionally, there are income limits that may affect eligibility, which are outlined in the form instructions. It is essential for taxpayers to review these criteria carefully to ensure they can claim the credit.

Required Documents for the Form IT-213 Claim for Empire State Child Credit Tax Year

When filing the Form IT-213, certain documents are necessary to support the claim. These include:

- Proof of residency in New York State.

- Social Security numbers for all qualifying children.

- Income documentation, such as W-2 forms or 1099s, to verify eligibility.

Having these documents ready can facilitate a smoother filing process and ensure that the claim is processed without delays.

Form Submission Methods for IT-213 Claim for Empire State Child Credit Tax Year

The Form IT-213 can be submitted through various methods, depending on the taxpayer's preference. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing the completed form along with the state tax return to the appropriate address.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can help ensure timely processing of the claim.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 213 claim for empire state child credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for businesses in the New York Empire State?

airSlate SignNow provides a range of features tailored for businesses in the New York Empire State, including customizable templates, secure eSigning, and document tracking. These tools streamline the signing process, making it efficient and user-friendly. Additionally, the platform ensures compliance with local regulations, which is crucial for businesses operating in New York.

-

How does airSlate SignNow support businesses in the New York Empire State with pricing?

airSlate SignNow offers competitive pricing plans designed to accommodate businesses of all sizes in the New York Empire State. With flexible subscription options, companies can choose a plan that fits their budget while still accessing essential features. This cost-effective solution helps businesses save money while improving their document management processes.

-

Can airSlate SignNow integrate with other tools commonly used in the New York Empire State?

Yes, airSlate SignNow seamlessly integrates with various tools and applications that businesses in the New York Empire State frequently use. This includes popular CRM systems, cloud storage services, and productivity software. These integrations enhance workflow efficiency and ensure that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for businesses in the New York Empire State?

Using airSlate SignNow provides numerous benefits for businesses in the New York Empire State, such as increased efficiency, reduced turnaround times, and enhanced security for sensitive documents. The platform's user-friendly interface allows teams to collaborate effectively, ensuring that all stakeholders can participate in the signing process. This leads to faster decision-making and improved customer satisfaction.

-

Is airSlate SignNow compliant with New York state regulations?

Absolutely, airSlate SignNow is designed to comply with all relevant regulations in the New York Empire State. This includes adherence to eSignature laws and data protection standards, ensuring that your documents are legally binding and secure. Businesses can confidently use the platform, knowing they are meeting legal requirements.

-

How can airSlate SignNow help streamline document workflows for New York Empire State businesses?

airSlate SignNow streamlines document workflows for businesses in the New York Empire State by automating the signing process and providing real-time tracking. This reduces the time spent on manual tasks and minimizes errors. With features like reminders and notifications, teams can stay organized and ensure timely completion of documents.

-

What types of documents can be signed using airSlate SignNow in the New York Empire State?

Businesses in the New York Empire State can use airSlate SignNow to sign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. This flexibility allows companies to manage all their signing requirements in one place.

Get more for Form IT 213 Claim For Empire State Child Credit Tax Year

Find out other Form IT 213 Claim For Empire State Child Credit Tax Year

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy